As a small business owner you may hire people as independent contractors or as employees. There are rules that will help you determine how to classify the people you hire. This will affect how much you pay in taxes, whether you need to withhold from your workers paychecks and what tax documents you need to file.

Here are some things every business owner should know about hiring people as independent contractors versus hiring them as employees:

1. The IRS uses three characteristics to determine the relationship between businesses and workers:

" Behavioral Control covers facts that show whether the business has a right to direct or control how the work is done through instructions, training or other means.

" Financial Control covers facts that show whether the business has a right to direct or control the financial and business aspects of the worker's job.

" Type of Relationship factor relates to how the workers and the business owner perceive their relationship.

If you have the right to control or direct not only what is to be done, but also how it is to be done, then your workers are most likely employees.

2. If you can direct or control only the result of the work done -- and not the means and methods of accomplishing the result -- then your workers are probably independent contractors.

3. Employers who misclassify workers as independent contractors can end up with substantial tax bills. Additionally, they can face penalties for failing to pay employment taxes and for failing to file required tax forms.

4. Workers can avoid higher tax bills and lost benefits if they know their proper status.

5. Both employers and workers can ask the IRS to make a determination on whether a specific individual is an independent contractor or an employee by filing a Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding, with the IRS.

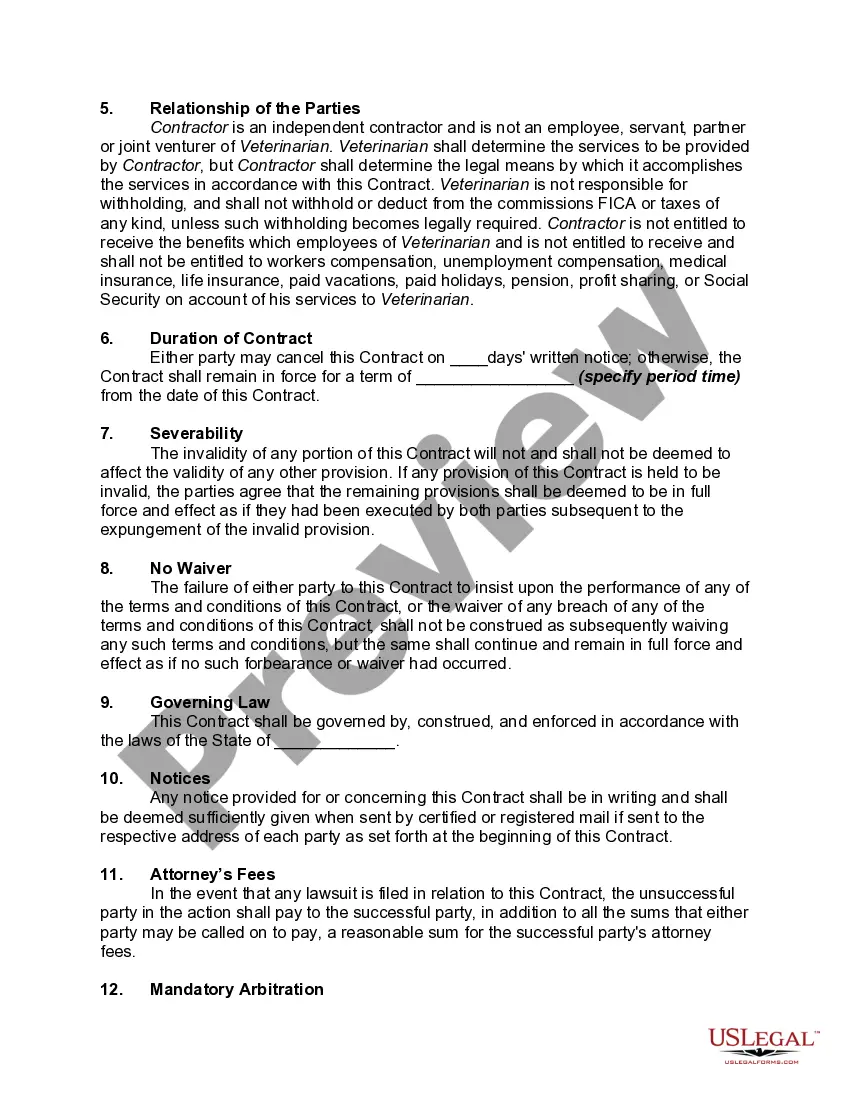

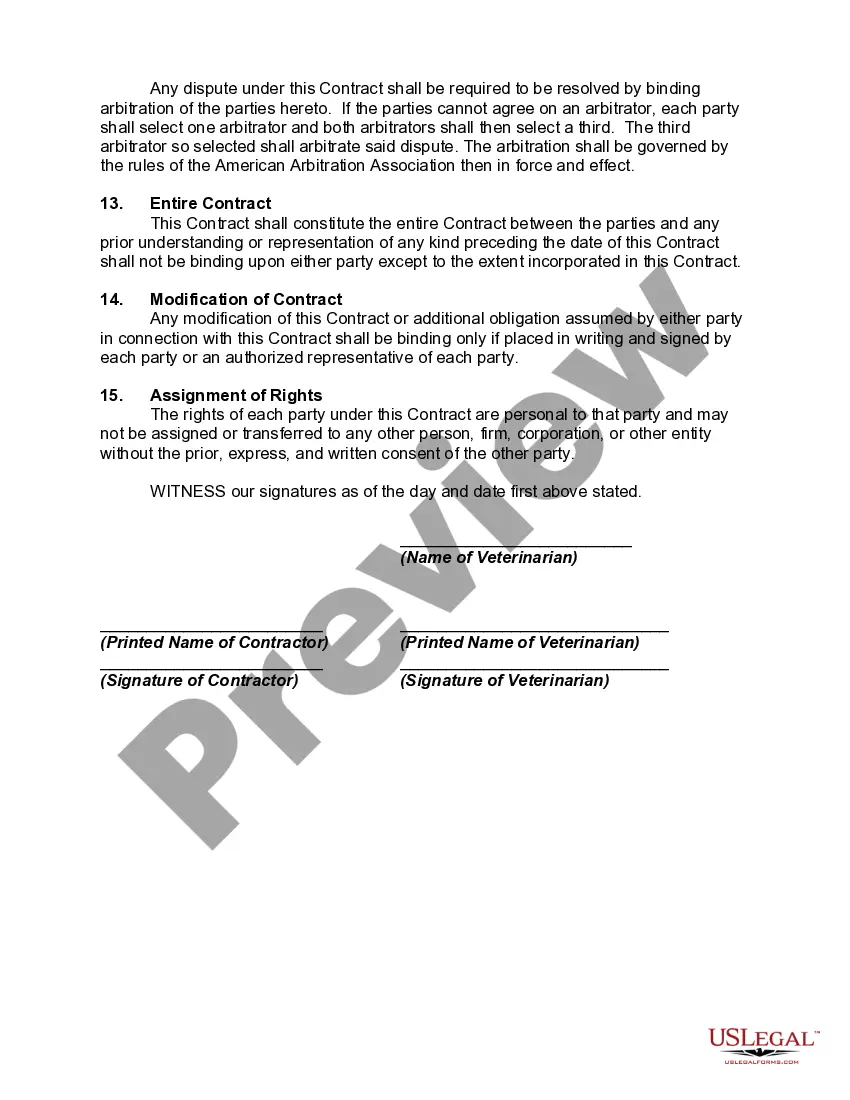

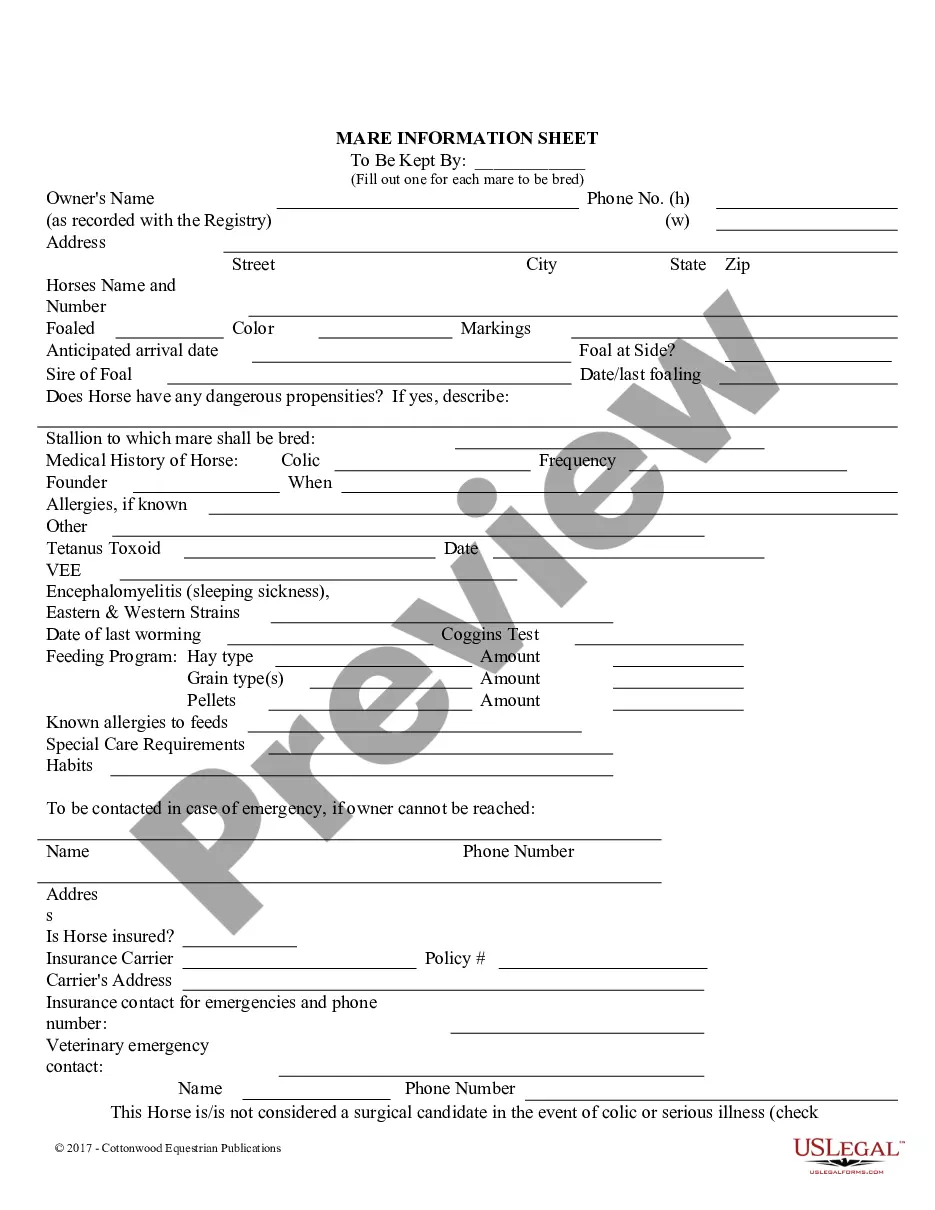

Title: Michigan Contract with Veterinarian Assistant as Independent Contractor with Provisions for Termination with or without Cause Introduction: In the state of Michigan, contracts between veterinarians and their assistant independent contractors play a crucial role in ensuring a clear understanding of mutual responsibilities and expectations. This detailed description will outline the key provisions and clauses typically included in Michigan contracts with veterinarian assistants functioning as independent contractors. Moreover, it will also highlight different types of contracts that exist within this context. 1. Independent Contractor Agreement: An independent contractor agreement is the primary contract entered into between a veterinarian and an assistant operating as an independent contractor. It establishes a legal relationship between both parties and defines the essential terms and conditions that govern their working relationship. Key Provisions within the Independent Contractor Agreement: A. Scope of Work: This provision outlines the specific tasks and responsibilities entrusted to the veterinarian assistant. It should clearly define the services that the assistant will provide, such as administering medications, performing basic veterinary procedures, assisting in surgeries, managing animal records, and maintaining cleanliness within the facility. B. Compensation and Payment Terms: This section details the agreed-upon compensation structure, which may include an hourly rate, a flat fee, or commission-based payments. It should also address the frequency of payments, accepted payment methods, and any additional expenses that the assistant might incur. C. Duration of the Agreement: The duration provision determines the length of the contractual relationship, specifying an agreed-upon start date and, if applicable, an end date. It might also include provisions for automatic renewal or the option to terminate the agreement early. D. Termination Clauses: i. Termination with Cause: This provision states the circumstances under which either party may terminate the agreement for valid reasons, such as breach of contract, misconduct, non-performance, violation of regulations, or failure to adhere to professional standards. It should outline the procedure to notify the non-performing party of the termination and any potential remedies to rectify the issue. ii. Termination without Cause: This clause enables either party to terminate the contract without providing a specific reason. It usually requires a written notice period to allow for adequate transition and the completion of ongoing obligations. The duration of notice required for termination without cause should be clearly defined within this provision. E. Non-Compete and Non-Disclosure Clauses: To protect the veterinary practice's interests, these clauses restrict the assistant from engaging in similar work within a defined geographic area for a specified time after the termination of the contract. Additionally, it safeguards the confidentiality of sensitive information, trade secrets, and client data acquired during the assistant's engagement. F. Governing Law and Jurisdiction: This provision establishes that the agreement is subject to Michigan state laws. It outlines the preferred jurisdiction for handling any legal disputes, such as mediation, arbitration, or litigation. Different Types of Contracts: 1. Full-Time Independent Contractor Agreement: This contract is designed for veterinary assistants who provide their services on a full-time basis. It outlines the assistant's commitment to work exclusively for the hiring veterinarian, often with a set schedule and fixed hours. 2. Part-Time Independent Contractor Agreement: This agreement is specifically tailored for assistants who work part-time or as needed. It allows more flexibility in terms of working hours, scheduling, and availability. 3. Project-Based Independent Contractor Agreement: In some instances, veterinarians may engage assistant contractors for specific projects or tasks. This type of contract is project-focused, outlining the deliverables, timeline, and compensation structure for the defined project duration. Conclusion: In the realm of veterinary practice in Michigan, the contract between a veterinarian and an assistant independent contractor protects the interests of both parties while ensuring clarity in their professional engagement. Adhering to the provisions and clauses, along with the understanding of different types of contracts, promotes a transparent and mutually beneficial working relationship.