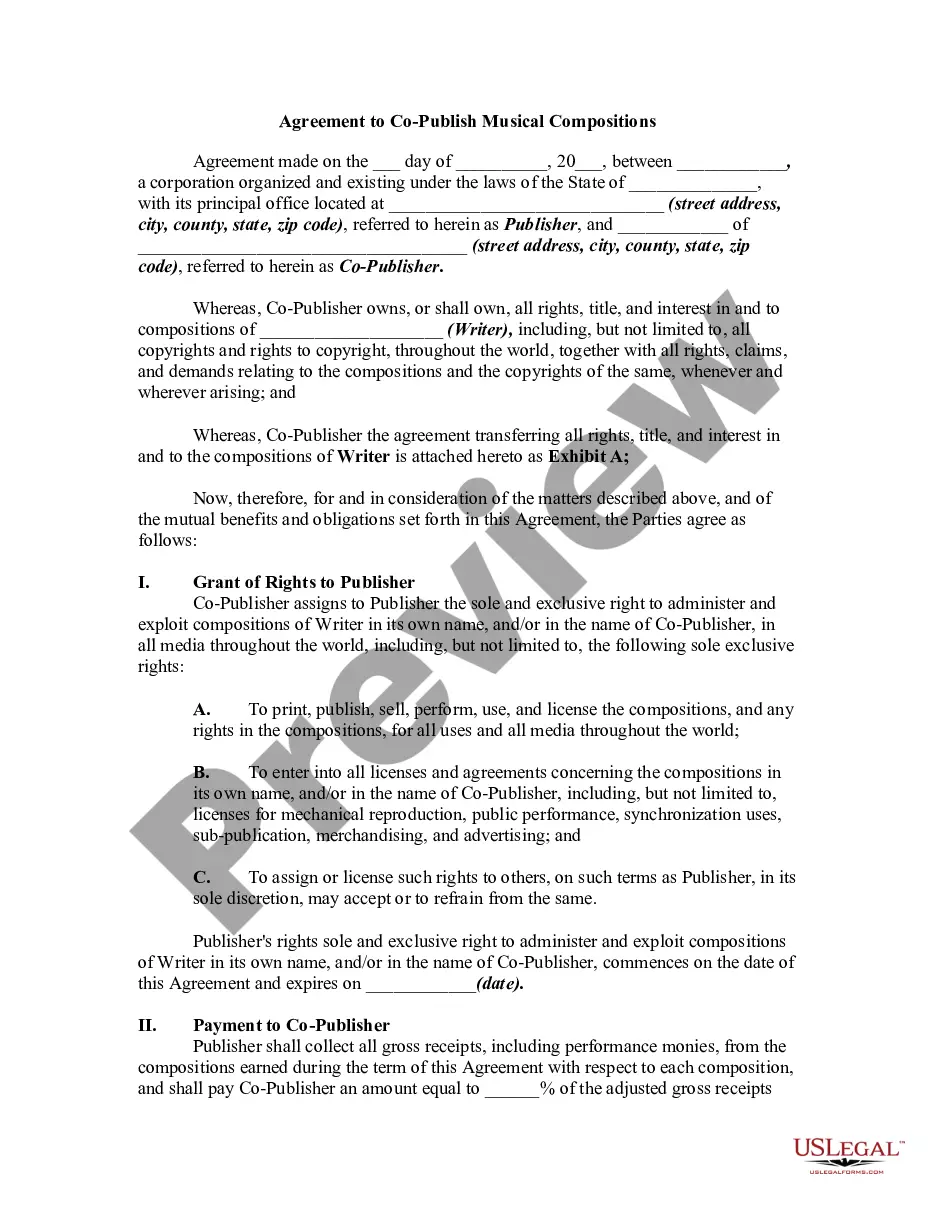

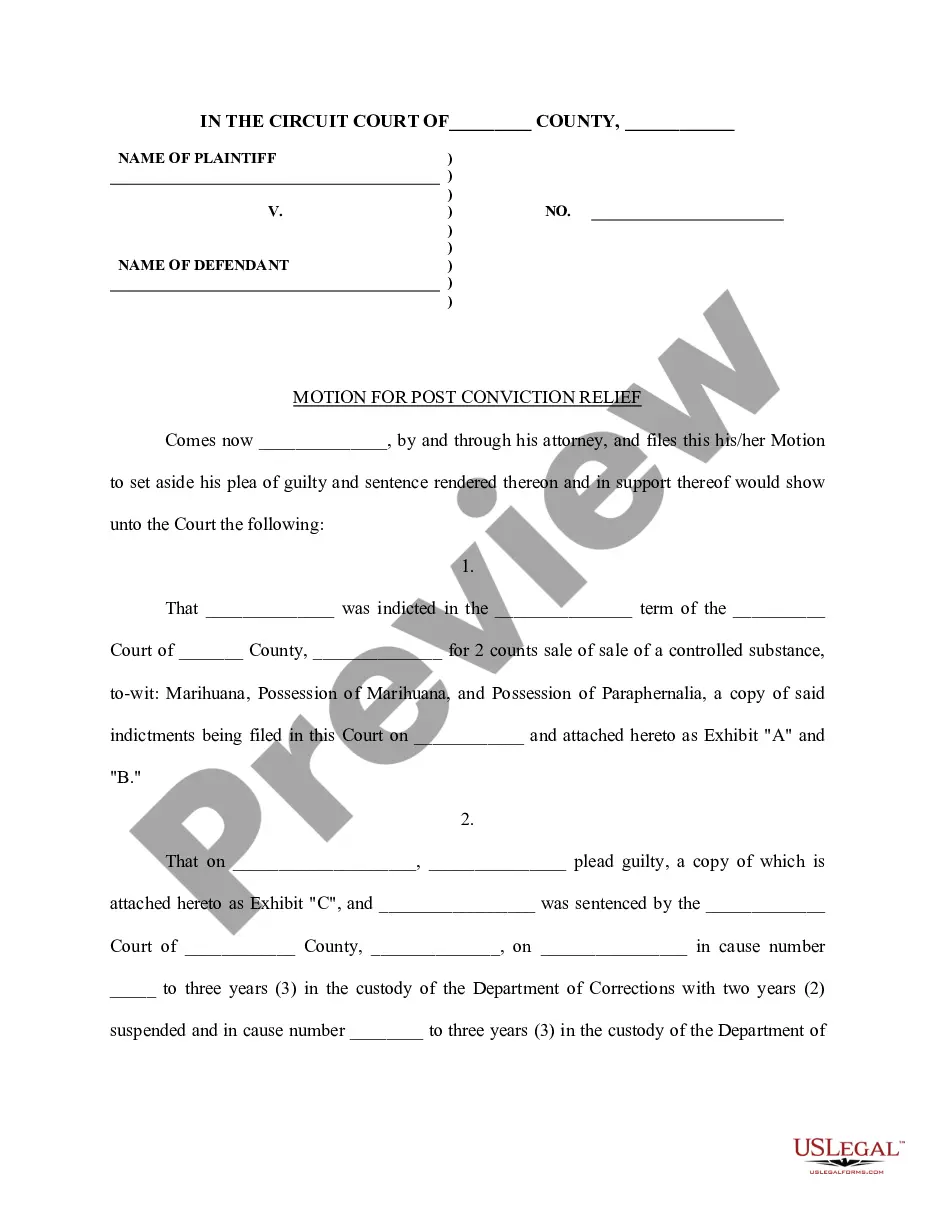

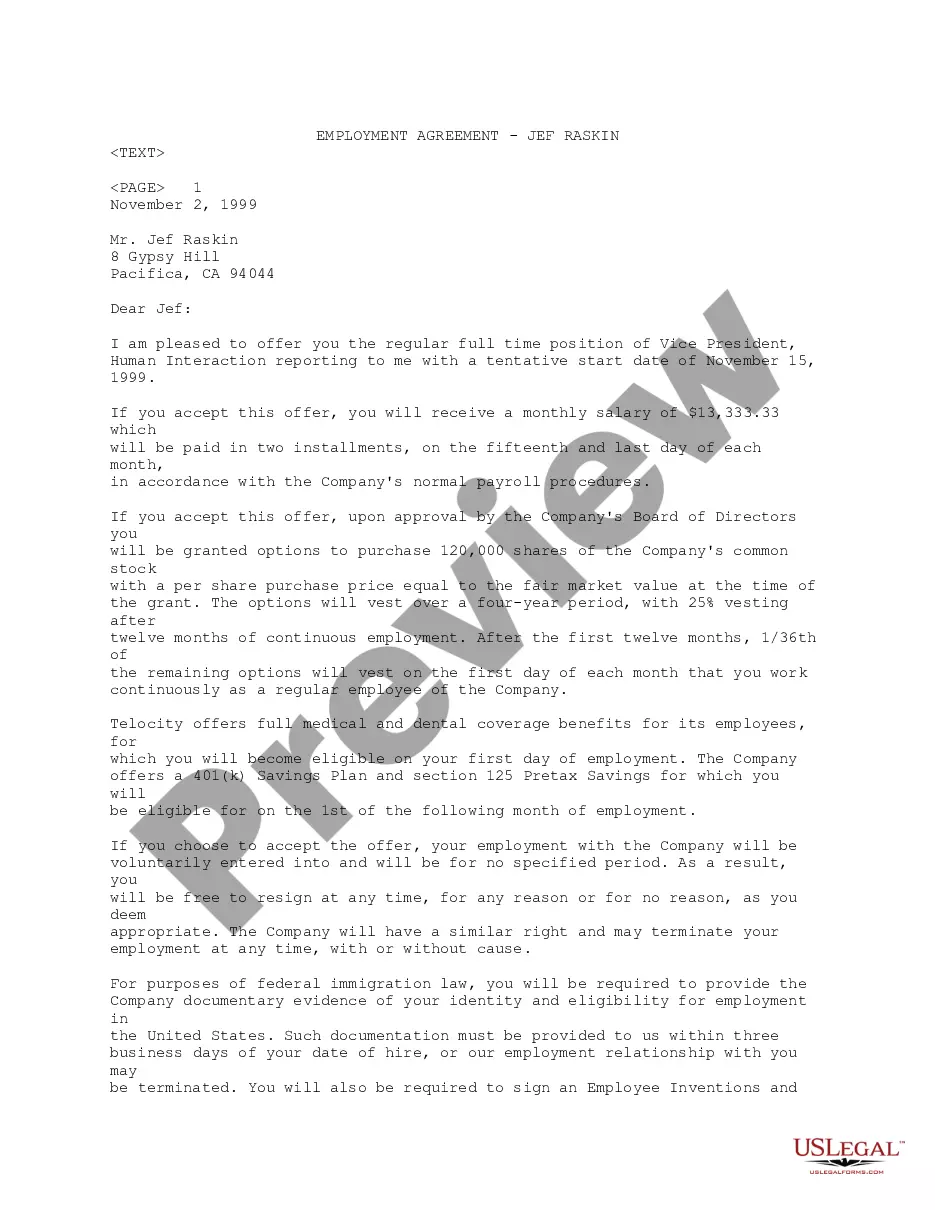

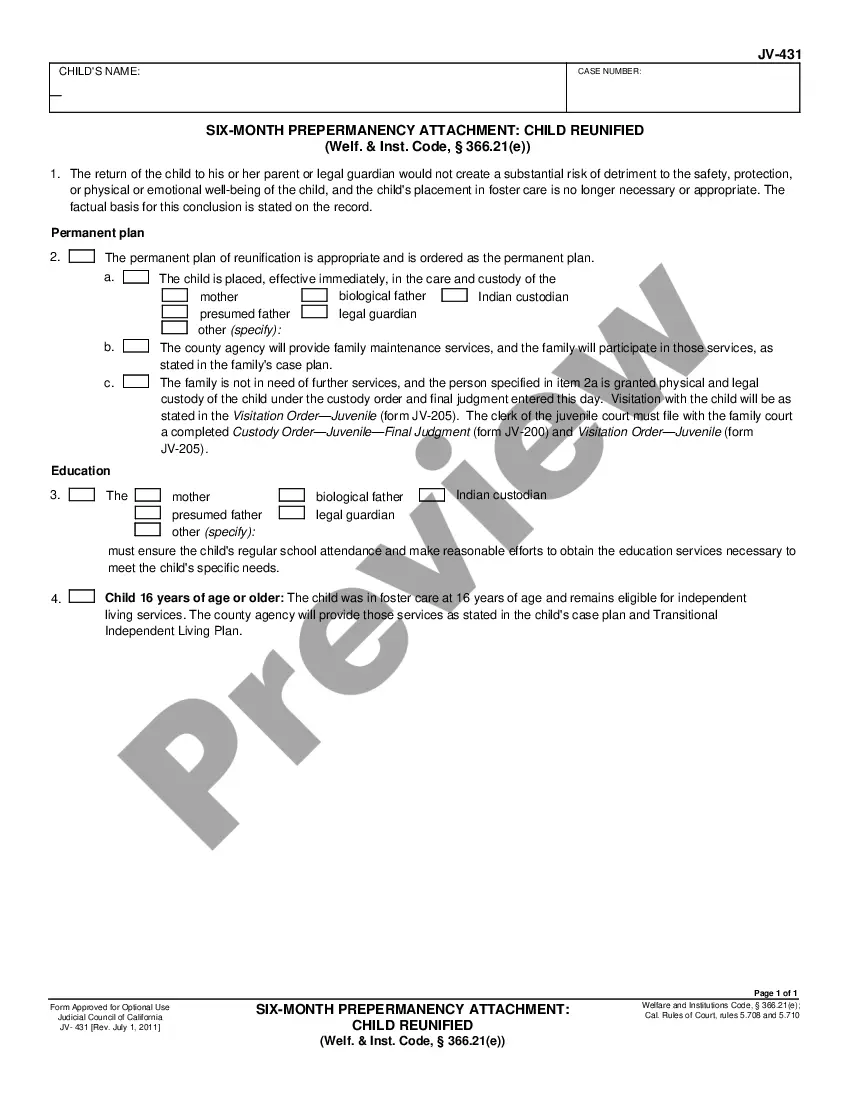

The Michigan Credit Card Agreement and Disclosure Statement is a comprehensive document that outlines the terms and conditions associated with a credit card issued by a financial institution in the state of Michigan. This agreement serves as a legally binding contract between the cardholder and the credit card issuer, governing the use of the credit card and the rights and responsibilities of both parties. The Michigan Credit Card Agreement and Disclosure Statement includes important information such as the annual percentage rate (APR) for purchases, cash advances, and balance transfers. It also highlights any introductory APR's, penalty APR's, and how the APR may change based on specific circumstances. Additionally, the document specifies the method for calculating interest charges, including any grace periods for purchases and repayment terms. It outlines the minimum payment requirements, any associated fees, and the consequences of late or missed payments. The Michigan Credit Card Agreement and Disclosure Statement provides a thorough overview of the cardholder's rights and protections. It explains the dispute resolution process, including how to file a formal complaint if needed. It also outlines the cardholder's liability for unauthorized charges, procedures for reporting lost or stolen cards, and any limitations on liability. Furthermore, the agreement includes details about any rewards programs or benefits associated with the credit card, such as cashback, airline miles, or loyalty points. It specifies how rewards are earned, redeemed, and potentially forfeited. In Michigan, various types of credit card agreements and disclosure statements may exist, tailored to meet the specific needs and offerings of different financial institutions. These may include: 1. Standard Credit Card Agreement and Disclosure Statement: This is the basic agreement that covers the general terms and conditions of a credit card, including APR's, fees, and payment obligations. 2. Rewards Credit Card Agreement and Disclosure Statement: This agreement focuses on the terms and conditions specific to credit cards that offer rewards or loyalty programs, detailing how the rewards are earned, redeemed, and any limitations or restrictions that may apply. 3. Student Credit Card Agreement and Disclosure Statement: This type of agreement is designed for college students or those with limited credit histories. It may outline special considerations, such as higher interest rates, lower credit limits, or educational resources for responsible credit card usage. 4. Secured Credit Card Agreement and Disclosure Statement: For individuals with poor or no credit, this agreement covers credit cards that require collateral, typically in the form of a cash deposit, which determines the card's credit limit. It specifies how the deposit is refunded and the impact on the cardholder's credit history. 5. Business Credit Card Agreement and Disclosure Statement: Geared towards business owners, this agreement addresses the specific needs of businesses, such as expense tracking, employee card issuance, and potential tax benefits. It may also detail the personal guarantee required for certain business credit cards. In conclusion, the Michigan Credit Card Agreement and Disclosure Statement is a vital document for credit card users, ensuring full understanding of the terms and conditions associated with their credit card. Various types of agreements exist to cater to different cardholder needs, such as standard, rewards, student, secured, and business credit cards. It is crucial for consumers to review and comprehend this document thoroughly before accepting and using any credit card.

Michigan Credit Card Agreement and Disclosure Statement

Description

How to fill out Michigan Credit Card Agreement And Disclosure Statement?

US Legal Forms - one of several greatest libraries of legitimate types in the States - gives a variety of legitimate papers web templates you can acquire or print out. Utilizing the web site, you can find a huge number of types for enterprise and specific reasons, sorted by classes, claims, or keywords and phrases.You will find the latest models of types just like the Michigan Credit Card Agreement and Disclosure Statement within minutes.

If you already possess a subscription, log in and acquire Michigan Credit Card Agreement and Disclosure Statement from the US Legal Forms catalogue. The Download switch can look on each and every develop you perspective. You get access to all earlier saved types within the My Forms tab of your account.

If you wish to use US Legal Forms the very first time, here are easy guidelines to get you began:

- Make sure you have selected the proper develop for your metropolis/region. Click the Review switch to analyze the form`s content. Browse the develop description to ensure that you have chosen the appropriate develop.

- When the develop does not satisfy your requirements, take advantage of the Lookup discipline near the top of the display to discover the one which does.

- If you are content with the shape, verify your selection by visiting the Purchase now switch. Then, pick the prices program you like and give your accreditations to sign up on an account.

- Method the transaction. Make use of your charge card or PayPal account to finish the transaction.

- Find the structure and acquire the shape on your own system.

- Make modifications. Fill up, modify and print out and signal the saved Michigan Credit Card Agreement and Disclosure Statement.

Each and every template you included in your bank account lacks an expiration particular date and it is your own for a long time. So, if you wish to acquire or print out one more version, just proceed to the My Forms area and then click on the develop you want.

Get access to the Michigan Credit Card Agreement and Disclosure Statement with US Legal Forms, probably the most comprehensive catalogue of legitimate papers web templates. Use a huge number of specialist and state-specific web templates that meet your business or specific needs and requirements.

Form popularity

FAQ

1?? As such, customers considering accepting a new credit card should carefully review their cardholder agreement in order to confirm that the actual provisions of the card are as advertised. Although their details vary, most cardholder agreements are written using a similar format and in a straightforward tone.

How to Read Your Credit Card Statements Account Information. The top of the statement may include your name, address, account number and the date range for the billing cycle. Summary of Account Activity. ... Payment Information. ... Account Notifications. ... Transactions. ... Interest, Fees, and Interest Rates. ... Rewards.

The Credit Card Arrangements Act 379 of 1984 regulates certain credit card transactions, agreements, charges, and disclosures; prescribes the powers and duties of the financial institutions bureau and certain state agencies; provides for the promulgation of rules; provides for fines and penalties.

The Cardholder Agreement details the terms and conditions of your credit card account and includes information such as the rate, fees, and other cost information associated with the account.

A credit card agreement is legal document between a credit card company and a customer that sets the terms for the credit card being offered to the customer. This agreement may also be referred to as a charge card agreement or bankcard agreement, depending on what type of institution has agreed to provide them.

"Agreement" means this Credit Card Agreement plus the Disclosure Statement, which is contained in the same envelope as, and folded together with, this Credit Card Agreement and which provides information on the periodic rate, the Annual Percentage Rate (APR), the Interest Charge and balance on which it is determined, ...

You should be able to find pricing and terms information adjacent to any credit card application. If you can't locate this information, contact the issuer directly and request it. They are required by law to give it to you.

Definition. A credit card disclosure is a document that outlines all of the fees, costs, interest rates, and terms that a customer could experience while using the credit card. Institutions that offer credit cards are required by law to disclose this information.