A Michigan Simple Promissory Note for Tuition Fee is a legal document that outlines an agreement between a borrower and a lender regarding the repayment of tuition fees. This type of promissory note is commonly used in Michigan to establish a formal agreement between parties involved in an educational transaction. Keywords: Michigan, simple promissory note, tuition fee, legal document, borrower, lender, repayment, agreement, educational transaction. There are several variations of Michigan Simple Promissory Notes for Tuition Fee, each designed to meet specific needs and circumstances. These variations may include: 1. Unsecured Promissory Note: This type of promissory note does not require any collateral or security against the borrowed funds. It solely relies on the borrower's promise to repay the tuition fee as agreed upon. 2. Secured Promissory Note: Unlike the unsecured promissory note, this document includes a specific asset or property as collateral to secure the borrowed funds. In case of default, the lender has the right to seize the pledged asset to satisfy the debt. 3. Amortizing Promissory Note: This promissory note outlines regular payments scheduled over a period of time, typically in equal installments, which include both principal and interest. This allows for systematic repayment of the tuition fee until the debt is fully paid. 4. Balloon Promissory Note: In contrast to the amortizing promissory note, this type incorporates smaller monthly payments with a large final payment — known as a balloon payment – at the end of the specified term. This structure provides flexibility for borrowers who anticipate a significant increase in income over time. 5. Interest-Free Promissory Note: This variation outlines the borrower's promise to repay the tuition fee without incurring any additional interest charges. It may be used in situations where there is a preexisting relationship between the parties involved or as a gesture of goodwill. It is crucial to choose the appropriate type of promissory note based on the specific circumstances and agreement between the borrower and lender. Seeking legal advice or utilizing pre-designed templates tailored to the laws of Michigan is recommended to ensure compliance with relevant regulations and to protect the interests of both parties involved in the transaction.

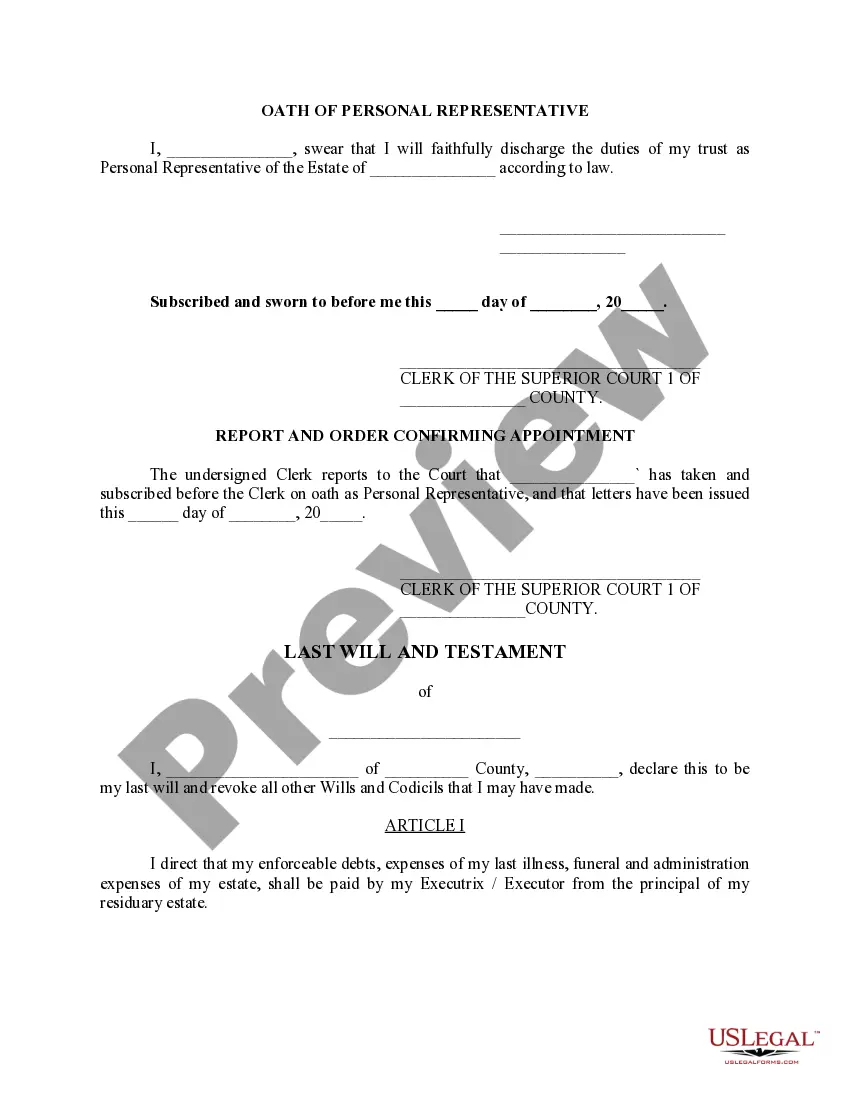

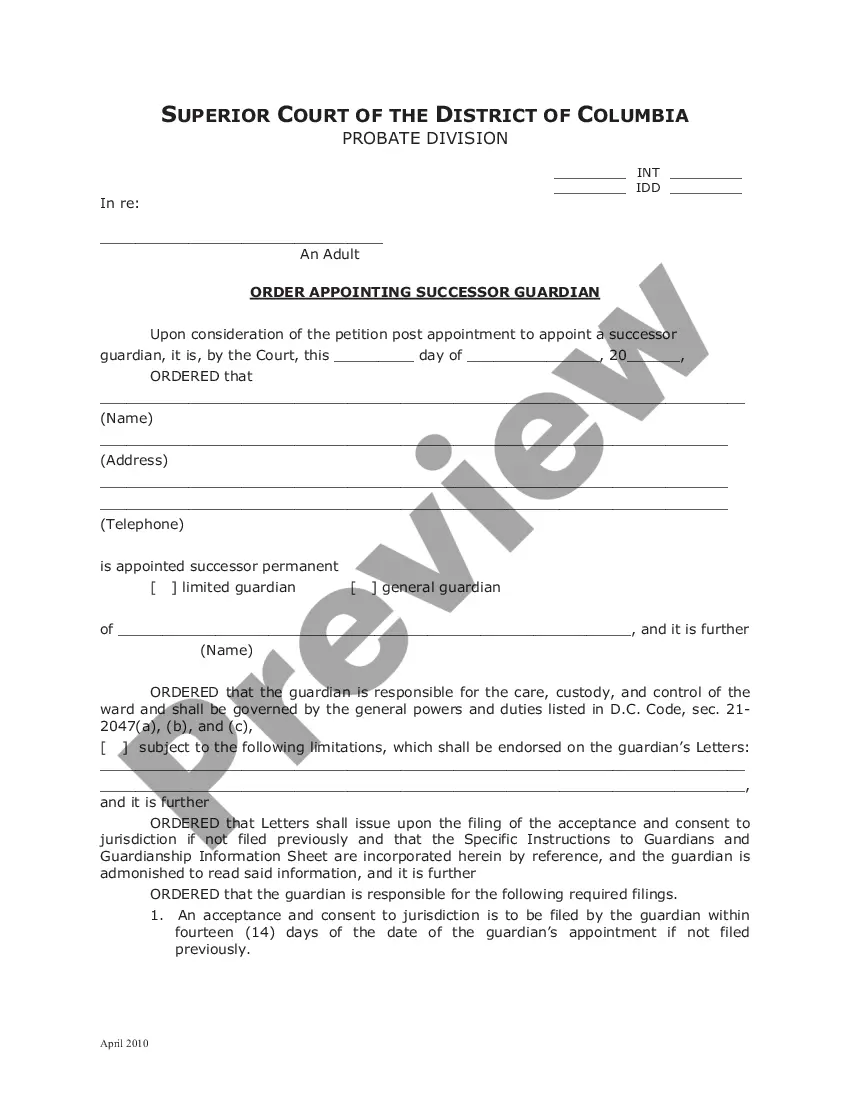

Michigan Simple Promissory Note for Tutition Fee

Description

How to fill out Michigan Simple Promissory Note For Tutition Fee?

US Legal Forms - one of several biggest libraries of legitimate types in America - provides a variety of legitimate papers themes you may download or printing. Using the site, you can get a huge number of types for organization and person functions, sorted by classes, states, or keywords and phrases.You will discover the latest versions of types like the Michigan Simple Promissory Note for Tutition Fee in seconds.

If you already have a membership, log in and download Michigan Simple Promissory Note for Tutition Fee through the US Legal Forms catalogue. The Acquire button can look on every form you look at. You get access to all previously downloaded types in the My Forms tab of your accounts.

In order to use US Legal Forms initially, allow me to share straightforward recommendations to help you get started:

- Be sure you have selected the best form to your metropolis/region. Click the Review button to analyze the form`s content material. See the form description to ensure that you have selected the right form.

- In the event the form does not suit your demands, make use of the Lookup area at the top of the display screen to obtain the the one that does.

- Should you be content with the shape, validate your choice by simply clicking the Purchase now button. Then, opt for the pricing prepare you want and offer your credentials to sign up to have an accounts.

- Process the purchase. Utilize your bank card or PayPal accounts to accomplish the purchase.

- Find the file format and download the shape on your own gadget.

- Make changes. Fill out, modify and printing and indication the downloaded Michigan Simple Promissory Note for Tutition Fee.

Each template you added to your money does not have an expiration time which is your own permanently. So, in order to download or printing another duplicate, just check out the My Forms segment and click around the form you need.

Get access to the Michigan Simple Promissory Note for Tutition Fee with US Legal Forms, by far the most comprehensive catalogue of legitimate papers themes. Use a huge number of expert and express-specific themes that satisfy your organization or person requirements and demands.

Form popularity

FAQ

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

There is no legal requirement for most promissory notes to be witnessed or notarized in Michigan (a promissory note for a home loan, however, may need to be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P. I promise to pay said amount on or before . Furthermore, I am fully aware that subsequent Promissory Notes shall not be accepted without settling my current due amount.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

This is to express in writing my inability to pay on time the amount due for my tuition fees amounting to P. I promise to pay said amount on or before . Furthermore, I am fully aware that subsequent Promissory Notes shall not be accepted without settling my current due amount.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

A valid promissory note only needs the signatures of the participating parties involved in the agreement, not necessitating acknowledgment or being witnessed by a notary public to be legitimate.

More info

Aptly Your Name First Last Submit.