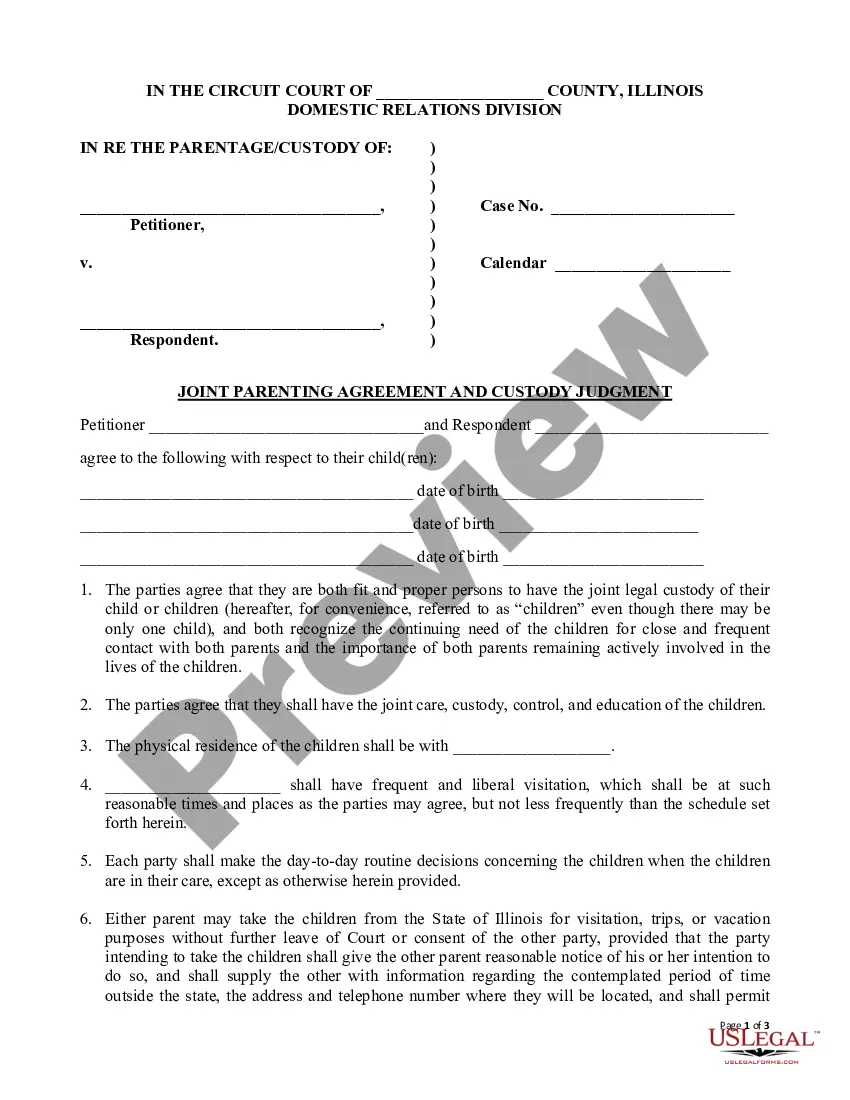

Michigan Checklist — Sale of a Business: A Comprehensive Guide Keywords: Michigan, checklist, sale of a business, detailed description, types Description: The Michigan Checklist — Sale of a Business is an essential tool for individuals or entities seeking to navigate the process of selling a business in the state of Michigan. This checklist serves as a comprehensive guide, outlining the various steps and important considerations to ensure a smooth and successful sale. Whether you are a business owner looking to sell your venture or a potential buyer interested in acquiring an enterprise, adhering to this checklist will help you avoid potential pitfalls and make informed decisions throughout the transaction. The Michigan Checklist — Sale of a Business generally encompasses the following key areas: 1. Financial Documentation: — Organizing financial statements, tax returns, and other necessary financial documents. — Validating the accuracy and completeness of the financial records. 2. Business Valuation: — Engaging a professional appraiser to determine the fair market value of the business. — Assessing the value of tangible and intangible assets, including inventory, equipment, intellectual property, customer base, and goodwill. 3. Legal Compliance: — Ensuring compliance with all federal, state, and local regulations relevant to the business. — Reviewing licenses, permits, contracts, leases, and other legal obligations. — Addressing any potential compliance issues that may arise during the sale process. 4. Business Operations: — Assessing the operational aspects, including any outstanding contracts, employee agreements, and vendor relationships. — Identifying potential risks and liabilities associated with the business operations. — Reviewing intellectual property rights, trademarks, and patents. 5. Due Diligence: — Collecting and reviewing documents and information related to the business's history, financials, operations, and customers. — Analyzing the business's competitive landscape and market position. — Identifying any potential risks or legal issues that may impact the sale. 6. Negotiating the Sale: — Establishing negotiation strategies and determining priorities. — Discussing terms, conditions, and sale price with potential buyers or sellers. — Engaging legal counsel to facilitate negotiations and draft purchase agreements. Types of Michigan Checklists — Sale of a Business: 1. Asset Purchase Checklist — Sale of a Business— - Focuses on the acquisition of specific assets of the business, rather than the entire entity. — Involves transferring individual assets, such as inventory, equipment, and customer contracts, while leaving behind liabilities and obligations. 2. Stock Purchase Checklist — Sale of a Business— - Involves the sale of the entire business, including all assets, liabilities, and obligations. — The purchaser assumes ownership of the company and its existing legal structure, assuming both the assets and potential liabilities. Whether pursuing an asset purchase or stock purchase, utilizing the Michigan Checklist — Sale of a Business will provide crucial guidance and ensure a comprehensive approach to the sale process, facilitating a successful transaction for all parties involved.

Michigan Checklist - Sale of a Business

Description

How to fill out Michigan Checklist - Sale Of A Business?

Choosing the right authorized document web template might be a battle. Of course, there are a lot of web templates available on the Internet, but how would you get the authorized form you want? Use the US Legal Forms website. The support gives 1000s of web templates, for example the Michigan Checklist - Sale of a Business, that you can use for enterprise and private requires. All of the varieties are checked by experts and satisfy federal and state specifications.

If you are presently signed up, log in in your bank account and then click the Obtain option to find the Michigan Checklist - Sale of a Business. Make use of your bank account to search from the authorized varieties you have ordered formerly. Go to the My Forms tab of your own bank account and get another backup of your document you want.

If you are a new end user of US Legal Forms, here are straightforward instructions that you should stick to:

- Initially, make certain you have chosen the right form to your city/area. You are able to check out the shape using the Preview option and study the shape outline to make sure it is the best for you.

- In the event the form fails to satisfy your expectations, use the Seach industry to discover the proper form.

- Once you are positive that the shape is proper, click on the Acquire now option to find the form.

- Choose the rates plan you need and enter in the needed info. Build your bank account and buy the transaction with your PayPal bank account or charge card.

- Select the document file format and obtain the authorized document web template in your system.

- Full, revise and printing and sign the attained Michigan Checklist - Sale of a Business.

US Legal Forms may be the biggest local library of authorized varieties in which you will find various document web templates. Use the service to obtain appropriately-produced paperwork that stick to express specifications.

Form popularity

FAQ

In order to close your sales tax permit in Michigan, you will need to complete the Michigan Notice of Change or Discontinuance form 163.

To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.

In order to close your sales tax permit in Michigan, you will need to complete the Michigan Notice of Change or Discontinuance form 163.

To dissolve your LLC in Michigan, submit a completed Michigan Certificate of Dissolution form to the Department Licensing and Regulatory Affairs (LARA) by mail or in person. The form cannot be filed online. Use of LARA forms is optional.

It takes a minimum of three months from the time of application to dissolution - this is the time in which creditors can object.

Following these steps can ensure you close down your business the right way, allowing you to carve a new path forward.Step 1: Create an exit strategy.Step 2: Notify employees.Step 3: Collect or sell outstanding receivables.Step 4: Sell your business assets.Step 5: File articles of dissolution.More items...?

Manage Your Michigan DBA To renew your assumed name, call (517) 241-6470. You can cancel your DBA by filing the Certificate of Termination of Assumed Name form. The fee for corporations and LPs is $10. The fee for LLCs is $25.

Steps to Take to Close Your BusinessFile a Final Return and Related Forms.Take Care of Your Employees.Pay the Tax You Owe.Report Payments to Contract Workers.Cancel Your EIN and Close Your IRS Business Account.Keep Your Records.

Closing an insolvent company In this scenario, your creditors (the people to whom your company owes money) take legal priority over the directors and shareholders. In other words, you must settle all your debts (as far as possible) before taking any money from the company yourself.

Read our in-depth guide to redundancy for further guidance.Tell HMRC you've stopped employing people.Pay final wages, outstanding PAYE and National Insurance contributions.Send out P45s.Send final payroll reports to HMRC.Close your payroll scheme.30 Sept 2021