Michigan Affidavit of Domicile for Deceased

Description

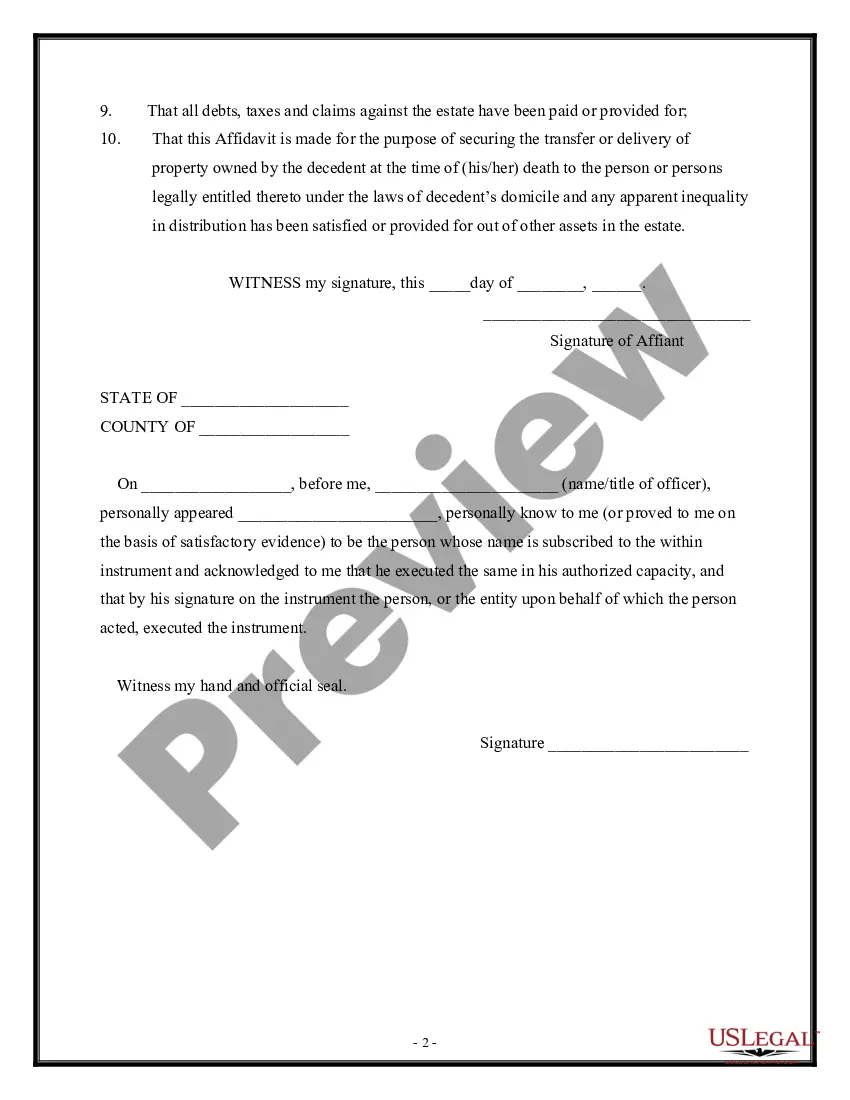

How to fill out Affidavit Of Domicile For Deceased?

US Legal Forms - among the most significant libraries of lawful kinds in the United States - gives a variety of lawful record layouts you can acquire or print. While using site, you will get 1000s of kinds for company and specific reasons, categorized by types, says, or keywords and phrases.You can get the most recent types of kinds like the Michigan Affidavit of Domicile for Deceased in seconds.

If you have a subscription, log in and acquire Michigan Affidavit of Domicile for Deceased in the US Legal Forms collection. The Acquire key will show up on every form you look at. You have access to all earlier saved kinds inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms for the first time, listed here are straightforward recommendations to help you get began:

- Be sure you have picked the correct form for your area/region. Click on the Preview key to analyze the form`s information. Look at the form description to ensure that you have chosen the correct form.

- In case the form does not match your requirements, utilize the Lookup industry on top of the monitor to discover the one who does.

- When you are satisfied with the shape, verify your selection by visiting the Purchase now key. Then, pick the rates prepare you prefer and offer your credentials to register on an bank account.

- Approach the transaction. Utilize your charge card or PayPal bank account to finish the transaction.

- Choose the file format and acquire the shape in your system.

- Make modifications. Complete, modify and print and indication the saved Michigan Affidavit of Domicile for Deceased.

Each and every format you put into your account does not have an expiry day and is the one you have permanently. So, if you would like acquire or print yet another backup, just go to the My Forms segment and click on on the form you require.

Get access to the Michigan Affidavit of Domicile for Deceased with US Legal Forms, probably the most substantial collection of lawful record layouts. Use 1000s of specialist and condition-distinct layouts that meet up with your organization or specific demands and requirements.

Form popularity

FAQ

In Michigan, creditors have up to 3 years from the date of death to present claims to the estate. However, if you have followed the Task: Publish Notice of Death correctly, creditors will have only 4 months from the date of the first publication of notice to creditors.

Real Estate Probate ? If a property is valued below $22,000, a spouse or any surviving heirs can petition a probate court to have the estate probated. For estates valued above $22,000 there is a formal supervised probate process which requires the appointment of a personal representative to distribute the estate.

Affidavit of Decedent's Successor for Delivery of Certain Assets Owned by Decedent (PC 598) may be used to affirm the following: More than 28 days have passed since the death of the decedent. The estate does not include real property.

Whether an estate is small depends on the value of the property in it. The dollar limit can change each year. If a person dies in 2023, an estate must be valued at $27,000 or less to be small. If a person died in 2022, an estate must be valued at $25,000 or less.

As part of the affidavit, the person filling out the paperwork, known as ?the affiant,? must provide certain information, including the deceased person's personal information, date of death, and a list of the deceased's property and debts. This document must be signed under oath, so honesty is paramount.

Here are a few common instances where assets do not require probate in the State of Michigan: Assets owned under ?joint tenancy.? Beneficiary designation assets (i.e. retirement accounts with a listed beneficiary) When the decedent has assets named within a trust.

Motor Vehicles. If a decedent dies with no probate assets (i.e., owns nothing in their name alone) except for one or more motor vehicles whose total value is not more than $60,000, title to the vehicles can be transferred by the Secretary of State without opening an estate in the Probate Court.