Michigan Affidavit of Residency

Description

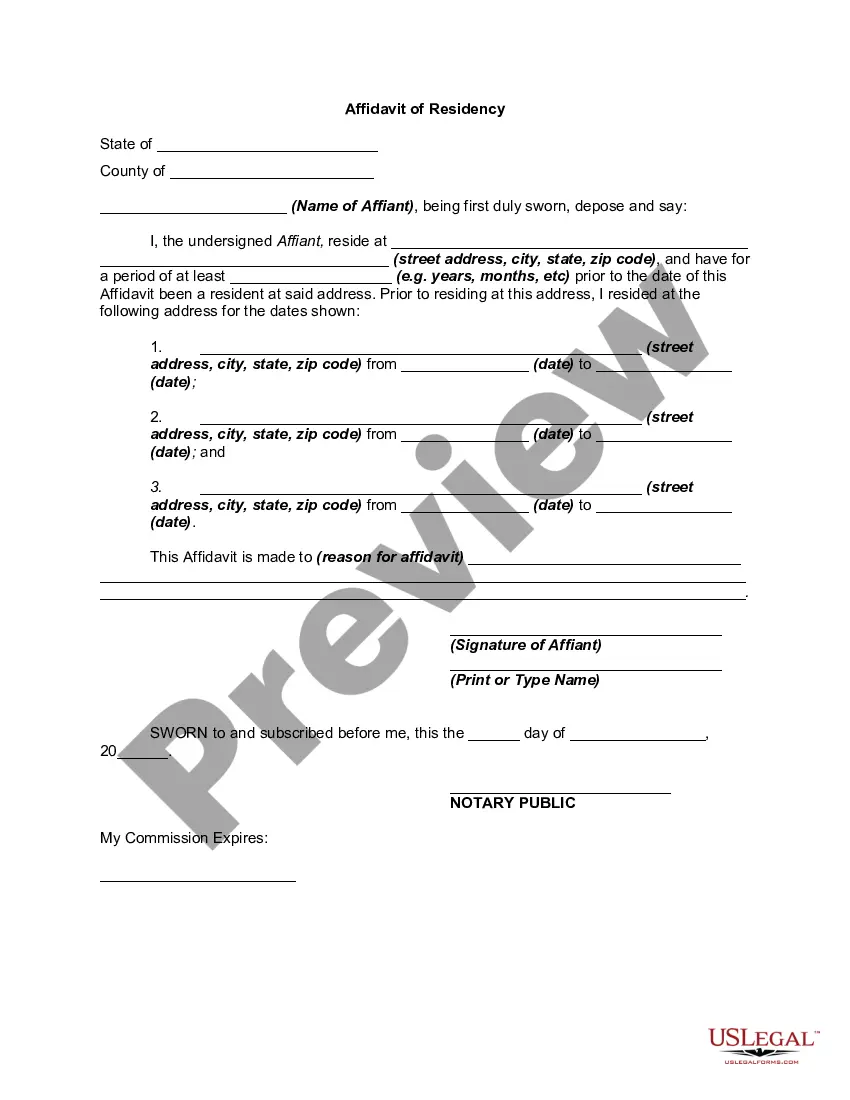

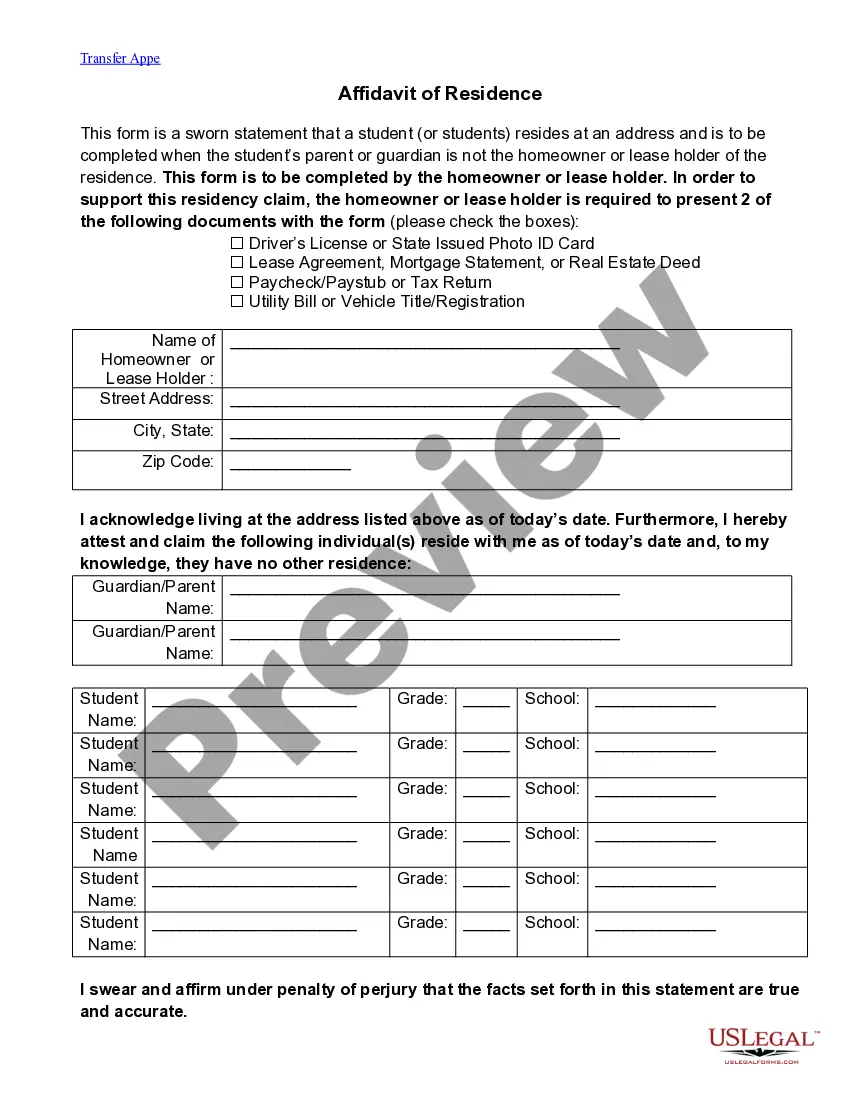

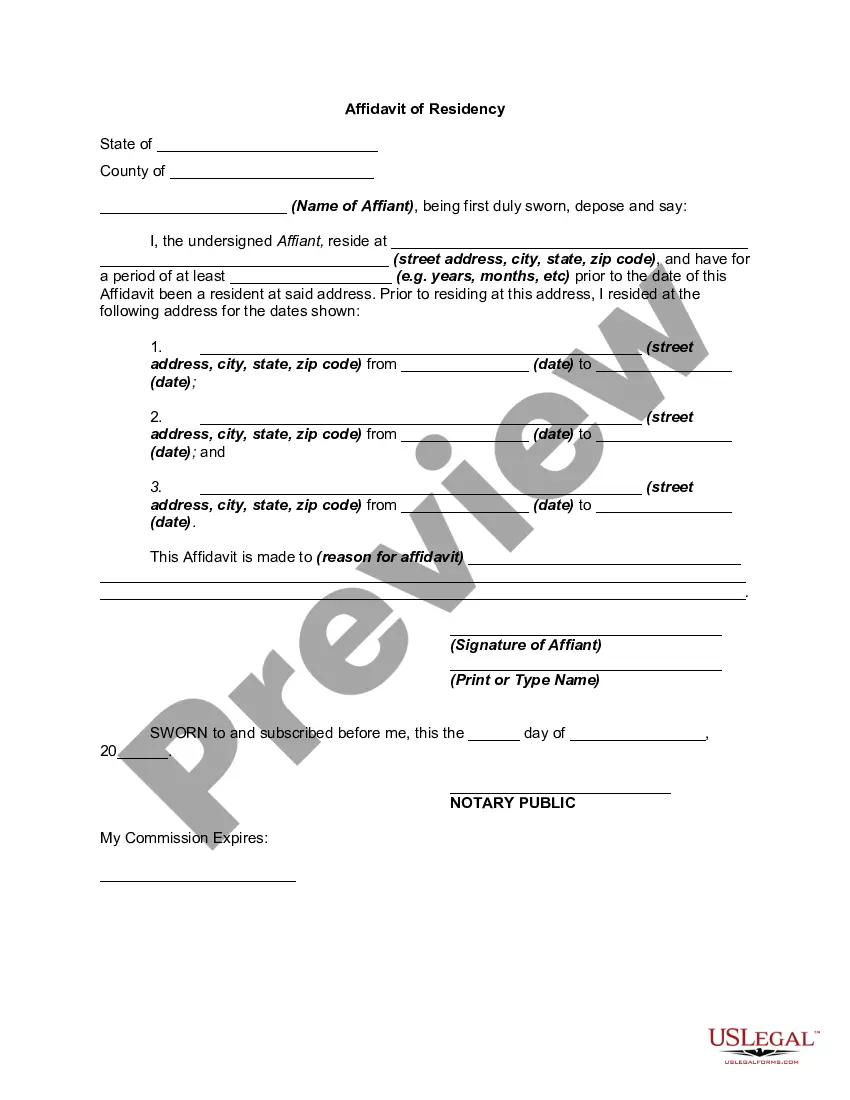

How to fill out Affidavit Of Residency?

US Legal Forms - one of the greatest libraries of legal varieties in the United States - delivers an array of legal document themes you may obtain or produce. Utilizing the web site, you can get a huge number of varieties for company and personal purposes, sorted by categories, claims, or search phrases.You will discover the newest types of varieties like the Michigan Affidavit of Residency within minutes.

If you already possess a registration, log in and obtain Michigan Affidavit of Residency through the US Legal Forms catalogue. The Download switch will appear on each and every form you perspective. You gain access to all previously saved varieties in the My Forms tab of your respective profile.

In order to use US Legal Forms initially, listed below are straightforward instructions to obtain started:

- Ensure you have chosen the correct form to your metropolis/county. Go through the Review switch to check the form`s content. Browse the form explanation to ensure that you have selected the appropriate form.

- If the form doesn`t match your demands, utilize the Look for area at the top of the display screen to obtain the one that does.

- Should you be happy with the form, verify your decision by visiting the Get now switch. Then, choose the pricing program you like and provide your credentials to sign up for an profile.

- Process the financial transaction. Utilize your bank card or PayPal profile to accomplish the financial transaction.

- Choose the file format and obtain the form on the system.

- Make changes. Fill up, change and produce and signal the saved Michigan Affidavit of Residency.

Every single web template you included with your money does not have an expiry time which is yours permanently. So, if you would like obtain or produce one more duplicate, just proceed to the My Forms portion and then click on the form you require.

Obtain access to the Michigan Affidavit of Residency with US Legal Forms, one of the most considerable catalogue of legal document themes. Use a huge number of professional and status-specific themes that fulfill your business or personal needs and demands.

Form popularity

FAQ

The Principal Residence Exemption excuses a qualified principal residence (Michigan law defines principal residence as the one place where a person has his or her true, fixed, and permanent home to which, whenever absent he or she intends to return and that shall continue as a principal residence until another ...

To claim a PRE, the property owner must submit a Principal Residence Exemption (PRE) Affidavit, Form 2368, to the assessor for the city or township in which the property is located.

Multiple principal residences They can only designate one as a principal residence each year. The owner will be subject to capital gains tax. However, they can choose which residence to designate (as long as they spend some time at both during the year).

The property will qualify as a principal residence if the taxpayer, taxpayer's current or former spouse or common-law partner, or any of the taxpayer's children lived in it at some time during the year. If the home is rented out the situation may change.

Property Tax Exemption An eligible person must own and occupy his/her home as a principal residence (homestead) and meet poverty income standards. The local Board of Review may interview the applicant in order to determine eligibility, ing to the local guidelines, and will review all applications.

To qualify for a principal residence exemption on a dwelling, MCL 211.7cc requires that the property be: (1) owned by a qualified owner as defined by MCL 211.7dd(a); (2) occupied as a principal residence by that owner of the property; (3) none of the disqualifying factors listed in MCL 211.7cc(3) apply; and (4) claimed ...

What is the Michigan Principal Residence Exemption? In Michigan, the PRE is a reduction of 18 mils each year on your property taxes on your primary residence. A mil is defined as $1 of tax per $1,000 of Taxable Value. Millage data can be found on the State of Michigan site here.

You must be the owner and occupant or be contracted to pay rent and occupy the dwelling. You can only have one homestead at a time. Cottages, second homes, property you own and rent/lease to others, and college dormitories do not qualify as a homestead.