The Michigan General Form of Assignment as Collateral for Note is a legal document used in the state of Michigan to assign collateral as security for a promissory note. This assignment is commonly utilized in various financial transactions, such as loans, mortgages, or the extension of credit. The primary purpose of the Michigan General Form of Assignment as Collateral for Note is to establish a clear and formal agreement between the lender (assignor) and the borrower (assignee) regarding the collateral that will secure the repayment of the note. By assigning collateral, the lender aims to mitigate potential risks associated with lending money or extending credit. This form of assignment serves to legally document the transfer of ownership rights and security interest in the collateral from the borrower to the lender. It outlines the terms and conditions of the assignment, including a detailed description of the collateral, the amount of the note, interest rates, repayment schedule, and any other relevant provisions agreed upon by both parties. In Michigan, there are different types of General Forms of Assignment as Collateral for Note, which may include specific variations based on the type of collateral being assigned. Some common examples of collateral that can be assigned include real estate, vehicles, equipment, inventory, accounts receivable, or other valuable assets. The specific type of collateral being assigned will determine the unique requirements and provisions within the assignment document. When using the Michigan General Form of Assignment as Collateral for Note, it is crucial to ensure that all the necessary details are accurately filled out to prevent any future disputes or legal complications. Additionally, it is highly advisable for both parties to consult with legal professionals to ensure compliance with Michigan state laws and regulations. In conclusion, the Michigan General Form of Assignment as Collateral for Note is an essential legal document used to protect the interests of lenders and borrowers in financial transactions. It establishes a legally binding agreement regarding the assignment of collateral as security for the repayment of a promissory note, and it is crucial to adhere to all relevant requirements and provisions to ensure a smooth and enforceable transaction.

Michigan General Form of Assignment as Collateral for Note

Description

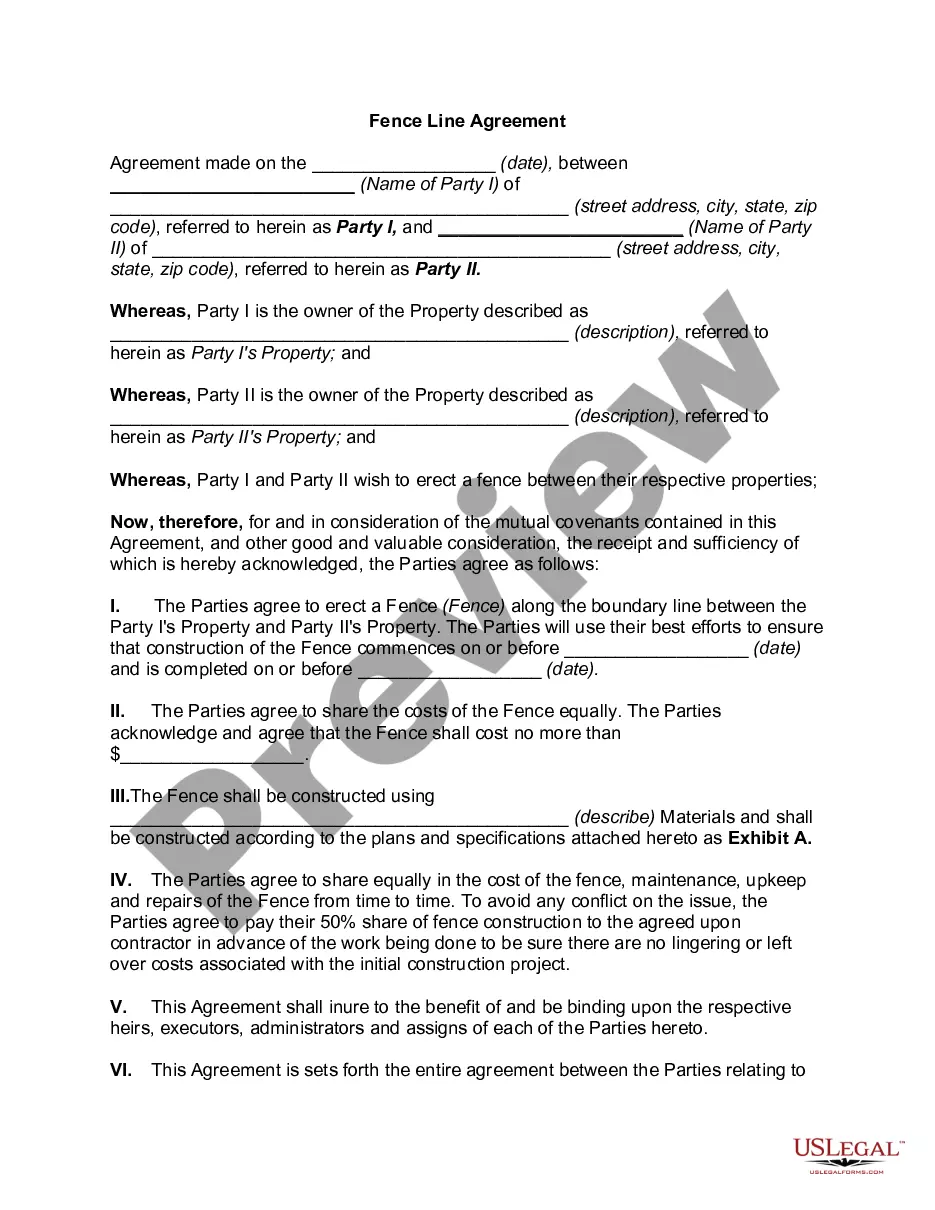

How to fill out Michigan General Form Of Assignment As Collateral For Note?

If you have to complete, acquire, or print lawful document themes, use US Legal Forms, the largest assortment of lawful types, which can be found on-line. Use the site`s basic and convenient research to get the files you require. Numerous themes for enterprise and specific purposes are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to get the Michigan General Form of Assignment as Collateral for Note in a handful of click throughs.

Should you be already a US Legal Forms buyer, log in to the account and click on the Download button to have the Michigan General Form of Assignment as Collateral for Note. You can even accessibility types you formerly delivered electronically in the My Forms tab of the account.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for your proper town/region.

- Step 2. Take advantage of the Preview solution to check out the form`s information. Do not overlook to read through the information.

- Step 3. Should you be not happy with the kind, make use of the Research area near the top of the screen to locate other variations in the lawful kind template.

- Step 4. When you have found the shape you require, go through the Buy now button. Choose the costs strategy you choose and add your accreditations to sign up to have an account.

- Step 5. Process the financial transaction. You should use your bank card or PayPal account to perform the financial transaction.

- Step 6. Select the format in the lawful kind and acquire it on your product.

- Step 7. Full, change and print or sign the Michigan General Form of Assignment as Collateral for Note.

Each lawful document template you purchase is yours forever. You possess acces to every kind you delivered electronically with your acccount. Click on the My Forms area and select a kind to print or acquire again.

Remain competitive and acquire, and print the Michigan General Form of Assignment as Collateral for Note with US Legal Forms. There are many professional and express-specific types you can utilize for the enterprise or specific demands.