Michigan Commercial Partnership Agreement between an Investor and Worker

Description

How to fill out Commercial Partnership Agreement Between An Investor And Worker?

You have the ability to allocate time online searching for the legal document template that aligns with the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by professionals.

You can obtain or print the Michigan Commercial Partnership Agreement between an Investor and Employee through the services.

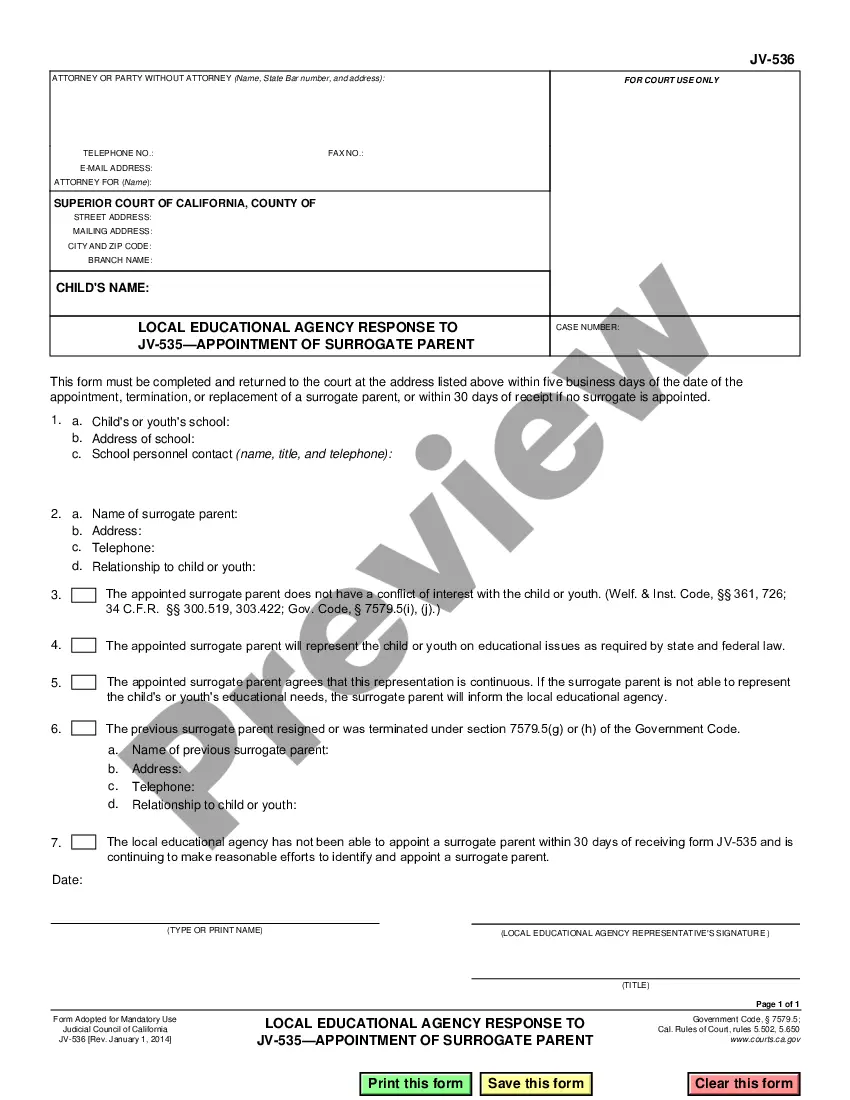

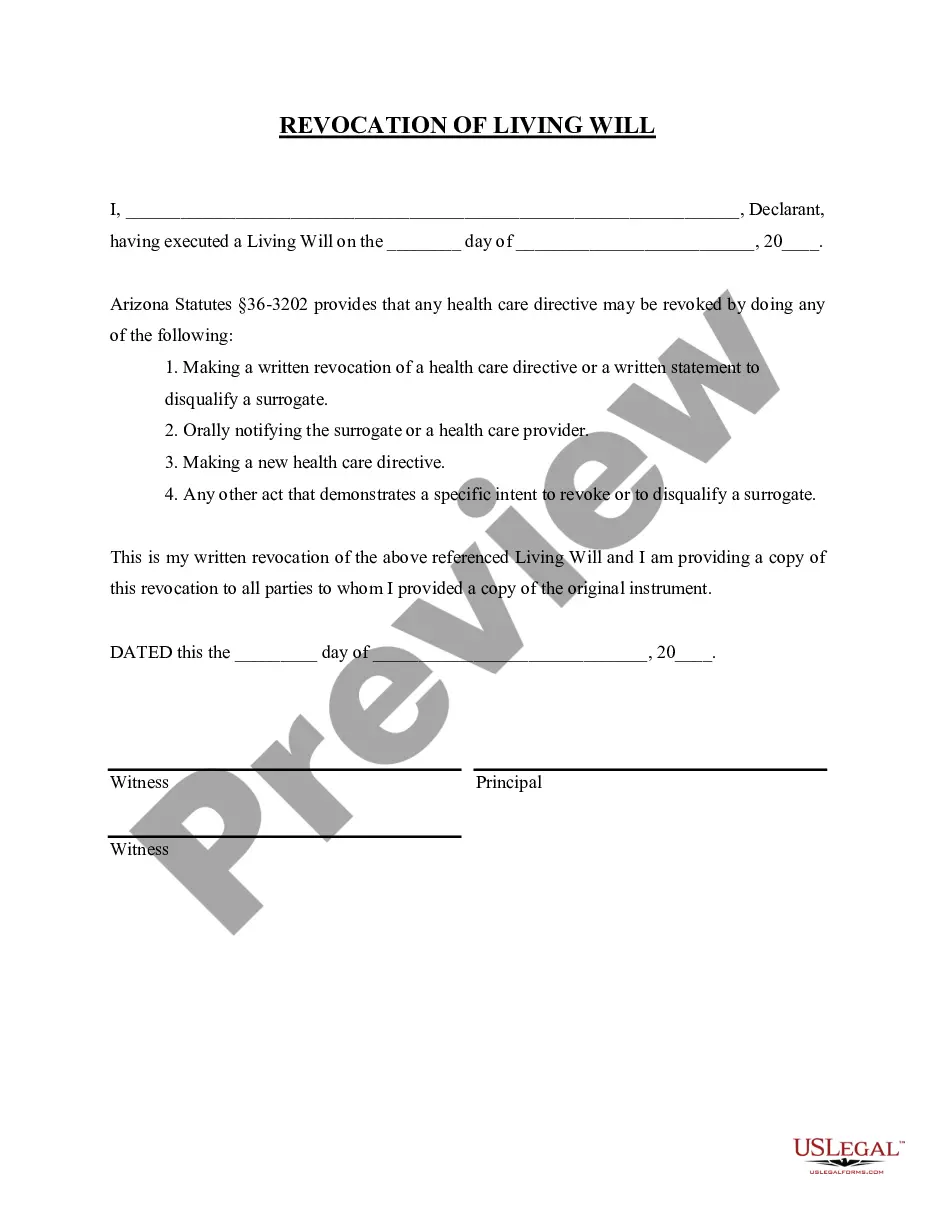

If available, use the Review option to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and select the Obtain option.

- After that, you can fill out, edit, print, or sign the Michigan Commercial Partnership Agreement between an Investor and Employee.

- Each legal document template you acquire is yours indefinitely.

- To request another copy of the purchased form, visit the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have chosen the correct document template for the area/city you desire.

- Review the form description to confirm you have selected the suitable document.

Form popularity

FAQ

A Partnership Agreement is a written agreement between business partners. It should set out clearly each party's contractual obligations and provide the framework for the day-to-day running of the business.

A general partnership is also sometimes called a commercial partnership. It is a company in which at least 2 persons work together under one common name. Every person who participates becomes a partner. Every partner contributes something. This can be money, as well as goods or labour.

Features of partnership form of organisation are discussed as below:Two or More Persons:Contract or Agreement:Lawful Business:Sharing of Profits and Losses:Liability:Ownership and Control:Mutual Trust and Confidence:Restriction on Transfer of Interest:More items...

The partnership agreement spells out who owns what portion of the firm, how profits and losses will be split, and the assignment of roles and duties. The partnership agreement will also typically spell how out disputes are to be adjudicated and what happens if one of the partners dies prematurely.

A partnership agreement is a legal document that outlines the management structure of a partnership and the rights, duties, ownership interests and profit shares of the partners. It's not legally required, but highly advisable, to have a partnership agreement to avoid conflicts among partners.

8 things your small business partnership agreement should includeWhat each business partner will contribute.How finances will be managed.Distribution of profits and losses.A process for dispute resolution.A non-compete clause.A non-disclosure confidentiality clause.A non-solicitation clause.More items...?

How to Write a Business Partnership Agreementname of the partnership.goals of the partnership.duration of the partnership.contribution amounts of each partner (cash, property, services, future contributions)ownership interests of each partner (assets)management roles and terms of authority of each partner.More items...

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP).

A partnership agreement is the legal document that dictates the way a business is run and details the relationship between each partner.

Here are five clauses every partnership agreement should include:Capital contributions.Duties as partners.Sharing and assignment of profits and losses.Acceptance of liabilities.Dispute resolution.