Michigan Promissory Note College to Church

Description

How to fill out Promissory Note College To Church?

Are you presently in a situation where you frequently require documents for either business or personal purposes.

There are numerous document templates available online, yet identifying trustworthy ones isn't simple.

US Legal Forms provides a vast collection of form templates, such as the Michigan Promissory Note from College to Church, designed to comply with state and federal regulations.

- If you are already familiar with the US Legal Forms website and have your account, just Log In.

- After that, you can obtain the Michigan Promissory Note from College to Church template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

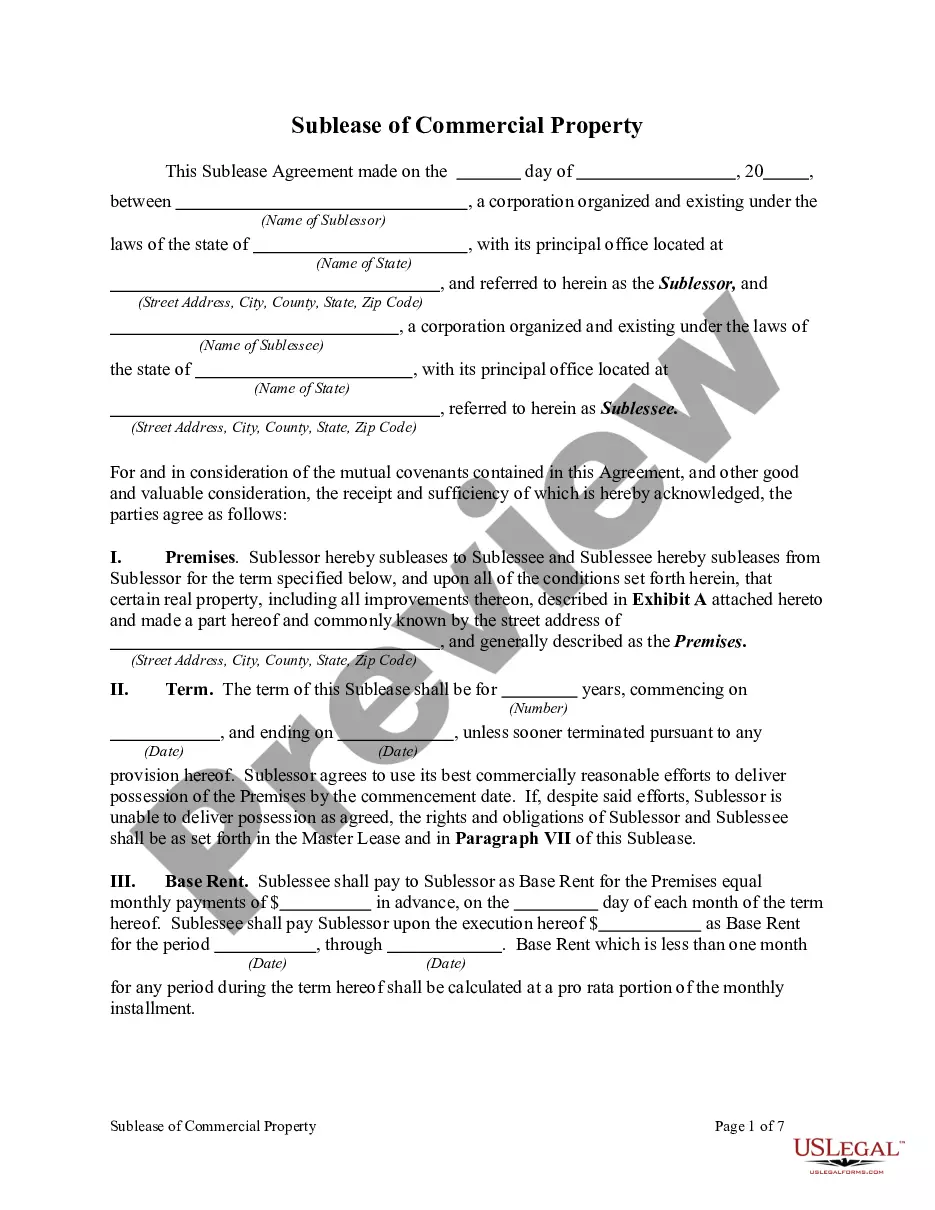

- Use the Preview button to review the form.

- Examine the description to confirm you have selected the correct form.

- If the form isn't what you're looking for, utilize the Search field to find the form that meets your needs and criteria.

- Once you find the right form, click Purchase now.

- Select the pricing plan you desire, provide the necessary information to create your account, and pay for your order using PayPal or a credit card.

Form popularity

FAQ

Filling in a promissory note involves carefully entering relevant information such as the borrower and lender’s names, amount borrowed, and repayment terms. Make sure to read the document thoroughly before signing to confirm accuracy. The Michigan Promissory Note College to Church context can provide an excellent reference for completing this form effectively.

When writing a promissory note for tuition, explicitly state the tuition amount, the student’s name, and the terms of repayment. Include any interest rates and deadlines for payments. By utilizing the Michigan Promissory Note College to Church template, you can guarantee that all necessary details are properly outlined.

An example of a promissory note includes a document where a student promises to repay a defined amount to a college after graduation. It details the amount borrowed, the interest rate, and the repayment schedule. This structure ensures clarity and protection for both the borrower and lender. Consider using the Michigan Promissory Note College to Church for a reliable template.

Filling up a sample promissory note is straightforward. Begin by entering the names of the borrower and lender, followed by the amount being borrowed. Next, include any repayment schedule details, interest rates, and signatures. Utilizing a Michigan Promissory Note College to Church template can streamline this process and ensure compliance with local regulations.

A promissory note does not require notarization to be legal; however, notarization can provide an added layer of security. In Michigan, a simple signed document is sufficient for it to be legally binding. For those crafting a Michigan Promissory Note College to Church, understanding this aspect can help in ensuring that all parties feel secure in the agreement.

Promissory notes are generally enforceable as long as they meet legal standards. If the note contains all necessary details and is signed, a lender can take legal action if the borrower defaults. In Michigan, the terms outlined in a Michigan Promissory Note College to Church must be unambiguous to strengthen enforceability and protect the lender’s interests.

A promissory note must include specific elements to be valid. It should contain the names of the borrower and lender, the amount borrowed, and the repayment terms. Additionally, it must be written clearly and signed by the borrower. In the context of a Michigan Promissory Note College to Church transaction, adhering to these requirements ensures that both parties understand their obligations.

You can download your Michigan Promissory Note College to Church directly from your lender’s website. Most lenders have a dedicated online portal where you can access your documents. If you’re unsure how to navigate their site, seeking help from their customer service can be very effective.

You can obtain a copy of your promissory note by contacting the lender who issued it or logging into your online account with them. They should provide an option to view or download your Michigan Promissory Note College to Church. If needed, you can also explore US Legal Forms for additional resources on obtaining such documents.

To download your Michigan Promissory Note College to Church, visit the lender’s website where your note was originated. Log into your account, navigate to your documents or loans section, and look for the option to download your MPN. If you encounter any issues, reach out to their support for guidance.