Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights.

How to fill out Buy-Sell Agreement Between Shareholders Of Closely Held Corporation?

If you desire to complete, obtain, or create valid document templates, utilize US Legal Forms, the largest assortment of legal templates available online.

Take advantage of the website's simple and convenient search to locate the documents you require.

Numerous templates for business and personal use are categorized by types and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal document template.

Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to create an account.

- Use US Legal Forms to locate the Michigan Buy-Sell Agreement between Shareholders of a Closely Held Corporation in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to retrieve the Michigan Buy-Sell Agreement between Shareholders of a Closely Held Corporation.

- You can also access documents you previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Do not forget to read the description.

Form popularity

FAQ

Writing up a shareholder agreement begins with detailing the rights and responsibilities of each shareholder. You should include provisions on share transfer, decision-making processes, and dispute resolution. Using the Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation from uslegalforms can greatly simplify this process, as it provides a structured format and expert advice to meet your specific needs.

Filling out a buy-sell agreement involves clearly defining the terms of ownership transfer and identifying all current shareholders. You'll need to specify the valuation method for shares, payment terms, and any conditions for triggering the agreement. To navigate this process confidently, consider utilizing the Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation available on the uslegalforms platform for detailed templates and guidance.

sell agreement is often referred to as a buysell contract or a shareholders' agreement. This legal document is crucial for business owners, as it outlines the procedures for transferring ownership shares. Specifically, the Michigan BuySell Agreement between Shareholders of Closely Held Corporation ensures a smooth transition in ownership when a shareholder departs, whether due to retirement, death, or other circumstances.

Shareholder agreements can lead to misunderstandings if not carefully drafted. Vague terms may create room for disputes among shareholders, undermining the intended collaborative environment. Therefore, utilizing resources like uslegalforms can help create a clear and effective Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation, avoiding potential pitfalls.

No, they are distinct documents serving different purposes. A shareholder agreement defines overall rights and responsibilities, while a buy-sell agreement focuses on the sale of shares and ownership transitions. For anyone managing a closely held corporation in Michigan, distinguishing between a Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation and a shareholder agreement is crucial for effective governance.

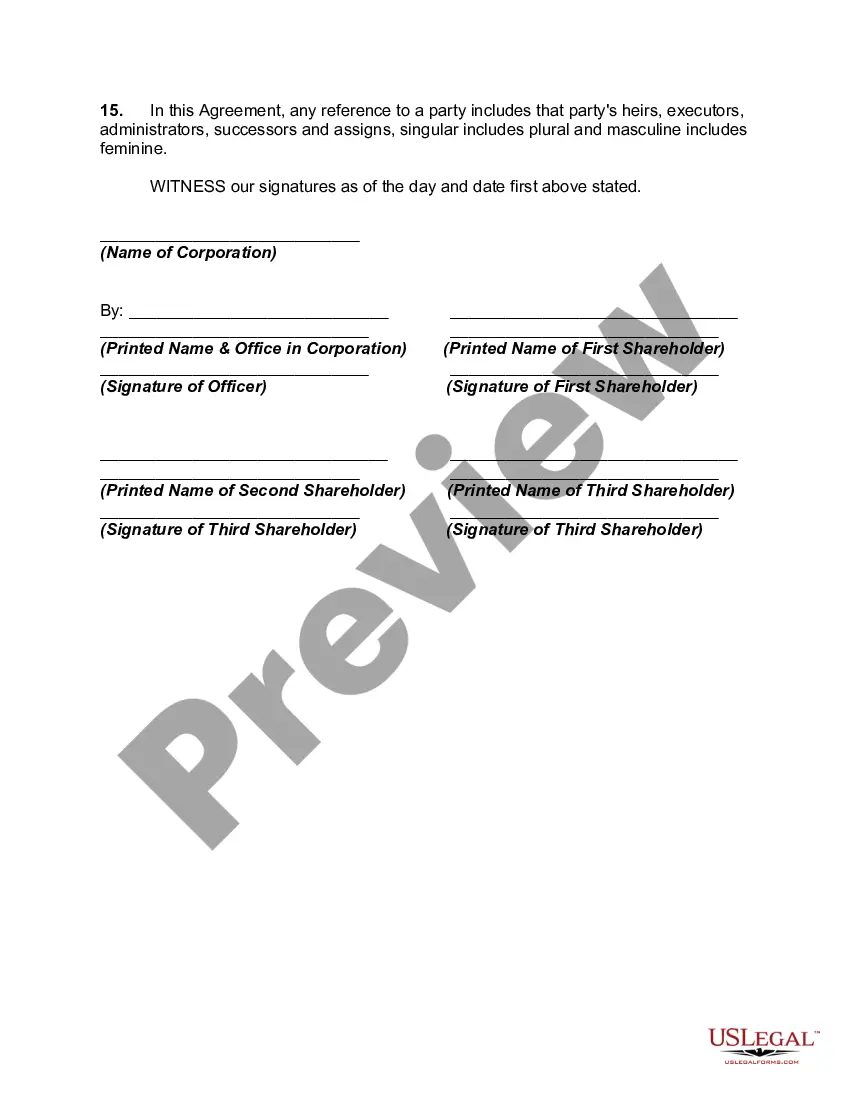

Executing a buy-sell agreement typically involves drafting the agreement with clear terms agreed upon by all shareholders. Once finalized, all parties must sign the document to make it legally binding. It's advisable to consult with legal professionals familiar with the Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation to ensure compliance and clarity.

While a buy-sell agreement offers many advantages, it is not without its drawbacks. One major concern is that it can limit the flexibility of shareholders to sell their shares freely. Additionally, the agreements can lead to conflicts if the valuation methods aren’t clearly defined. Having a well-structured Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation can help mitigate these disadvantages by setting clear parameters.

A shareholder agreement outlines the broader relationship and responsibilities among shareholders. In contrast, a buy-sell agreement specifically addresses the terms under which shares can be bought or sold, often upon certain triggering events. Understanding this distinction is vital for close corporations in Michigan, as the Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation provides essential guidelines for transitions.

A shareholders agreement becomes legally binding when it meets specific criteria, such as the mutual consent of all parties involved and compliance with relevant laws. In the context of a Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation, ensuring that all shareholders sign and adhere to the terms is vital for the agreement's enforceability. Documenting these agreements with clear language and proper legal format enhances their legitimacy.

While both documents serve essential roles, a shareholder agreement and a buy-sell agreement are not identical. The Michigan Buy-Sell Agreement between Shareholders of Closely Held Corporation focuses specifically on procedures for buying or selling shares, whereas a more general shareholder agreement may cover broader governance issues. Understanding these distinctions is vital for effective corporate management.