Michigan Assignment and Transfer of Stock refers to the legal process by which ownership of company shares, also known as stock, is transferred from one party to another within the state of Michigan. This process involves the assignment and transfer of rights, responsibilities, and financial interests associated with the stock. The assignment and transfer of stock in Michigan can occur through various means, including voluntary agreements, inheritance, gifting, or sale transactions. These transfers require adherence to specific rules and regulations set forth by the Michigan Corporations Division, which oversees corporate governance in the state. Different types of Michigan Assignment and Transfer of Stock include: 1. Voluntary Assignment: In this type of transfer, shareholders willingly assign their stock to another individual or entity. It often involves the execution of a legally binding document known as an Assignment of Stock, where the assignor gives up their ownership rights to the assignee. 2. Inheritance Assignment: When a shareholder passes away and leaves behind stock holdings, their ownership rights can be transferred to heirs or beneficiaries through the process of inheritance assignment. Legal documentation, such as a will or trust, may specify how the stock should be transferred. 3. Stock Gifting: Shareholders may choose to transfer their stock as a gift to another person or organization without any monetary exchange. Gift transfers often require completing a Gift Assignment of Stock form to facilitate the transfer and record the change in ownership. 4. Stock Sale or Purchase: Shareholders have the option to sell or purchase stock in Michigan through various types of sales transactions, such as private sales, public offerings, or secondary market transactions. These transfers involve the negotiation and execution of a Stock Purchase Agreement, ensuring a smooth transfer of ownership and consideration between buyer and seller. It is crucial to comply with relevant state laws and regulations while executing Michigan Assignment and Transfer of Stock. This typically involves submitting necessary documents, such as stock certificates, transfer forms, and legal agreements, to the Michigan Corporations Division or other relevant authorities for proper recording and validation of the ownership transfer. In conclusion, Michigan Assignment and Transfer of Stock encompass various processes for transferring ownership rights and interests in company shares. Understanding the different types of transfers and complying with state regulations is vital for accurately recording and protecting the rights of shareholders involved in these transactions.

Michigan Assignment and Transfer of Stock

Description

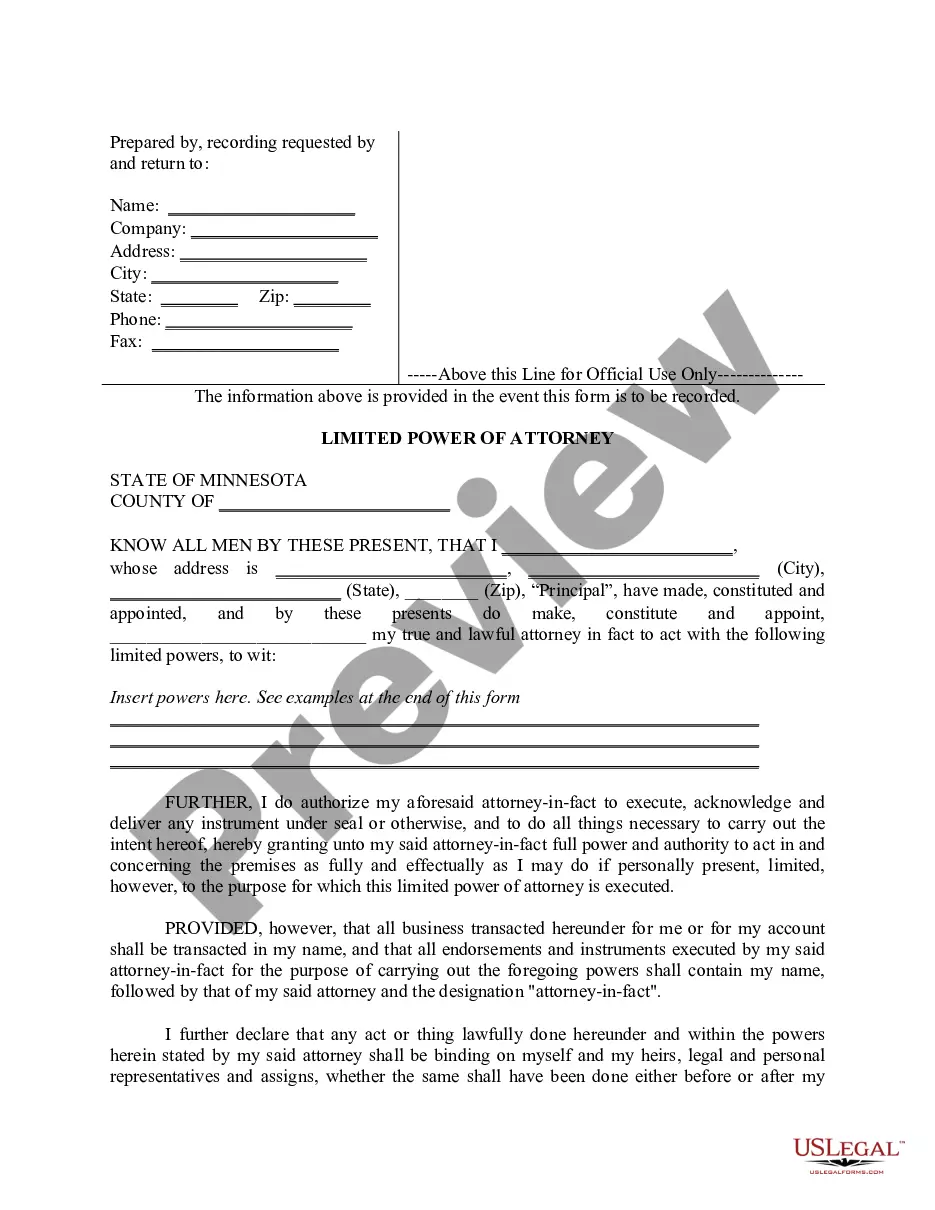

How to fill out Michigan Assignment And Transfer Of Stock?

Finding the right lawful record design could be a battle. Obviously, there are plenty of templates available online, but how can you get the lawful form you need? Utilize the US Legal Forms site. The support delivers thousands of templates, for example the Michigan Assignment and Transfer of Stock, which you can use for business and personal requires. All of the types are checked out by specialists and meet state and federal specifications.

When you are previously registered, log in for your account and click on the Obtain switch to have the Michigan Assignment and Transfer of Stock. Use your account to check with the lawful types you have bought formerly. Visit the My Forms tab of your respective account and obtain another copy from the record you need.

When you are a brand new customer of US Legal Forms, allow me to share easy instructions for you to comply with:

- Very first, be sure you have selected the right form for your area/state. You are able to look over the form making use of the Preview switch and read the form information to guarantee it is the right one for you.

- In the event the form does not meet your expectations, utilize the Seach area to discover the proper form.

- When you are sure that the form would work, click the Get now switch to have the form.

- Choose the pricing program you want and enter the necessary information. Build your account and pay for the transaction with your PayPal account or bank card.

- Select the data file formatting and acquire the lawful record design for your system.

- Complete, change and print out and indicator the received Michigan Assignment and Transfer of Stock.

US Legal Forms is definitely the largest local library of lawful types in which you can see a variety of record templates. Utilize the service to acquire expertly-created files that comply with condition specifications.

Form popularity

FAQ

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract.

A stock assignment agreement is the transfer of ownership of stock shares. It occurs when one party legally transfers their shares of stock property to another party or to a business.

What is assignment? An option assignment represents the seller's obligation to fulfill the terms of the contract by either selling or buying the underlying security at the exercise price. This obligation is triggered when the buyer of an option contract exercises their right to buy or sell the underlying security.

There are no tax implications for the recipient when the shares are transferred, but you may face a gift tax if the value of the stock transfer exceeds a certain amount.

What is assignment? An option assignment represents the seller's obligation to fulfill the terms of the contract by either selling or buying the underlying security at the exercise price. This obligation is triggered when the buyer of an option contract exercises their right to buy or sell the underlying security.

By selling a cash-covered put, you can collect money (the premium) from the option buyer. The buyer pays this premium for the right to sell you shares of stock, any time before expiration, at the strike price. The premium you receive allows you to lower your overall purchase price if you get assigned the shares.

The good news is if you're assigned, you can choose which lot of shares to deliver. In this case you might consider the second set, as you would pay less in capital gains taxes. Keep in mind that if you are assigned, this isn't your only choice. You could also not even deliver any of the stock you currently own.

American-style options can be exercised by the owner at any time before expiration. Thus, the seller of an American-style option may be assigned at any time before expiration. As of this writing, all equity options are American-style contracts.

Change in Ownership means any sale, disposition, transfer or issuance or series of sales, dispositions, transfers and/or issuances of shares of the capital stock by the Corporation or any holders thereof which results in any person or group of persons (as the term group is used under the Securities Exchange Act of

Transferring stocks is a straightforward process to complete.Request a Transfer of Stock Ownership form from your stockbroker or directly from the brokerage company.Write a letter with the instructions on the means of transfer to include with your Transfer of Stock Ownership form.More items...