A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

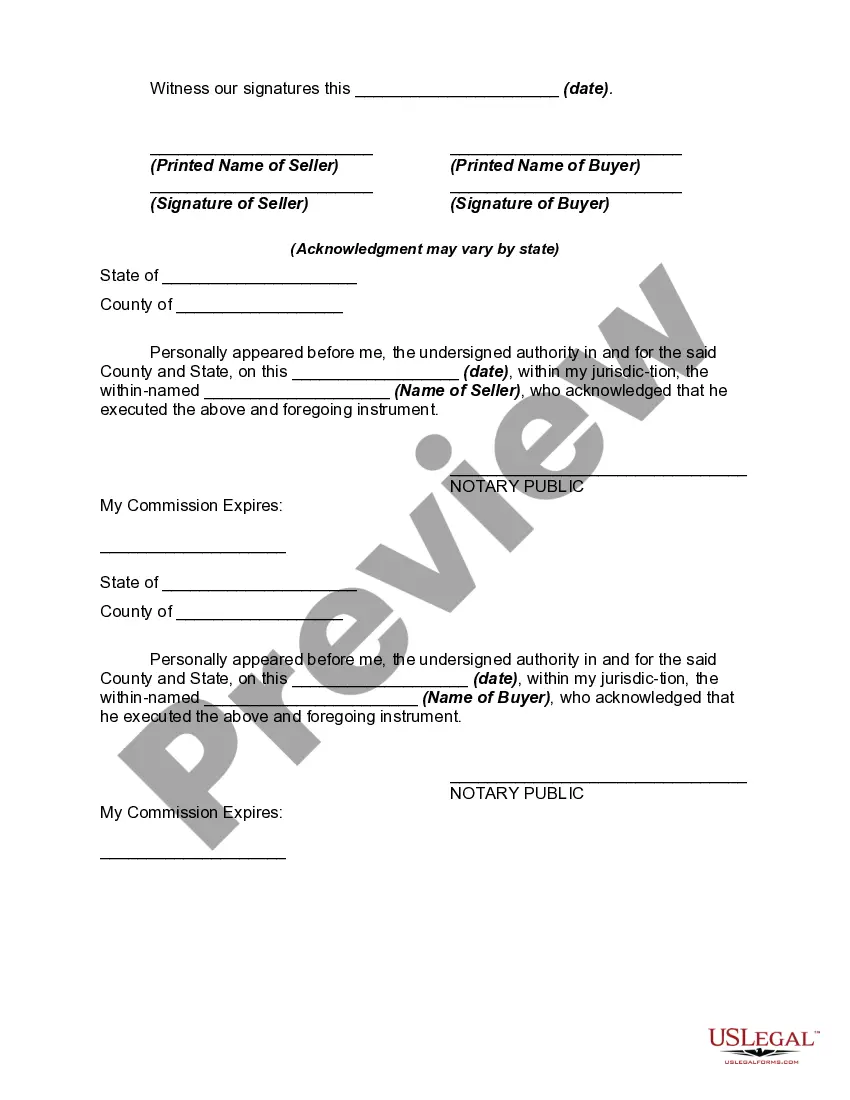

The Michigan Bill of Sale of Motor Vehicle — With Encumbrances is a legal document used for the transfer of ownership of a motor vehicle between a seller and a buyer. This type of bill of sale is specifically used when the vehicle is still encumbered, meaning there are outstanding loans or liens against the vehicle. The Michigan Bill of Sale of Motor Vehicle — With Encumbrances is crucial for both parties involved in the transaction as it provides a clear record of the sale and ensures that the buyer receives a legally clear title to the vehicle. It includes important details such as the vehicle's make, model, year, vehicle identification number (VIN), odometer reading, and any encumbrances or liens held against the vehicle. There are different types of Michigan Bills of Sale of Motor Vehicle — With Encumbrances depending on the specific circumstances of the sale. Some common variations include: 1. Michigan Bill of Sale of Motor Vehicle — With Bank Loan: This document is used when the seller has outstanding loans against the vehicle and wishes to transfer ownership to the buyer. 2. Michigan Bill of Sale of Motor Vehicle — With Lien: This type of bill of sale is employed when there are specific liens, such as mechanic's liens, against the vehicle. 3. Michigan Bill of Sale of Motor Vehicle — With Multiple Encumbrances: This variation is used when there is more than one encumbrance or lien against the vehicle, and all parties involved need to be accounted for. 4. Michigan Bill of Sale of Motor Vehicle — With Outstanding Debt: In cases where the seller owes a certain amount of money to the buyer or another party, this bill of sale ensures the debt is clearly stated, protecting the buyer's rights. 5. Michigan Bill of Sale of Motor Vehicle — With Outstanding Taxes: This document is used when the seller hasn't paid the necessary taxes or fees associated with the vehicle, and the buyer agrees to assume responsibility for these outstanding amounts. It is essential to note that each variation of the Michigan Bill of Sale of Motor Vehicle — With Encumbrances serves a specific purpose and must be accurately completed and signed by both the seller and buyer. Consulting an attorney or using a trusted online legal service can help ensure the proper documentation and completion of this important legal form.The Michigan Bill of Sale of Motor Vehicle — With Encumbrances is a legal document used for the transfer of ownership of a motor vehicle between a seller and a buyer. This type of bill of sale is specifically used when the vehicle is still encumbered, meaning there are outstanding loans or liens against the vehicle. The Michigan Bill of Sale of Motor Vehicle — With Encumbrances is crucial for both parties involved in the transaction as it provides a clear record of the sale and ensures that the buyer receives a legally clear title to the vehicle. It includes important details such as the vehicle's make, model, year, vehicle identification number (VIN), odometer reading, and any encumbrances or liens held against the vehicle. There are different types of Michigan Bills of Sale of Motor Vehicle — With Encumbrances depending on the specific circumstances of the sale. Some common variations include: 1. Michigan Bill of Sale of Motor Vehicle — With Bank Loan: This document is used when the seller has outstanding loans against the vehicle and wishes to transfer ownership to the buyer. 2. Michigan Bill of Sale of Motor Vehicle — With Lien: This type of bill of sale is employed when there are specific liens, such as mechanic's liens, against the vehicle. 3. Michigan Bill of Sale of Motor Vehicle — With Multiple Encumbrances: This variation is used when there is more than one encumbrance or lien against the vehicle, and all parties involved need to be accounted for. 4. Michigan Bill of Sale of Motor Vehicle — With Outstanding Debt: In cases where the seller owes a certain amount of money to the buyer or another party, this bill of sale ensures the debt is clearly stated, protecting the buyer's rights. 5. Michigan Bill of Sale of Motor Vehicle — With Outstanding Taxes: This document is used when the seller hasn't paid the necessary taxes or fees associated with the vehicle, and the buyer agrees to assume responsibility for these outstanding amounts. It is essential to note that each variation of the Michigan Bill of Sale of Motor Vehicle — With Encumbrances serves a specific purpose and must be accurately completed and signed by both the seller and buyer. Consulting an attorney or using a trusted online legal service can help ensure the proper documentation and completion of this important legal form.