Michigan Expense Report

Description

How to fill out Expense Report?

If you wish to finalize, obtain, or print out legal document templates, utilize US Legal Forms, the most significant collection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search feature to locate the documents you require.

Various templates for corporate and personal purposes are categorized by groups and regions, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You may use your Visa or Mastercard, or PayPal account to finalize the purchase. Step 6. Choose the format of your legal document and download it to your device. Step 7. Fill out, modify, and print or sign the Michigan Expense Report. Each legal document template you acquire is yours indefinitely. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Stay competitive and obtain and print the Michigan Expense Report with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to find the Michigan Expense Report in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to access the Michigan Expense Report.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have chosen the form appropriate for the specific city/state.

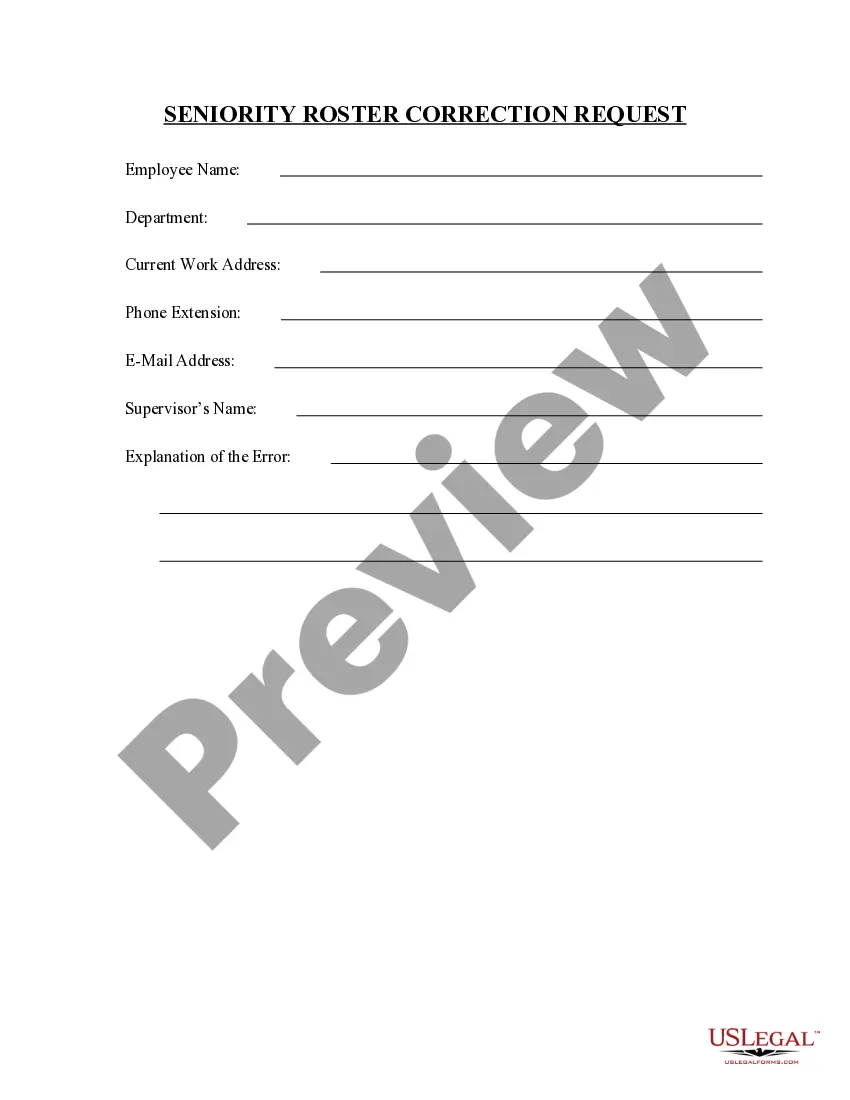

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Yes, the IRS can request proof of expenses during audits. They typically want to see documentation that supports the claims made in your Michigan Expense Report. Therefore, it's essential to keep all receipts and supporting documents organized and accessible. By using resources like USLegalForms, you can create efficient reporting habits that prepare you for any IRS inquiries.

Reporting reimbursed expenses usually involves noting them on your Michigan Expense Report accurately. Generally, you should provide details regarding the nature of the expense and ensure you have all backing documents. When using a structured platform like USLegalForms, you will find guided processes that clarify how to report these expenses correctly. This will help streamline your financial tracking and enhance transparency.

Without receipts, you can claim up to a total of $75 in expenses on your Michigan Expense Report. However, while the IRS has this limit, it's vital to maintain accurate records of all your expenses, even those under this threshold. Doing so protects you in case you need to verify your claims. Using services like USLegalForms can aid in organizing your claims for smooth filing.

The IRS generally sets the threshold for maintaining receipts at $75 for most expense reports. This means that expenses exceeding $75 must have proper documentation for your Michigan Expense Report. Keeping all necessary paperwork helps you stay compliant with tax regulations while easing the reimbursement process. Remember, it's wise to keep records beyond just the limits set by the IRS.

Typically, expense reports should be submitted promptly after the expenses are incurred. This practice ensures that you receive timely reimbursement. Many organizations have specific deadlines, such as monthly or quarterly submissions, so it’s essential to know your company's policies. By staying organized, your Michigan Expense Report can be processed quickly and efficiently.

Filing an expense report is straightforward. You will need to gather all relevant receipts and details about your expenses, then organize them according to your company’s guidelines. On platforms like USLegalForms, you can find templates and tools that simplify this process. By using these resources, you can ensure your Michigan Expense Report is comprehensive and complies with legal standards.

In general, the IRS does not require receipts for expenses under $75 when you're filing your Michigan Expense Report. However, it's crucial to keep accurate records and notes about these expenses. This practice helps protect you in case of an audit. Ultimately, maintaining clear documentation is best for your financial accuracy.

Expense reports are usually processed by the finance or accounting department in a company. They review the Michigan Expense Reports for accuracy and ensure all required documentation is present. By using tools like uslegalforms, companies can simplify this process and maintain organized records.

Management of Michigan Expense Reports typically falls to financial departments or designated managers within an organization. They oversee submission, approval, and tracking of expenses to ensure compliance with internal policies. This structure helps maintain transparency and control over organizational finances.

A Michigan Expense Report is a document that details expenses incurred during business activities. It serves as a record that helps organizations manage costs efficiently. This document is essential for reimbursement and financial auditing purposes.