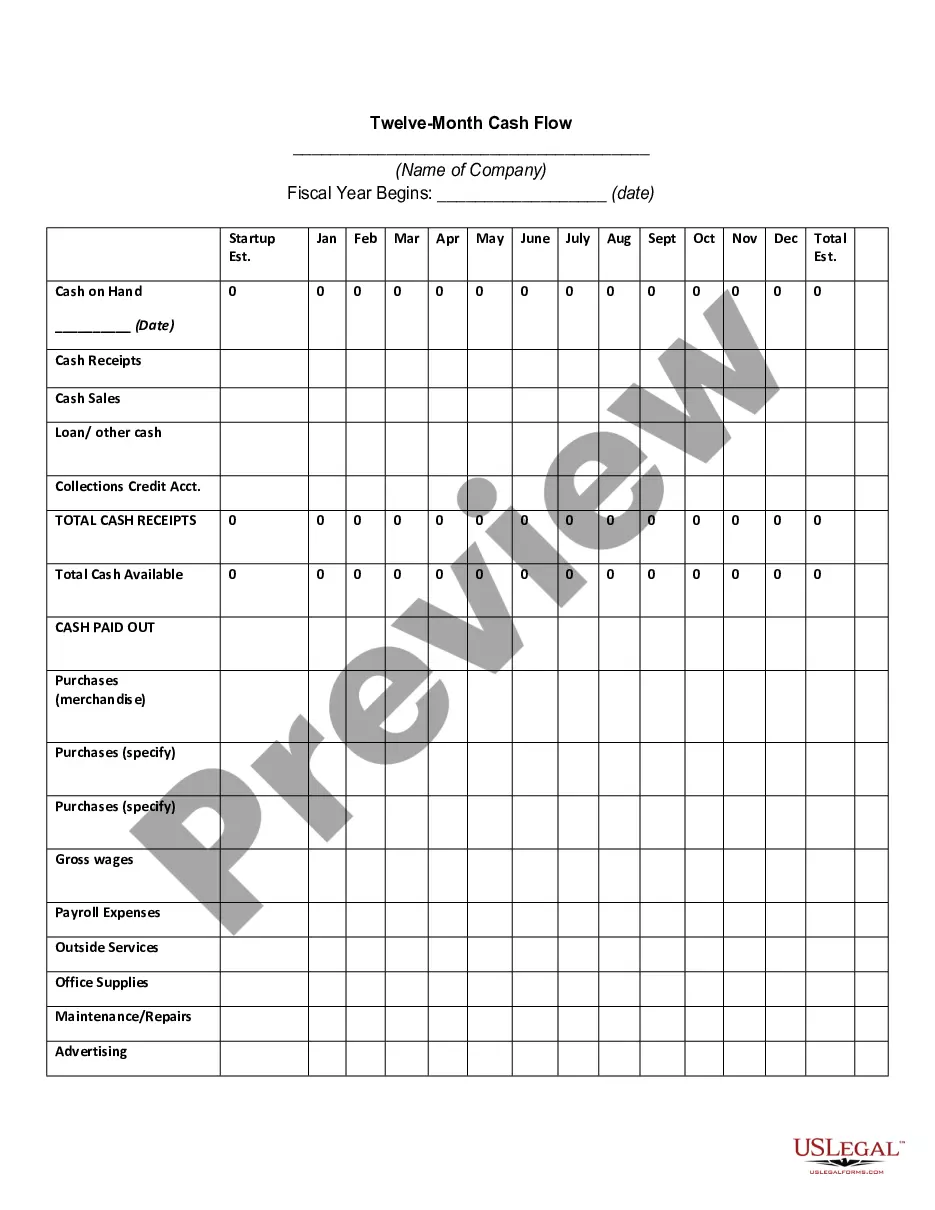

This form can be used for sales planning.

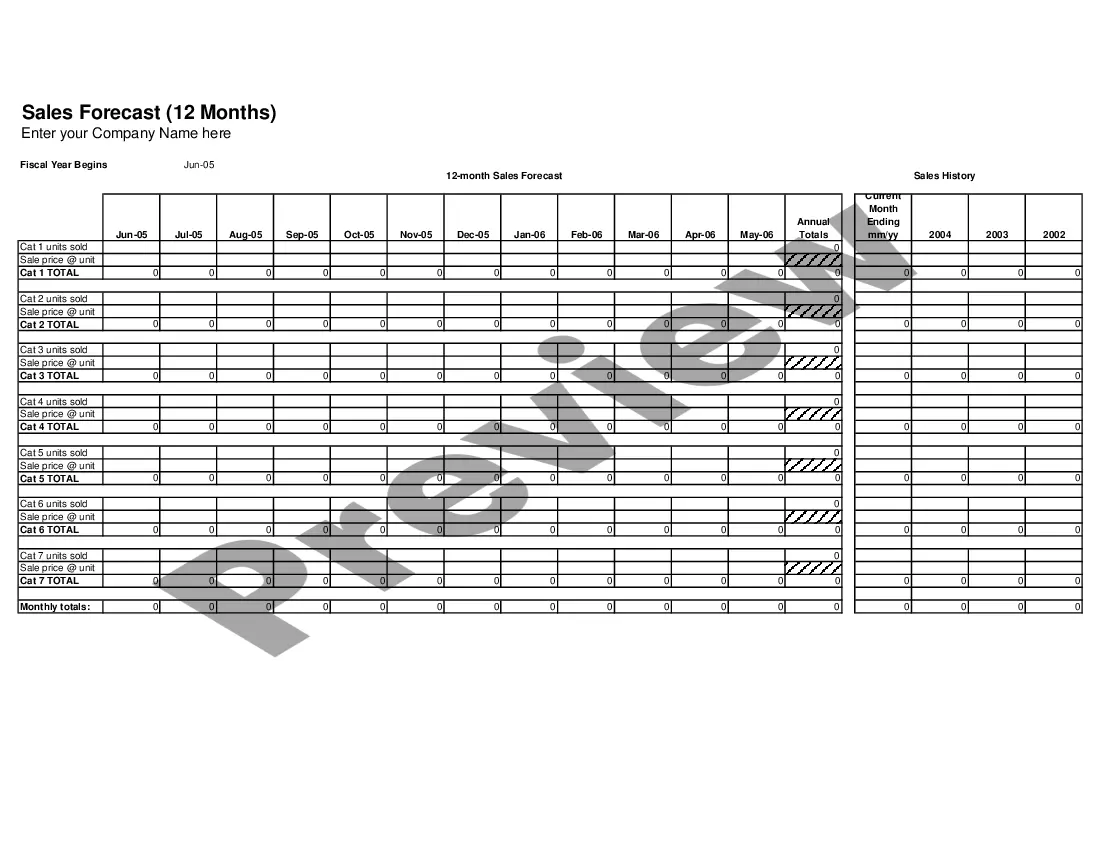

Michigan Twelve Month Sales Forecast

Description

How to fill out Twelve Month Sales Forecast?

Are you presently in a position that requires paperwork for either business or personal purposes nearly all the time.

There are numerous credible document templates accessible online, but finding ones you can rely on is not easy.

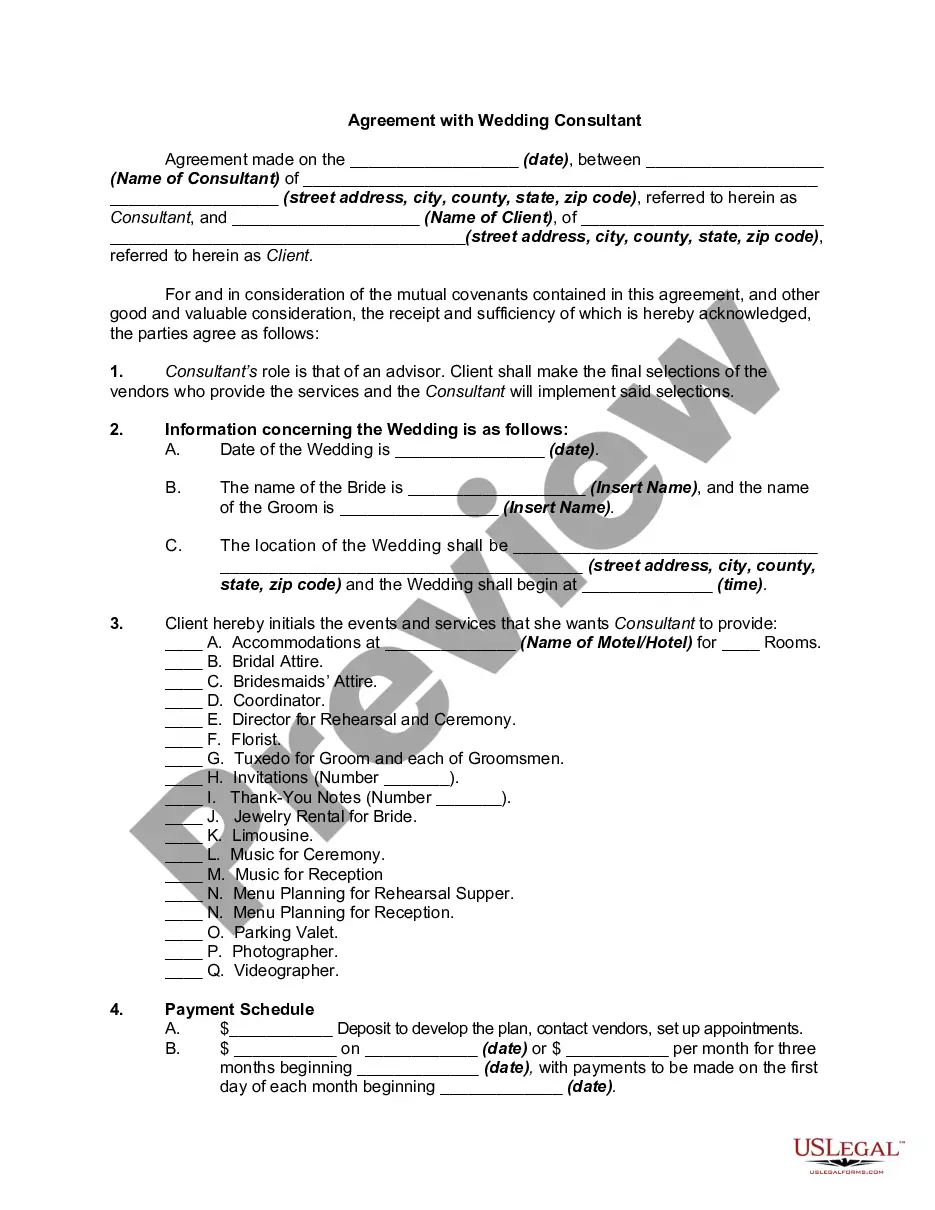

US Legal Forms offers a vast array of form templates, similar to the Michigan Twelve Month Sales Forecast, which are designed to comply with federal and state regulations.

Utilize US Legal Forms, the most extensive collection of authentic forms, to save time and avoid mistakes.

This service provides professionally crafted legal document templates that can be employed for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are currently familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the Michigan Twelve Month Sales Forecast template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and verify it is for the correct city/area.

- Use the Review option to evaluate the form.

- Read the description to confirm that you have chosen the correct form.

- If the form does not suit your needs, utilize the Lookup field to locate the form that meets your specifications.

- Once you find the appropriate form, click Acquire now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using PayPal or a credit card.

- Choose a preferred file format and download your copy.

- Access all the document templates you have acquired in the My documents section. You can obtain another version of the Michigan Twelve Month Sales Forecast at any time if needed. Just go through the required form to download or print the template.

Form popularity

FAQ

A Michigan sales tax license is typically valid for a period of four years; however, it must be renewed to remain active. Staying proactive about your license renewal ensures that your business remains compliant with state regulations. This aspect affects your ability to make sound projections in your Michigan Twelve Month Sales Forecast. Always keep an eye on your license's expiration date to avoid disruptions.

To report Michigan sales tax, you can complete the necessary sales tax return form and submit it through the Michigan Department of Treasury's online portal or by mail. It's important to keep accurate for record-keeping in alignment with your Michigan Twelve Month Sales Forecast. Utilizing platforms like USLegalForms can simplify the process and ensure you have all required documentation filed correctly.

In Michigan, the filing frequency for withholding tax can vary based on the amount you withhold. Generally, employers must file quarterly, but certain thresholds may necessitate more frequent filings. Knowing your obligation helps maintain compliance and positively affects your Michigan Twelve Month Sales Forecast. It is helpful to stay aware of these requirements to avoid any penalties.

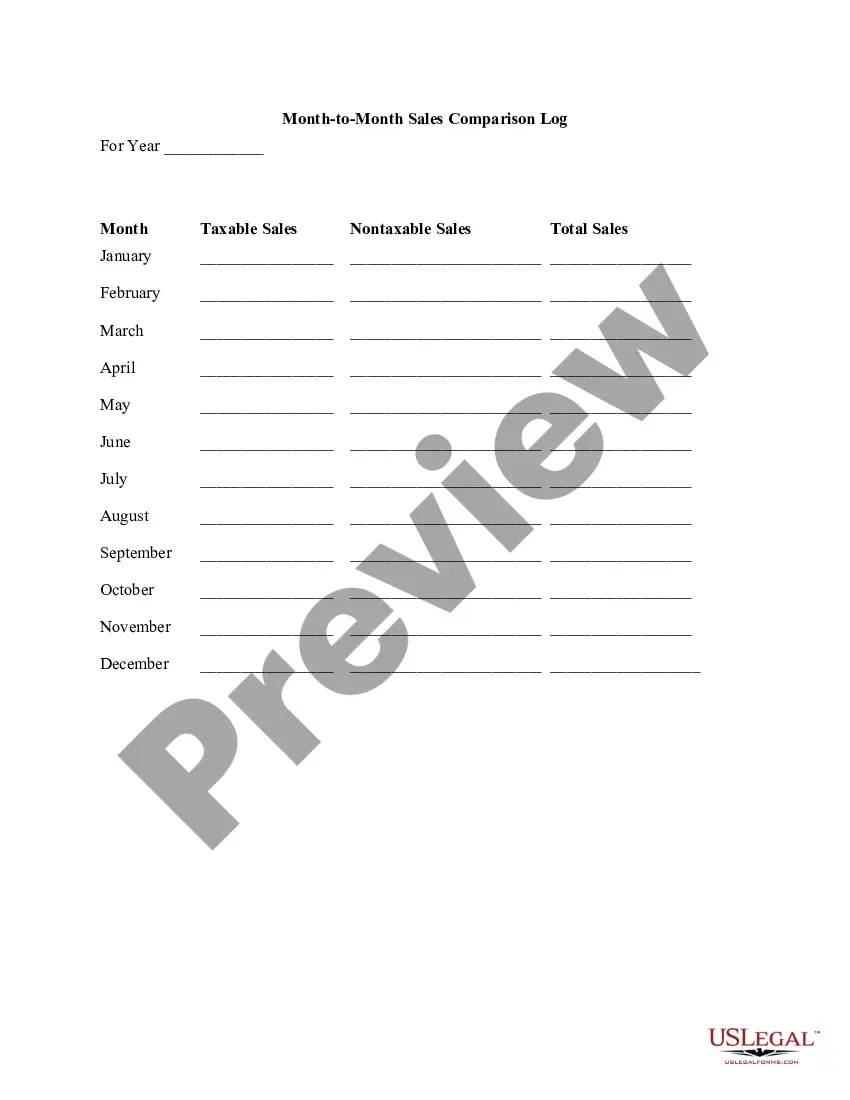

The frequency of filing sales tax in Michigan depends on your business's tax liability. Generally, you can file monthly, quarterly, or annually based on your sales volume. Monitoring your sales closely and adjusting your filing frequency aligns with your Michigan Twelve Month Sales Forecast, ensuring that you meet state requirements effectively. This practice can help mitigate issues down the road.

A Michigan sales tax license does not automatically renew. Business owners must apply for renewal before the license expires to avoid any lapses in compliance. Keeping track of your renewal dates ensures your ability to continue making accurate sales tax calculations, contributing positively to your Michigan Twelve Month Sales Forecast. Checking in with the Michigan Department of Treasury can help you stay updated.

The Michigan sales tax form for annual return is typically the sales tax return form issued by the Michigan Department of Treasury. While most businesses file quarterly or monthly, the annual return is suitable for those with lower sales volume. By preparing this form accurately, you can ensure that your records align with your Michigan Twelve Month Sales Forecast. It is essential to keep detailed sales records to simplify the filing process.

To obtain a sales forecast, analyze historical sales data and then account for current market trends. Incorporating insights from potential economic factors and shifts in consumer behavior will help refine your forecast. Using resources like USLegalForms can provide tools and templates necessary to create an accurate Michigan Twelve Month Sales Forecast.

The formula for estimated sales is generally estimated as: Estimated Sales = Average Historical Sales + Growth Rate. This equation allows a business to consider past performance while estimating future sales. By utilizing this formula, you can build a solid basis for your Michigan Twelve Month Sales Forecast.

The formula for annual forecasted sales is: Annual Forecasted Sales = Total Monthly Sales x 12. By multiplying the monthly sales projections by twelve, you can establish a clear projection for the entire year. This straightforward approach can greatly enhance your Michigan Twelve Month Sales Forecast.

To perform sales forecasting in Excel, input your historical sales data into a spreadsheet. Utilize Excel functions like ‘FORECAST’ or create a chart to visualize trends. This tool can help you develop a robust Michigan Twelve Month Sales Forecast, allowing easy adjustments based on real-time data.