Title: Understanding Michigan Miller Trust Forms for Assisted Living: An Overview Introduction: In Michigan, Miller Trust Forms serve as a crucial tool for individuals who require financial assistance in order to qualify for Medicaid coverage while residing in assisted living facilities. This article aims to provide a comprehensive understanding of Michigan Miller Trust Forms and the various types available, shedding light on their importance in assisting individuals with limited means to meet eligibility requirements for Medicaid. 1. Michigan Miller Trust Forms Explained: A Michigan Miller Trust is a specific type of trust designed to help individuals meet the income limit requirements set by the Medicaid program. It allows individuals with excess income to channel their funds into a trust, often enabling them to qualify for Medicaid while ensuring their long-term care expenses are covered. 2. Eligibility for Michigan Miller Trust Form: To be eligible for a Michigan Miller Trust, individuals must have a monthly income exceeding the Medicaid income eligibility limit. In Michigan, this limit is 300% of the Federal Benefit Rate (FOR). Individuals can establish the trust only if they require long-term care services and are residing in a nursing home or an assisted living facility. 3. Types of Michigan Miller Trust Forms for Assisted Living: a) Income-Only Michigan Miller Trust: The Income-Only Michigan Miller Trust is primarily used by individuals whose income exceeds the Medicaid income eligibility limit. This trust facilitates the redirection of income to cover the cost of care, allowing the individual to meet Medicaid eligibility requirements. b) Income and Asset Michigan Miller Trust: The Income and Asset Michigan Miller Trust is suitable for individuals whose assets, in addition to income, surpass the Medicaid eligibility limit. This type of trust allows excess assets to become "non-countable" for Medicaid, thereby enabling the individual to qualify for coverage. 4. Procedures for Establishing a Michigan Miller Trust: To establish a Michigan Miller Trust, individuals must consult with an elder law attorney or a qualified Medicaid planner experienced in the creation of these trusts. The process includes drafting the trust document, opening a trust bank account, and designating a trustee who will manage the funds appropriately. 5. Benefits and Considerations of Michigan Miller Trust Forms for Assisted Living: — Enables individuals with excessive income/assets to qualify for Medicaid coverage while residing in assisted living facilities. — Provides financial stability for long-term care expenses. — Ensures proper utilization of income and assets to meet Medicaid eligibility guidelines. — Allows individuals to retain a portion of their income for personal needs. — Requires careful monitoring to ensure compliance with Medicaid regulations. Conclusion: Michigan Miller Trust Forms for Assisted Living play an essential role in assisting individuals who require financial assistance in meeting Medicaid eligibility while residing in assisted living facilities. These forms, including the Income-Only and Income and Asset Michigan Miller Trusts, provide a pathway to access necessary long-term care coverage. By working with professionals experienced in Medicaid planning, individuals can navigate the process smoothly and ensure their eligibility for vital assistance.

Michigan Miller Trust Forms for Assisted Living

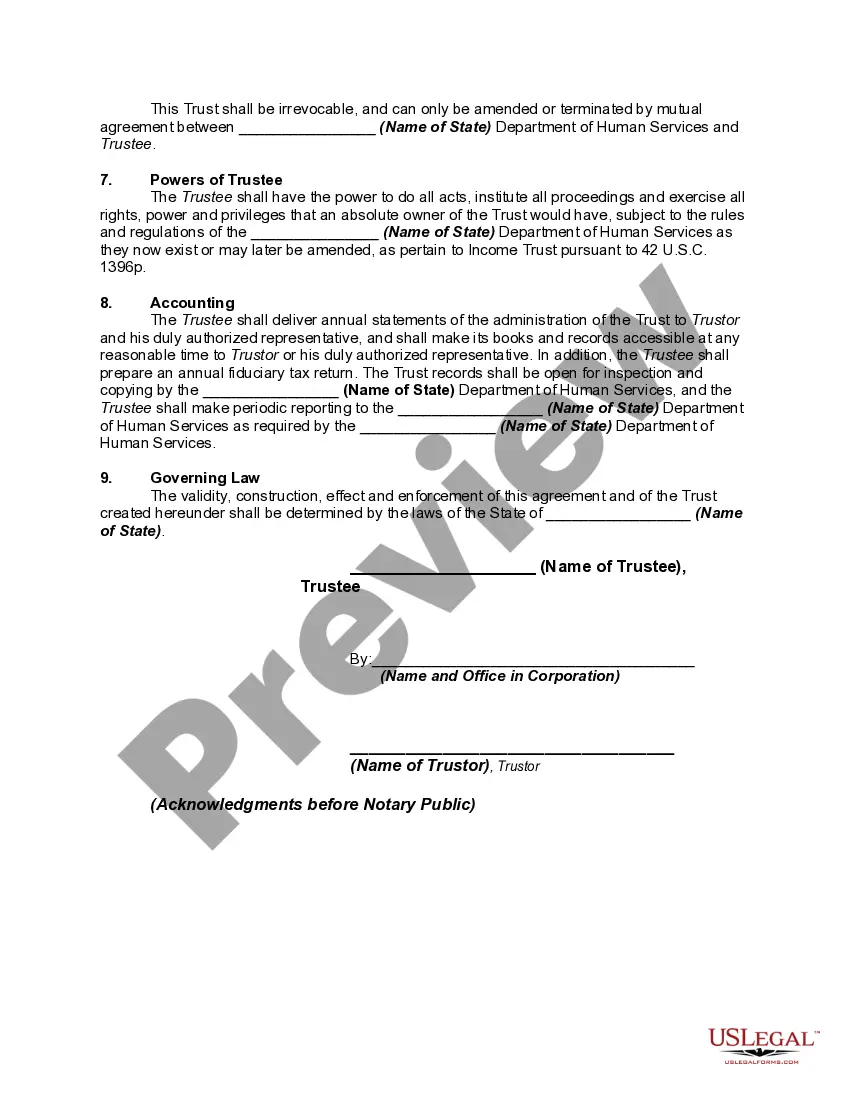

Description

How to fill out Michigan Miller Trust Forms For Assisted Living?

Are you currently inside a place where you will need paperwork for sometimes company or person reasons virtually every time? There are a variety of authorized record themes available on the net, but discovering versions you can rely is not effortless. US Legal Forms offers thousands of develop themes, just like the Michigan Miller Trust Forms for Assisted Living, that happen to be written to satisfy state and federal needs.

When you are currently familiar with US Legal Forms web site and possess a merchant account, simply log in. Afterward, it is possible to down load the Michigan Miller Trust Forms for Assisted Living design.

Should you not provide an bank account and would like to start using US Legal Forms, adopt these measures:

- Get the develop you want and make sure it is for the proper city/area.

- Make use of the Preview button to analyze the form.

- Read the outline to ensure that you have selected the right develop.

- In case the develop is not what you`re seeking, use the Lookup industry to find the develop that meets your needs and needs.

- Whenever you obtain the proper develop, click on Buy now.

- Opt for the rates plan you desire, fill out the specified details to generate your account, and pay money for your order using your PayPal or charge card.

- Choose a hassle-free paper structure and down load your version.

Locate each of the record themes you have bought in the My Forms food list. You can obtain a additional version of Michigan Miller Trust Forms for Assisted Living at any time, if needed. Just click the necessary develop to down load or print out the record design.

Use US Legal Forms, one of the most comprehensive variety of authorized kinds, to conserve efforts and prevent blunders. The service offers expertly created authorized record themes that can be used for a selection of reasons. Make a merchant account on US Legal Forms and initiate producing your daily life easier.