Michigan Investment Letter regarding Intrastate Offering

Description

How to fill out Investment Letter Regarding Intrastate Offering?

Are you presently in a situation where you need paperwork for either professional or personal purposes almost every business day.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Michigan Investment Letter for Intrastate Offering, which are designed to comply with both state and federal regulations.

Once you find the appropriate form, click on Acquire now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Michigan Investment Letter for Intrastate Offering template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and verify it is applicable to your specific area/county.

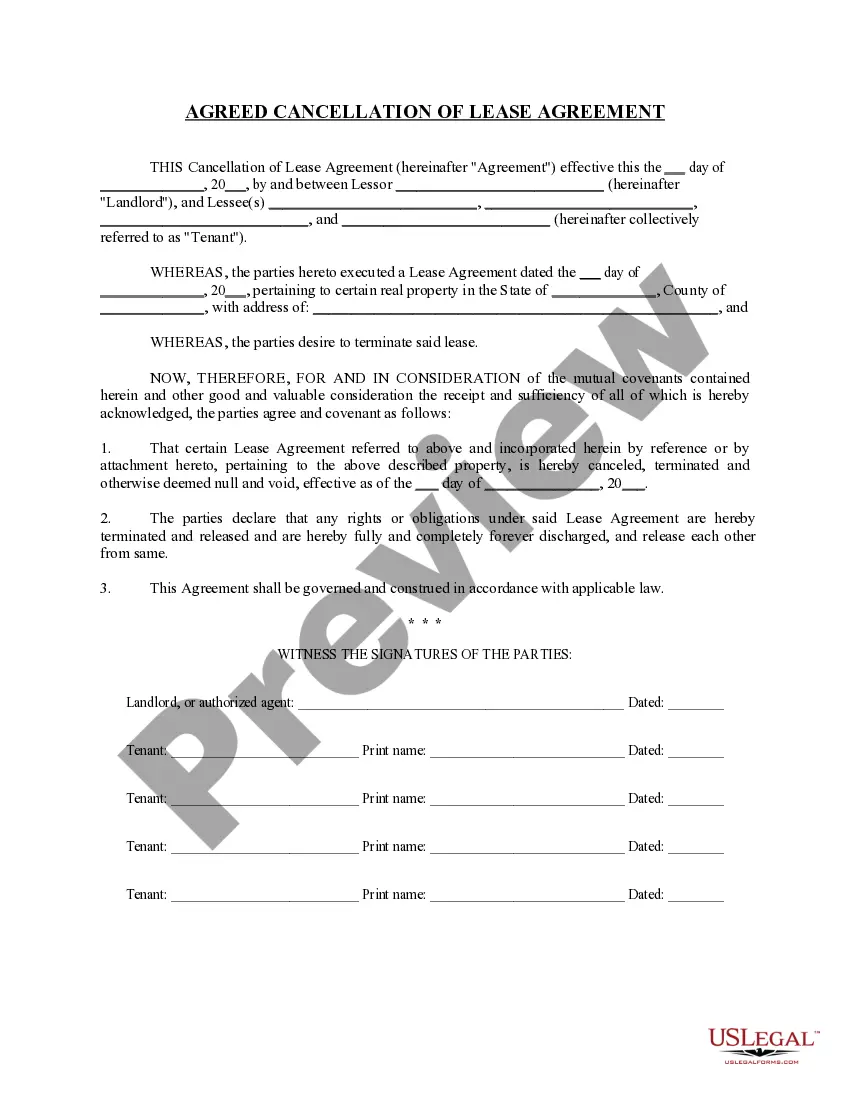

- Utilize the Review option to review the form.

- Examine the description to ensure that you have selected the correct form.

- If the form does not meet your criteria, use the Lookup field to find the form that suits your needs and requirements.

Form popularity

FAQ

The Securities Act applies to the offer and sale of securities, protecting investors from fraudulent activities and ensuring proper disclosure of information. This legislation encompasses both public and private offerings, making it particularly relevant for businesses within Michigan. If you're drafting a Michigan Investment Letter regarding Intrastate Offering, understanding how the Securities Act applies is crucial for compliance and investor security.

The Uniform Securities Act provides guidelines for registration, sales, and reporting of securities in Michigan. It outlines the requirements for issuers and brokers, helping maintain a fair market. Utilizing a Michigan Investment Letter regarding Intrastate Offering involves adhering to the provisions outlined in this act, ensuring compliance and facilitating successful transactions.

The Uniform Securities Act in Michigan establishes a framework for regulating securities transactions within the state. It aims to protect investors by enforcing compliance and providing oversight of securities dealers and offerings. When you are preparing a Michigan Investment Letter regarding Intrastate Offering, this act serves as a vital reference for legal and regulatory obligations.

The Uniform Trade Practices Act in Michigan regulates the conduct of businesses involved in the trade of securities. It promotes ethical standards and fair practices within the industry, ensuring that all parties can engage in transactions without fear of malpractice. This act is essential when utilizing a Michigan Investment Letter regarding Intrastate Offering, as it governs appropriate trade practices.

The Uniform Securities Act protects investors by ensuring transparency and fairness in the offering and selling of securities. It benefits individual and institutional investors alike, providing guidelines that prevent fraud and deceit in investment transactions. If you’re working with a Michigan Investment Letter regarding Intrastate Offering, understanding this act is crucial for safeguarding your investments.

Exceptions to blue sky laws may include private placements, offerings to accredited investors, and certain government securities. Each state may have specific exemptions, making it essential to understand the implications of the Michigan Investment Letter regarding Intrastate Offering. By leveraging the expertise of uslegalforms, you can identify these exceptions and navigate compliance effectively.

'Blue sky' refers to laws that prevent fraudulent investment schemes by requiring businesses to disclose information about their offerings. The term signifies the idea that investors should have a clear, unobstructed view of what they are investing in. In relation to the Michigan Investment Letter regarding Intrastate Offering, these laws ensure transparency and honesty in investments.

Michigan's blue sky law regulates the sale of securities within the state to protect investors from fraud. It requires companies to register their securities offerings and provide specific disclosures. By utilizing the Michigan Investment Letter regarding Intrastate Offering, you can align your investments with state regulations, facilitating a trustworthy transaction environment.

The no blue sky rule allows certain transactions to escape compliance with blue sky laws, making them easier for companies to navigate. This rule typically applies to private placements and small offerings. However, when dealing with the Michigan Investment Letter regarding Intrastate Offering, it is essential to know which exemptions apply, ensuring compliance while accessing investment opportunities.

Blue sky laws safeguard investors by regulating securities offerings and preventing fraud. They ensure that companies provide accurate information about their investment opportunities. In the context of the Michigan Investment Letter regarding Intrastate Offering, these laws require disclosures that protect you from misleading practices.