Michigan Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank A Line of Credit or Loan Agreement between a corporate or business borrower and a bank plays a crucial role in the financial management of an organization. Specifically designed to meet the borrowing needs of businesses in Michigan, these agreements enable companies to access funds efficiently and manage their cash flows effectively. The Michigan Line of Credit or Loan Agreement can be customized to suit the unique requirements of different types of businesses. It provides the borrower with a flexible arrangement where they can access funds up to a pre-approved credit limit established by the bank. The borrower can draw funds as and when needed, making it an ideal solution for managing unpredictable expenses, meeting operational costs, or pursuing growth opportunities. Main types of Michigan Line of Credit or Loan Agreement: 1. Revolving Line of Credit: The revolving line of credit gives businesses the flexibility to borrow and repay funds multiple times during a specified period, typically with no set repayment schedule. It allows borrowers to have continuous access to funds up to the credit limit as long as they comply with the agreed terms and conditions. 2. Non-Revolving Line of Credit: Unlike the revolving line of credit, a non-revolving line of credit provides a one-time lump-sum loan disbursed to the borrower. Once the funds are drawn, the borrower cannot access further credit without applying for a new loan agreement. This type of line of credit is suitable for specific business purposes with a defined borrowing requirement. 3. Asset-Based Line of Credit: Asset-based lines of credit are secured by the borrower's assets, such as accounts receivables, inventory, or equipment. The credit limit is determined based on the value of the pledged assets, making it an option for companies with valuable collateral. This type of line of credit allows borrowers to maximize their borrowing capacity by utilizing their assets as security. The Michigan Line of Credit or Loan Agreement typically outlines the terms and conditions of the borrowing arrangement. It includes details such as the credit limit, interest rate, repayment terms, fees, collateral, and any specific covenants or requirements set by the bank. Both parties must agree to these terms before the agreement takes effect. A comprehensive Line of Credit or Loan Agreement ensures clarity and transparency between the corporate or business borrower and the bank. Properly executed agreements help build a strong business-banking relationship by addressing the financial needs of companies and minimizing potential risks for both parties. In conclusion, a Michigan Line of Credit or Loan Agreement between a corporate or business borrower and a bank provides a flexible borrowing solution to meet the financial requirements of businesses in Michigan. The different types of agreements, such as revolving, non-revolving, and asset-based lines of credit, allow companies to access funds based on their unique needs and circumstances. By establishing clear terms and conditions, these agreements promote financial stability and growth for businesses while ensuring a mutually beneficial relationship between the borrower and the bank.

Michigan Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank

Description

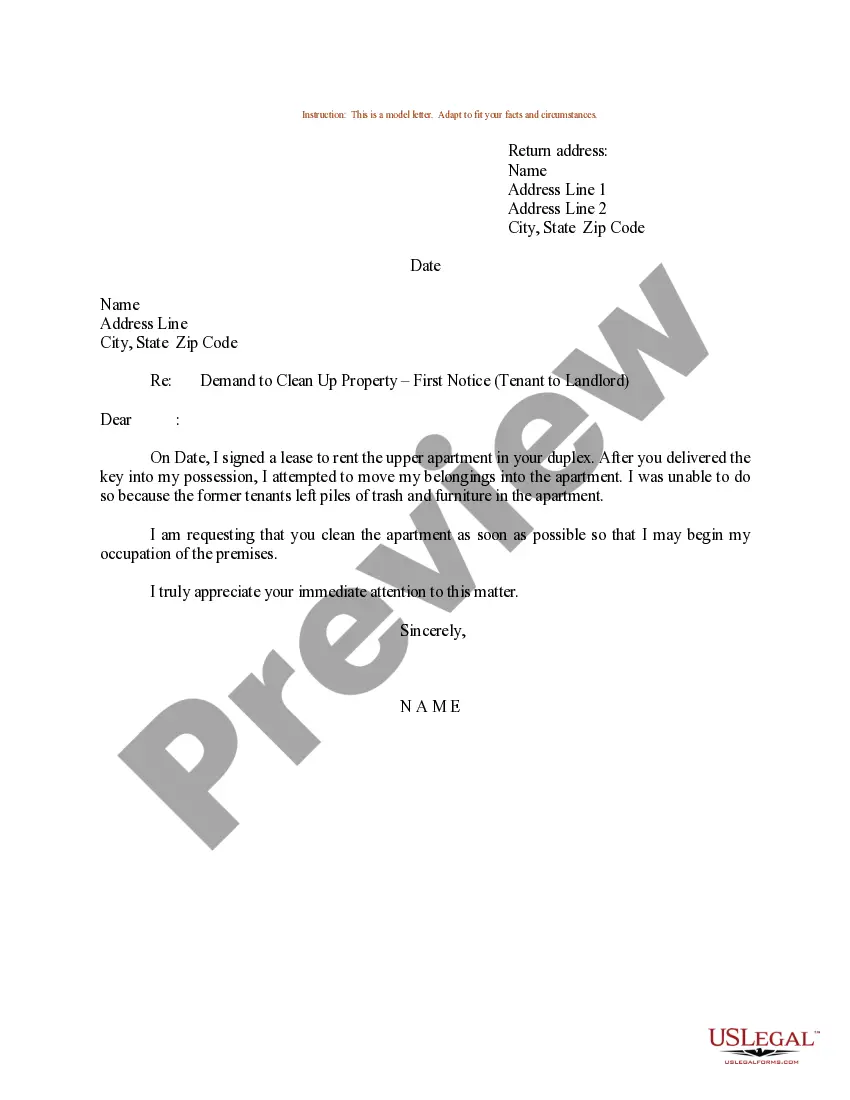

How to fill out Michigan Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

You are able to commit time on-line attempting to find the lawful record template that fits the state and federal demands you need. US Legal Forms provides 1000s of lawful forms that happen to be examined by specialists. You can easily download or printing the Michigan Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank from your assistance.

If you already possess a US Legal Forms profile, you may log in and then click the Download switch. Following that, you may full, edit, printing, or signal the Michigan Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank. Every lawful record template you purchase is your own property forever. To obtain yet another copy associated with a bought develop, visit the My Forms tab and then click the related switch.

If you are using the US Legal Forms internet site initially, adhere to the straightforward recommendations under:

- Very first, make certain you have selected the right record template for the county/metropolis of your choice. See the develop information to ensure you have selected the right develop. If available, make use of the Review switch to check with the record template also.

- If you wish to find yet another variation in the develop, make use of the Research area to discover the template that fits your needs and demands.

- Upon having discovered the template you want, click on Acquire now to continue.

- Choose the prices plan you want, key in your accreditations, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You can utilize your Visa or Mastercard or PayPal profile to cover the lawful develop.

- Choose the format in the record and download it for your gadget.

- Make adjustments for your record if necessary. You are able to full, edit and signal and printing Michigan Line of Credit or Loan Agreement Between Corporate or Business Borrower and Bank.

Download and printing 1000s of record templates while using US Legal Forms site, that provides the greatest selection of lawful forms. Use professional and condition-certain templates to handle your organization or person requires.