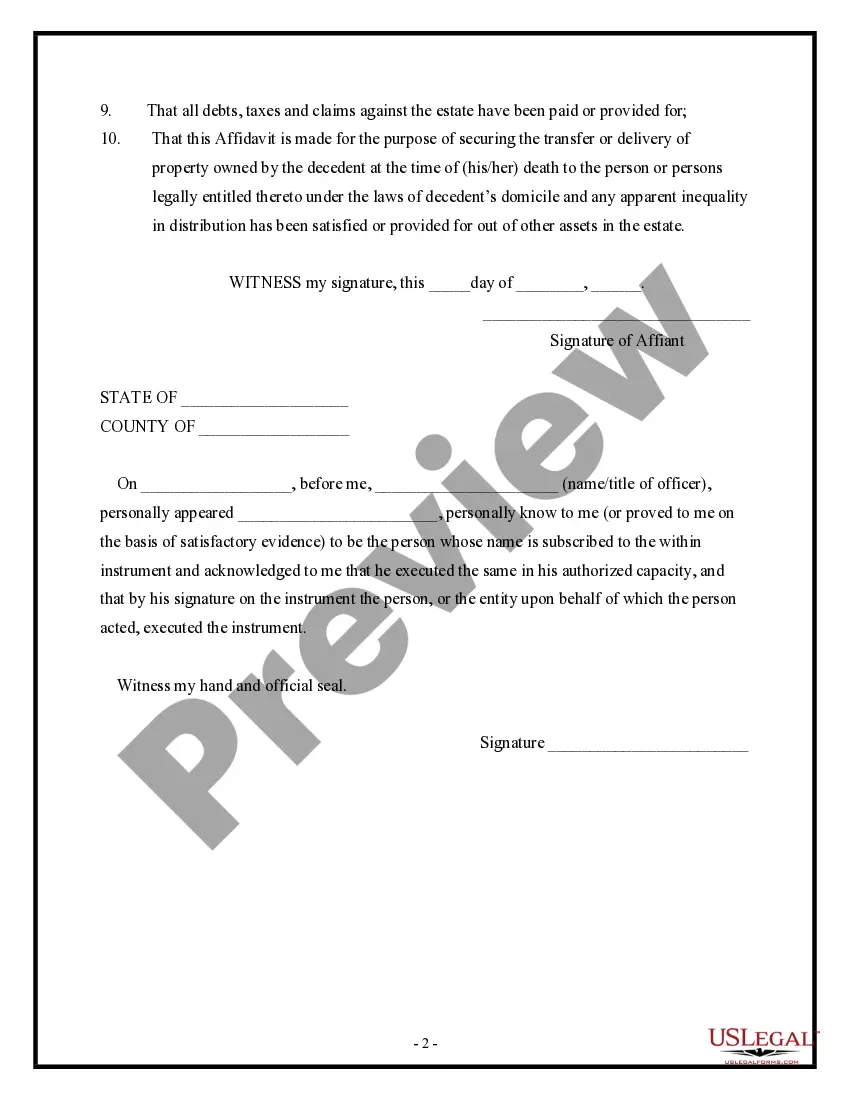

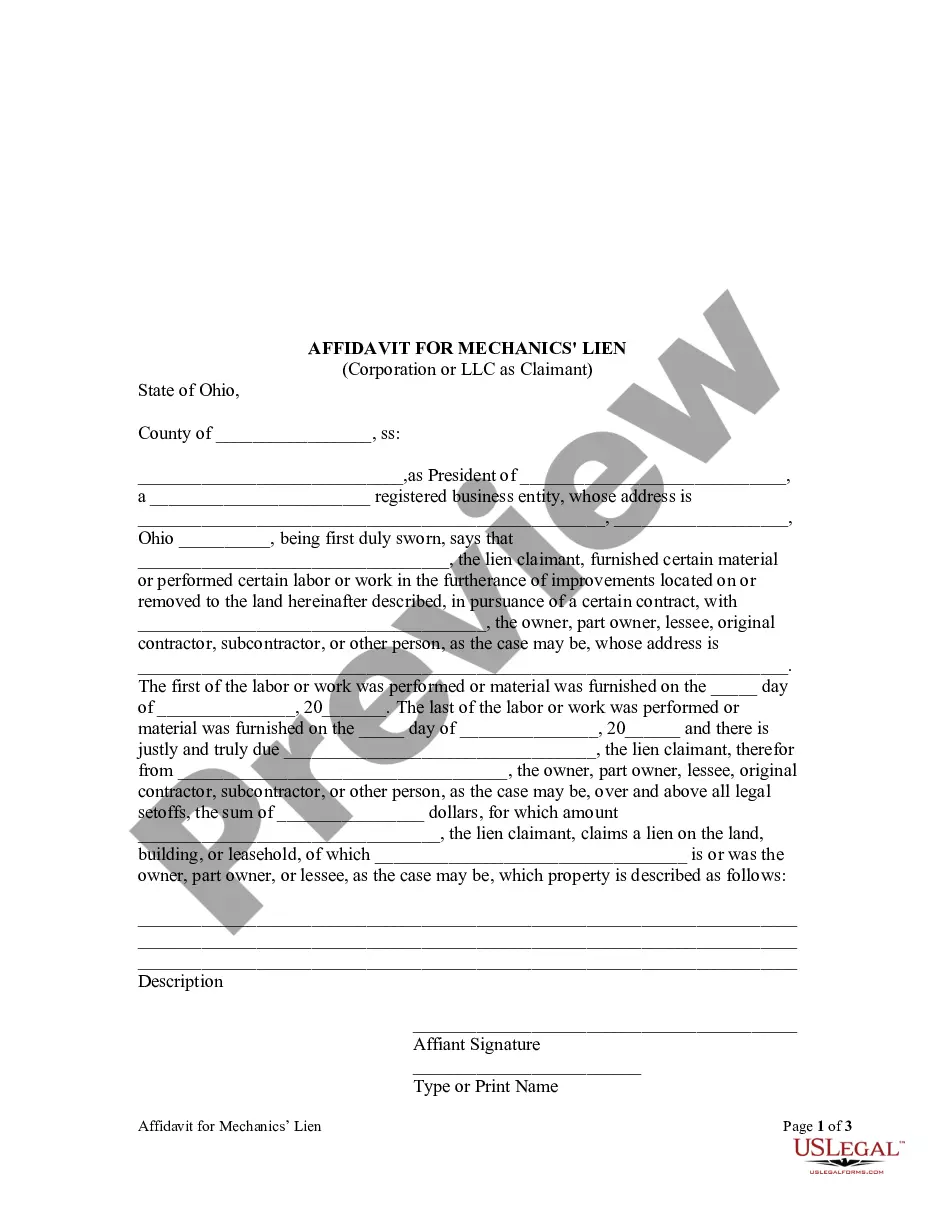

Michigan Affidavit of Domicile

Description

How to fill out Affidavit Of Domicile?

Are you within a place the place you require documents for either company or personal functions just about every day time? There are a variety of legitimate document web templates available on the net, but locating kinds you can rely on isn`t straightforward. US Legal Forms provides a large number of kind web templates, just like the Michigan Affidavit of Domicile, which are created to meet state and federal demands.

Should you be currently knowledgeable about US Legal Forms web site and possess a free account, merely log in. After that, it is possible to down load the Michigan Affidavit of Domicile design.

Unless you offer an accounts and need to start using US Legal Forms, abide by these steps:

- Get the kind you need and make sure it is to the proper metropolis/region.

- Take advantage of the Review switch to analyze the shape.

- Read the information to actually have selected the proper kind.

- If the kind isn`t what you are searching for, make use of the Look for field to find the kind that suits you and demands.

- Whenever you obtain the proper kind, simply click Buy now.

- Select the rates program you desire, fill in the required information to generate your money, and buy the transaction using your PayPal or charge card.

- Select a handy document format and down load your backup.

Locate all of the document web templates you possess purchased in the My Forms food selection. You can get a additional backup of Michigan Affidavit of Domicile any time, if necessary. Just click the essential kind to down load or print the document design.

Use US Legal Forms, one of the most extensive variety of legitimate forms, to conserve time and avoid faults. The services provides expertly made legitimate document web templates that can be used for a range of functions. Generate a free account on US Legal Forms and start creating your life easier.

Form popularity

FAQ

What Is the Difference Between a Residence and a Domicile? A residence is a location where you may live part-time or full-time. A domicile is your legal address, and your domicile is located in the state where you pay taxes.

You possess a Michigan driver's license or voter's registration; you possess a Permanent Resident Alien visa; you have continuous physical presence in Michigan for one year or more; you sign a statement of intent to be domiciled in Michigan.

Legally, you can have multiple residences in multiple states, but only one domicile. You must be physically in the same state as your domicile most of the year, and able to prove the domicile is your principal residence, ?true home? or ?place you return to.?

(3) A person whose residency cannot be determined by the above guidelines shall be deemed a resident of Michigan if he lives within the state for not less than 183 days during the tax year or for more than 1/2 the days during a taxable year of less than 12 months.

You are a Michigan resident if your domicile is in Michigan. Your domicile is where you have your permanent home. It is the place you plan to return to whenever you go away. You may have several residences, but you can have only one domicile at a time (MCL 206.18).

You possess a Michigan driver's license or voter's registration; you possess a Permanent Resident Alien visa; you have continuous physical presence in Michigan for one year or more; you sign a statement of intent to be domiciled in Michigan.

If an individual lives in this state at least 183 days during the tax year or more than 1/2 the days during a taxable year of less than 12 months he shall be deemed a resident individual domiciled in this state.