The right of an employee to compensation is based on either an express or implied contract. Whether the employment contract is express or implied, it need not be formalized in order for the terms of employment to begin. Once employment has begun, the employment contract represents the right of the employee to be paid the wages agreed upon for services he or she has performed and the right of an employer to receive the services for which the wages have been paid.

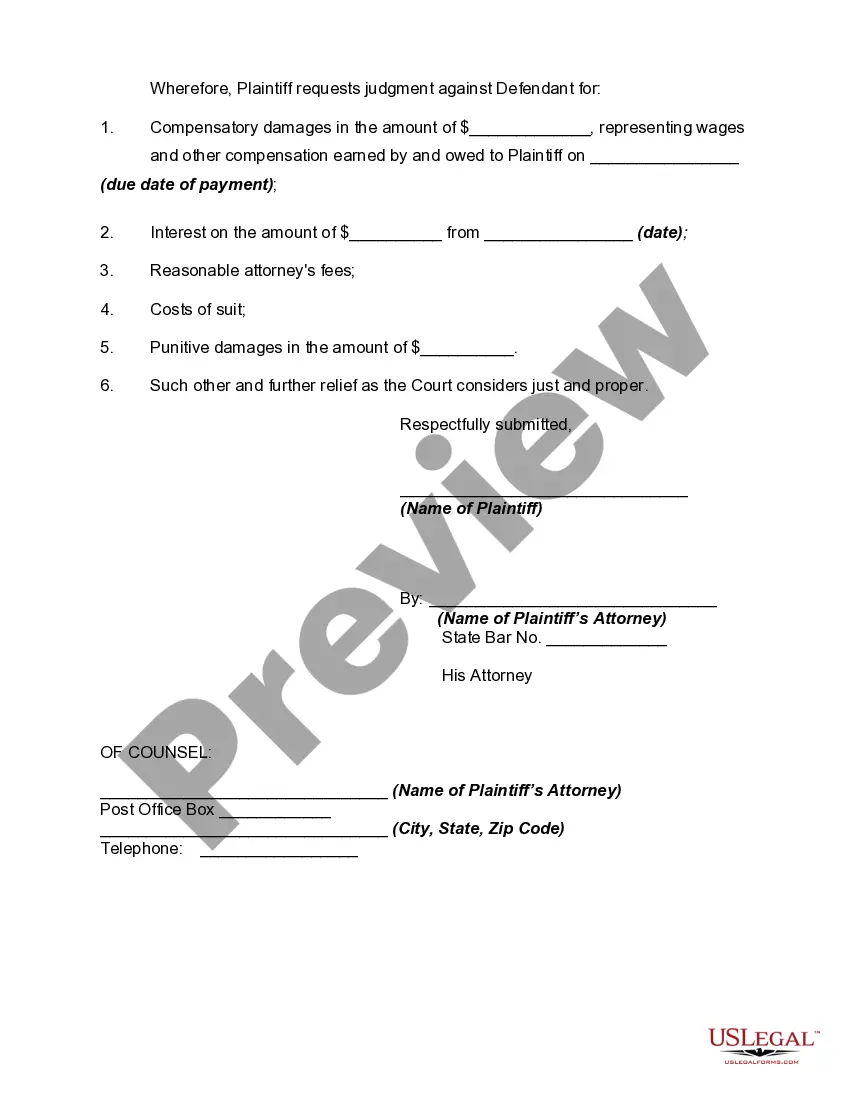

Michigan Complaint for Recovery of Unpaid Wages

Description

How to fill out Complaint For Recovery Of Unpaid Wages?

If you have to complete, down load, or produce lawful papers templates, use US Legal Forms, the most important assortment of lawful varieties, that can be found on the web. Use the site`s basic and hassle-free research to obtain the documents you need. Different templates for company and individual reasons are categorized by categories and says, or keywords. Use US Legal Forms to obtain the Michigan Complaint for Recovery of Unpaid Wages with a number of clicks.

When you are previously a US Legal Forms buyer, log in for your bank account and click the Acquire switch to find the Michigan Complaint for Recovery of Unpaid Wages. You may also entry varieties you earlier delivered electronically inside the My Forms tab of the bank account.

Should you use US Legal Forms the first time, follow the instructions below:

- Step 1. Be sure you have selected the form to the right city/country.

- Step 2. Make use of the Review choice to look through the form`s content material. Don`t neglect to see the information.

- Step 3. When you are unsatisfied with all the type, take advantage of the Search industry on top of the screen to discover other models of the lawful type design.

- Step 4. Upon having identified the form you need, go through the Get now switch. Opt for the costs program you prefer and add your accreditations to register on an bank account.

- Step 5. Approach the purchase. You can utilize your bank card or PayPal bank account to accomplish the purchase.

- Step 6. Pick the format of the lawful type and down load it on your own device.

- Step 7. Total, edit and produce or sign the Michigan Complaint for Recovery of Unpaid Wages.

Every single lawful papers design you acquire is yours forever. You possess acces to every type you delivered electronically inside your acccount. Select the My Forms area and choose a type to produce or down load again.

Be competitive and down load, and produce the Michigan Complaint for Recovery of Unpaid Wages with US Legal Forms. There are millions of professional and status-particular varieties you can use for your company or individual needs.

Form popularity

FAQ

You should report fraudulent or abusive returns, including those with questionable Forms W-2, to the IRS by submitting Form 3949-A, Information ReferralPDF. You can also report fraudulent or abusive returns without using the IRS form but you must still send the information to the address shown on Form 3949-A.

Section 7(4)(e) prohibits an overpayment deduction until all deductions expressly permitted by law, collective bargaining agreement, or employee's written consent are made.

Definition. Tax evasion is the illegal non-payment or under-payment of taxes, usually by deliberately making a false declaration or no declaration to tax authorities ? such as by declaring less income, profits or gains than the amounts actually earned, or by overstating deductions.

Employers must pay their employees at least weekly, biweekly, or monthly on regular paydays. Employers in agriculture must pay their employees who harvest crops by hand at least weekly. Employees who are paid weekly or biweekly must be paid within 14 days of the end of the pay period.

The IRS Whistleblower Office pays monetary awards to eligible individuals whose information is used by the IRS. The award percentage depends on several factors, but generally falls between 15 and 30 percent of the proceeds collected and attributable to the whistleblower's information.

A: The Wage and Fringe Benefit Act was enacted by the Michigan Legislature in 1978 to regulate the time and manner of payment of wages and fringe benefits to employees. The Act also regulates the authority of the employer to take deductions from the wages or fringe benefits due to be paid to the employee.

Suspected Tax Fraud ReportTaxFraud@Michigan.gov. . . .

Use the Form 3949-A, Information Referral if you suspect an individual or a business is not complying with the tax laws. You can submit Form 3949-A online or by mail. We don't take tax law violation referrals over the phone. We will keep your identity confidential when you file a tax fraud report.