A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property

Description

How to fill out Transmutation Or Postnuptial Agreement To Convert Community Property Into Separate Property?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal document formats that you can download or print.

While navigating the website, you can discover thousands of forms for commercial and personal uses, organized by categories, states, or keywords. You can find the latest editions of forms such as the Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property in a matter of minutes.

If you possess a monthly subscription, Log In and download the Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property from the US Legal Forms collection. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

Select the format and download the document to your device.

Make modifications. Fill out, edit, and print and sign the downloaded Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property. Each template you add to your account does not expire and is yours forever. Therefore, to download or print an additional copy, simply visit the My documents section and click on the document you need.

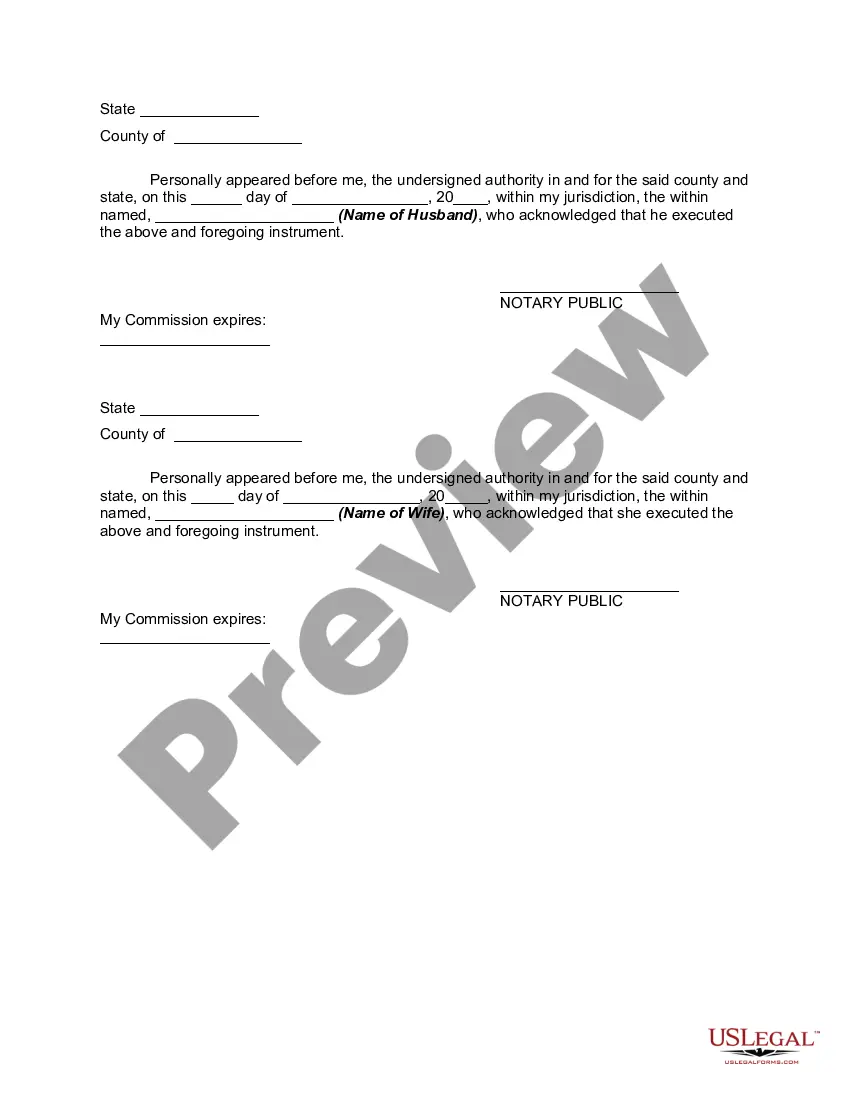

- Ensure that you have selected the correct form for your area/region. Use the Preview button to examine the form's contents.

- Review the form description to confirm that you have chosen the right document.

- If the form doesn’t meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Get now button.

- Next, choose the pricing plan you prefer and provide your information to register for an account.

- Complete the transaction. Use a credit card or PayPal account to finalize the purchase.

Form popularity

FAQ

Spousal support, or alimony, in Michigan is not strictly tied to a specific duration of marriage. Courts consider various factors, including financial needs and contributions to the marriage. If you're concerned about how property or spousal support may be affected, a Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property may be useful for planning your financial future.

In most cases, property purchased before marriage remains separate. However, if marital funds or efforts increase its value, things can get complicated. A Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can provide clarity on ownership and help protect your home from claims in the event of a divorce.

After a decade of marriage in Michigan, a wife typically has rights to certain marital assets, including property acquired during the marriage. While each case varies, marital contributions can impact asset division. To secure your individual interests, think about a Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, which can help define what belongs to whom.

In Michigan, assets are divided equitably during a divorce. This does not mean an equal split, but rather a fair distribution based on various factors. If you want to protect your separate property, consider using a Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property. This can help clarify ownership and protect your interests.

In Michigan, after you have been married for a minimum of 10 years, you can typically expect to divide marital assets equally. However, it's essential to understand that Michigan follows equitable distribution laws, which means assets may be divided fairly but not necessarily equally. If you have a Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, this legal document can help clarify ownership rights and protect your interests better. To ensure you receive the benefits you deserve, consider consulting a legal professional for personalized guidance.

Yes, postnuptial agreements, commonly known as postnups, are enforceable in Michigan. These agreements, including a Michigan Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, must meet certain criteria to ensure validity. It is crucial that both parties enter into the agreement voluntarily and disclose all relevant financial information. Additionally, having the agreement reviewed by legal professionals helps solidify its enforceability in potential future disputes.

A postnuptial agreement cannot include terms related to child custody or child support, as Michigan courts prioritize the child's best interests in these matters. Additionally, any illegal terms or stipulations that violate public policy are not enforceable. Therefore, focusing on property division and financial matters is essential when formulating a postnuptial agreement in Michigan.

To transmute separate property into community property, both spouses must agree to this conversion explicitly, often through a carefully drafted agreement. This process involves documenting consent and the intention behind the change to avoid any confusion later on. In Michigan, having a legal framework in place, such as a postnuptial agreement, helps facilitate this transition smoothly.

The primary purpose of a transmutation agreement is to clarify the ownership of property within a marriage. By formalizing this change, couples in Michigan can ensure that community property is acknowledged as separate property, thus reducing potential disputes in the future. A well-defined agreement provides peace of mind and legal security for both parties.

While both transmutation agreements and postnuptial agreements address property division, they serve different purposes. A transmutation agreement specifically focuses on changing the nature of property ownership, whereas a postnuptial agreement may cover a broader range of financial and property matters. Understanding these distinctions helps couples in Michigan make informed decisions tailored to their unique circumstances.