Michigan General Journal

Description

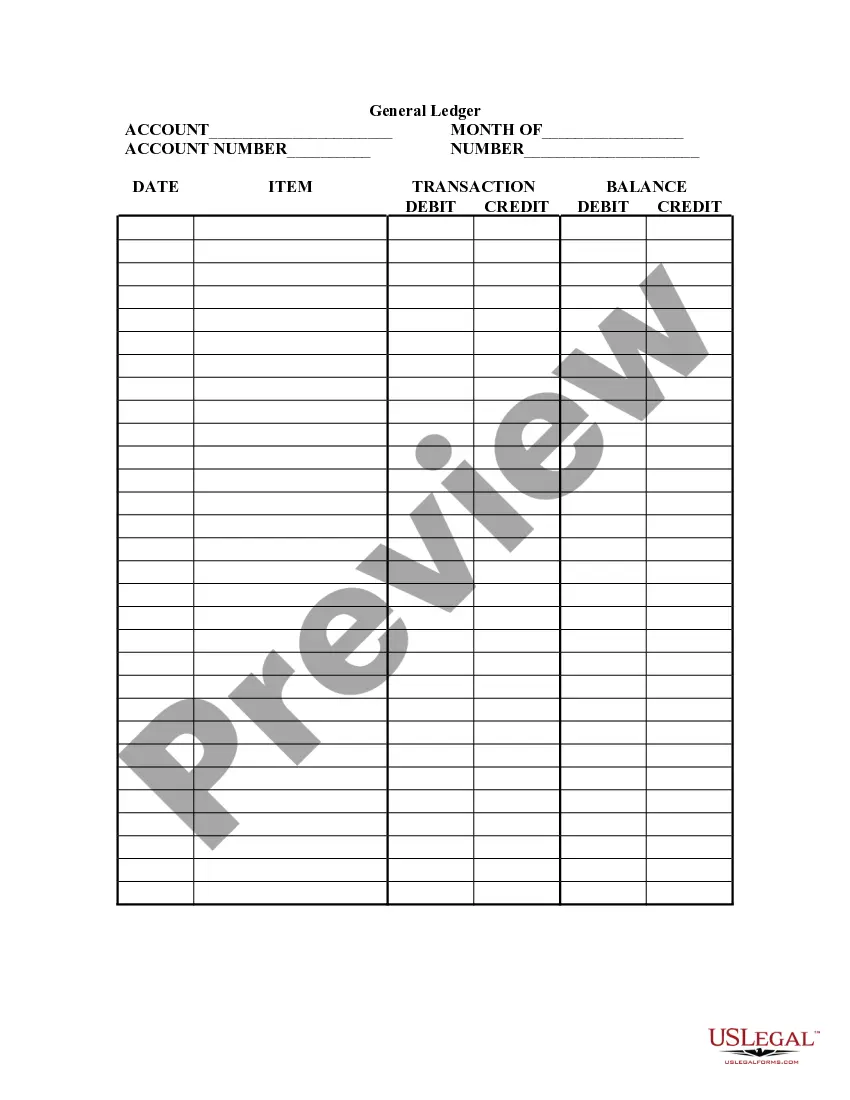

How to fill out General Journal?

Selecting the optimal legal document format may be a challenge. Certainly, there are numerous templates accessible online, but how do you determine the legal form you need? Utilize the US Legal Forms website. The service offers a vast array of templates, including the Michigan General Journal, which can be utilized for both business and personal purposes.

All of the documents are reviewed by professionals and comply with state and federal requirements.

If you are already registered, Log In to your account and then click the Download button to acquire the Michigan General Journal. Use your account to view the legal forms you have purchased previously. Navigate to the My documents tab in your account and obtain another copy of the document you need.

Finally, complete, edit, print, and sign the acquired Michigan General Journal. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Take advantage of the service to download professionally crafted documents that meet state requirements.

- First, ensure you have selected the correct form for your city/county.

- You can view the form using the Preview button and read the form description to confirm it is the appropriate one for you.

- If the form does not meet your needs, make use of the Search field to locate the appropriate form.

- Once you are certain that the form is suitable, click the Buy now button to obtain the form.

- Choose the pricing plan you prefer and enter the required information. Set up your account and process the payment using your PayPal account or credit card.

- Select the document file format and download the legal document format to your device.

Form popularity

FAQ

You must file Michigan W2 forms with the Michigan Department of Treasury, along with the appropriate documentation. You can submit these forms online or through conventional mailing methods, depending on your preference. Using the Michigan General Journal to track your payroll records simplifies this filing process and ensures you meet all requirements on time.

The tax rate on a 1099 in Michigan typically depends on your individual income tax bracket. Generally, this income is not subject to withholding, so you may need to estimate your tax liabilities. Using the Michigan General Journal helps you keep track of all transactions, making tax preparation more manageable when tax season arrives.

The best way to file 1099s involves using reliable accounting software that can accurately prepare forms based on your records. This method provides a straightforward approach and reduces chances for errors. Leveraging the Michigan General Journal can also enhance your filing process by maintaining organized financial records.

To file 1099s with the state of Michigan, complete the necessary forms accurately and ensure all information is up-to-date. You may submit these forms electronically or via mail, depending on your preference. By utilizing tools like the Michigan General Journal, you can simplify the process and help ensure all details are accounted for.

Yes, 1099s need to be filed with the state of Michigan if you meet certain reporting thresholds. Filing these forms not only complies with state laws but also helps keep your records in order. Using the Michigan General Journal can make tracking these transactions easier and more efficient.

Writing a general journal in accounting involves recording transactions in chronological order. Each entry includes the date, description, and amounts for debits and credits. Utilizing the Michigan General Journal helps maintain an organized record, which is essential for preparing financial statements and ensuring accurate bookkeeping.

To file Michigan 1099s, you must first gather all necessary information from your payees. You can prepare the forms manually or use accounting software that integrates with the Michigan General Journal. After completing the forms, submit them to the Michigan Department of Treasury by the designated deadline, ensuring compliance with both state and federal requirements.

The general journal serves as a detailed record of all financial transactions as they occur, while the general ledger compiles these transactions by account. This structured approach allows you to manage your finances better. Utilizing a Michigan General Journal, you can ensure that your data stays organized and accessible, aiding in financial decision-making.

Quizlet is a tool for studying and learning. In the context of accounting, the general ledger consolidates financial data by account, while the Michigan General Journal records transactions in the order they happen. Using Quizlet, you can enhance your understanding of these concepts and improve your accounting skills effectively.

The general journal records transactions as they occur, detailing date, account names, and amounts in order of occurrence. Conversely, the general ledger compiles these entries by account to provide a clear view of each account's balance over time. Understanding this distinction is crucial when managing finances through your Michigan General Journal.