Title: Michigan Sample Letter for New Business with Credit Application — A Comprehensive Guide for Entrepreneurs Introduction: Starting a new business venture in Michigan often requires the completion of a credit application process. To assist budding entrepreneurs in this endeavor, this article provides a detailed description of what a Michigan sample letter for new business with a credit application entails. It aims to highlight the key elements, offer insights into its importance, and discuss different types of Michigan sample letters available. Keywords: Michigan, sample letter, new business, credit application, entrepreneurs, detailed description, elements, importance, types. 1. Elements and Structure of a Michigan Sample Letter for New Business with Credit Application: A Michigan sample letter for a new business with a credit application typically contains the following elements: — Heading: Company name, address, and contact information. — Date: The date on which the letter is written. — Recipient's Information: The name, designation, and address of the recipient. — Salutation: A formal greeting addressing the recipient. — Introduction: A brief introduction of the new business and its purpose. — Request for Credit Application: Clear statement requesting the recipient to provide credit application forms or documents. — Business Details: Comprehensive information about the business, such as its legal structure, products/services provided, industry overview, and unique selling points. — Financial Information: Details about the financial aspects of the business, including projected income, expenses, assets, liabilities, and any existing financial relationships. — Credit Requirements: A clear statement regarding the credit amount or credit line required, along with the purpose for which funds will be utilized. — Supporting Documentation: A list of relevant documents attached with the letter, such as business plans, financial statements, tax returns, and supporting references. — Conclusion: A polite closing statement expressing gratitude for the recipient's time and consideration. — Signature: The sender's full name, designation, and contact details. 2. Importance of a Michigan Sample Letter for New Business with Credit Application: A well-crafted Michigan sample letter for a new business with a credit application holds significant importance for entrepreneurs: — It showcases professionalism and seriousness about establishing a trustworthy business relationship. — It provides relevant information to potential creditors to evaluate the creditworthiness of the business. — It serves as a formal request for credit, facilitating the application process. — It creates a positive first impression and increases the likelihood of credit approval. — It ensures transparency and clarity, enabling creditors to understand the business's goals, financial standing, and repayment capability. 3. Types of Michigan Sample Letters for New Business with Credit Application: While the structure and content of the sample letter remain similar, variations may occur based on the specific nature of the business or the creditor's requirements. Some common types of Michigan sample letters for new businesses with credit application include: — General Business Credit Application Letter: Suitable for businesses across various industries. — Startup Business Credit Application Letter: Tailored for new businesses in their initial stages. — Small Business Credit Application Letter: Designed specifically for small-scale enterprises. — Industry-Specific Credit Application Letter: Customized based on the industry-specific requirements like manufacturing, service, retail, etc. — Supplier/Vendor Credit Application Letter: Focused on establishing credit relationships with suppliers or vendors. Conclusion: A detailed and well-drafted Michigan sample letter for new business with a credit application is crucial for entrepreneurs seeking financial assistance to kick-start their ventures. By leveraging the provided insights regarding its elements, importance, and types, aspiring business owners can effectively navigate the credit application process and increase their chances of obtaining credit for their enterprise in Michigan.

Michigan Sample Letter for New Business with Credit Application

Description

How to fill out Michigan Sample Letter For New Business With Credit Application?

If you want to total, download, or print out legal record templates, use US Legal Forms, the most important collection of legal kinds, which can be found on the web. Take advantage of the site`s simple and handy research to find the paperwork you will need. Numerous templates for organization and person reasons are categorized by categories and suggests, or search phrases. Use US Legal Forms to find the Michigan Sample Letter for New Business with Credit Application within a number of clicks.

Should you be currently a US Legal Forms client, log in to your account and then click the Acquire switch to find the Michigan Sample Letter for New Business with Credit Application. You can also gain access to kinds you formerly saved in the My Forms tab of your own account.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your correct city/region.

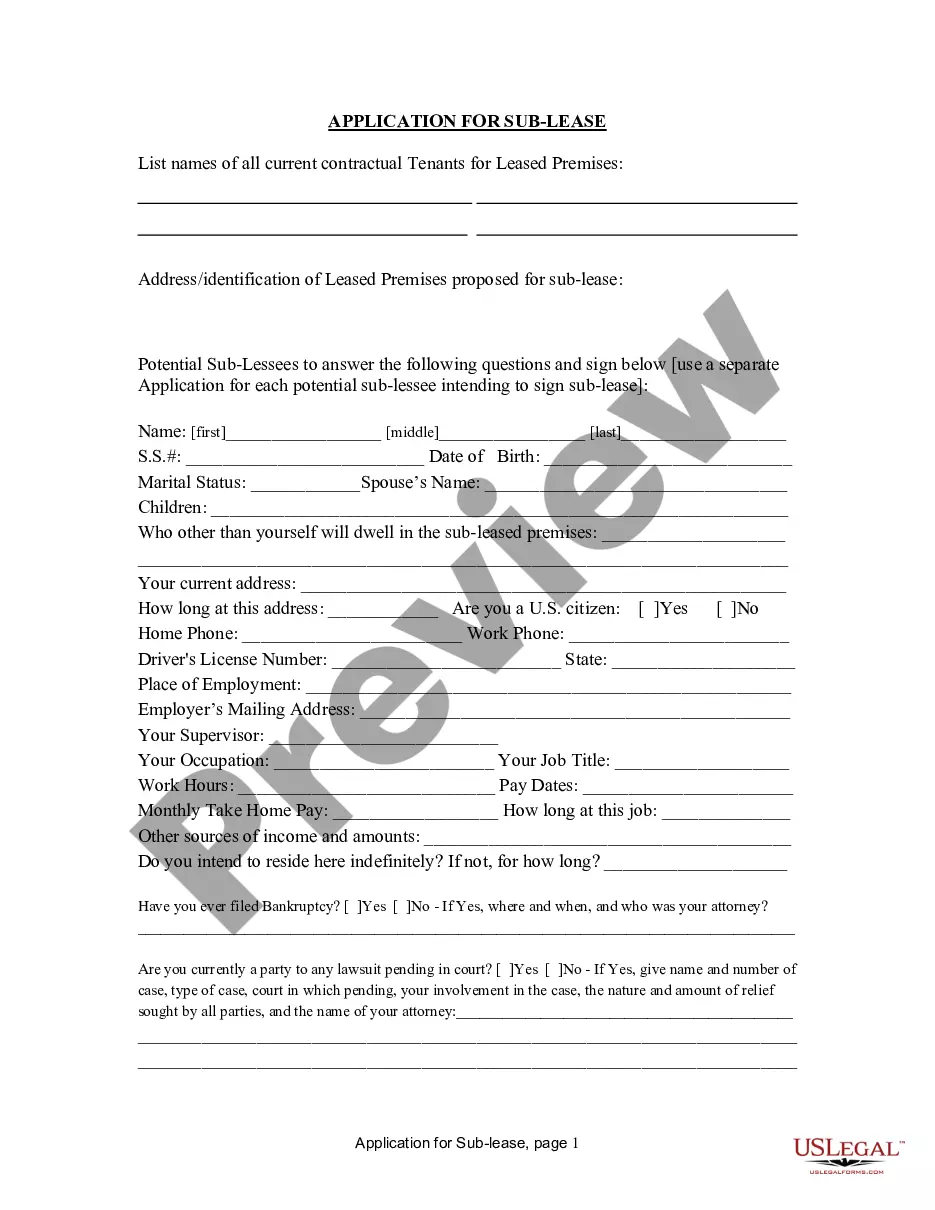

- Step 2. Use the Review option to examine the form`s information. Don`t neglect to see the outline.

- Step 3. Should you be unsatisfied with all the type, make use of the Look for area towards the top of the monitor to locate other versions of your legal type web template.

- Step 4. Upon having discovered the shape you will need, select the Purchase now switch. Pick the pricing strategy you choose and include your accreditations to sign up for the account.

- Step 5. Process the transaction. You should use your charge card or PayPal account to accomplish the transaction.

- Step 6. Pick the structure of your legal type and download it on the product.

- Step 7. Complete, revise and print out or signal the Michigan Sample Letter for New Business with Credit Application.

Every legal record web template you get is the one you have permanently. You have acces to every single type you saved within your acccount. Select the My Forms section and choose a type to print out or download again.

Remain competitive and download, and print out the Michigan Sample Letter for New Business with Credit Application with US Legal Forms. There are many professional and express-particular kinds you can use for your personal organization or person needs.