Michigan Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws refers to a legal transaction where a corporation in Michigan sells its assets without the need to comply with bulk sales laws. This process allows the corporation to transfer its assets to another entity swiftly and efficiently, avoiding the complexities and requirements typically associated with bulk sales laws. The Michigan Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws can be categorized into two types: voluntary asset sales and involuntary asset sales. 1. Voluntary Asset Sales: In this type of sale, a corporation in Michigan proactively decides to sell its assets to another entity. This can occur due to various reasons, such as mergers, acquisitions, or a desire to restructure the corporation's operations. By utilizing the exception to comply with bulk sales laws, the corporation can expedite the transfer of assets, ensuring a seamless transition. 2. Involuntary Asset Sales: In some situations, a corporation in Michigan may face involuntary asset sales, such as bankruptcy or foreclosure. In these cases, the corporation may not have sufficient funds to fulfill its obligations or repay debts, forcing it to sell its assets to satisfy creditors or settle financial obligations. By leveraging the exemption from complying with bulk sales laws, the corporation can expedite the asset sale process and meet its legal obligations efficiently. The Michigan Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws provides several advantages for corporations involved in asset transfers. Firstly, it allows for a quicker and more streamlined transaction, saving both time and resources for the corporation and the acquiring entity. Additionally, this exemption helps protect the interests of both parties involved, ensuring a fair exchange of assets without unnecessary legal complications. However, it's important to note that while Michigan provides an exemption from bulk sales laws, certain legal requirements and procedures must still be followed to safeguard the interests of all parties involved. Engaging legal professionals experienced in Michigan corporate law is crucial to ensure compliance and a smooth asset transfer process. In summary, the Michigan Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws allows corporations to sell their assets without the need to adhere to bulk sales laws, facilitating the seamless transfer of assets. This exemption applies to both voluntary asset sales and involuntary asset sales, such as those occurring during bankruptcy or foreclosure proceedings. By leveraging this exemption, corporations can efficiently complete asset transfers while protecting the interests of all involved parties. Legal guidance is essential to navigate the complexities of this process and ensure compliance with Michigan corporate law.

Michigan Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Michigan Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

Choosing the right authorized record design might be a have a problem. Naturally, there are a lot of layouts available on the Internet, but how do you find the authorized develop you require? Use the US Legal Forms website. The services provides 1000s of layouts, like the Michigan Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws, that you can use for company and personal needs. Every one of the varieties are inspected by professionals and meet up with state and federal demands.

If you are already registered, log in to the accounts and then click the Download option to obtain the Michigan Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws. Use your accounts to search from the authorized varieties you have ordered formerly. Go to the My Forms tab of your own accounts and have one more version of the record you require.

If you are a brand new user of US Legal Forms, here are easy instructions that you can follow:

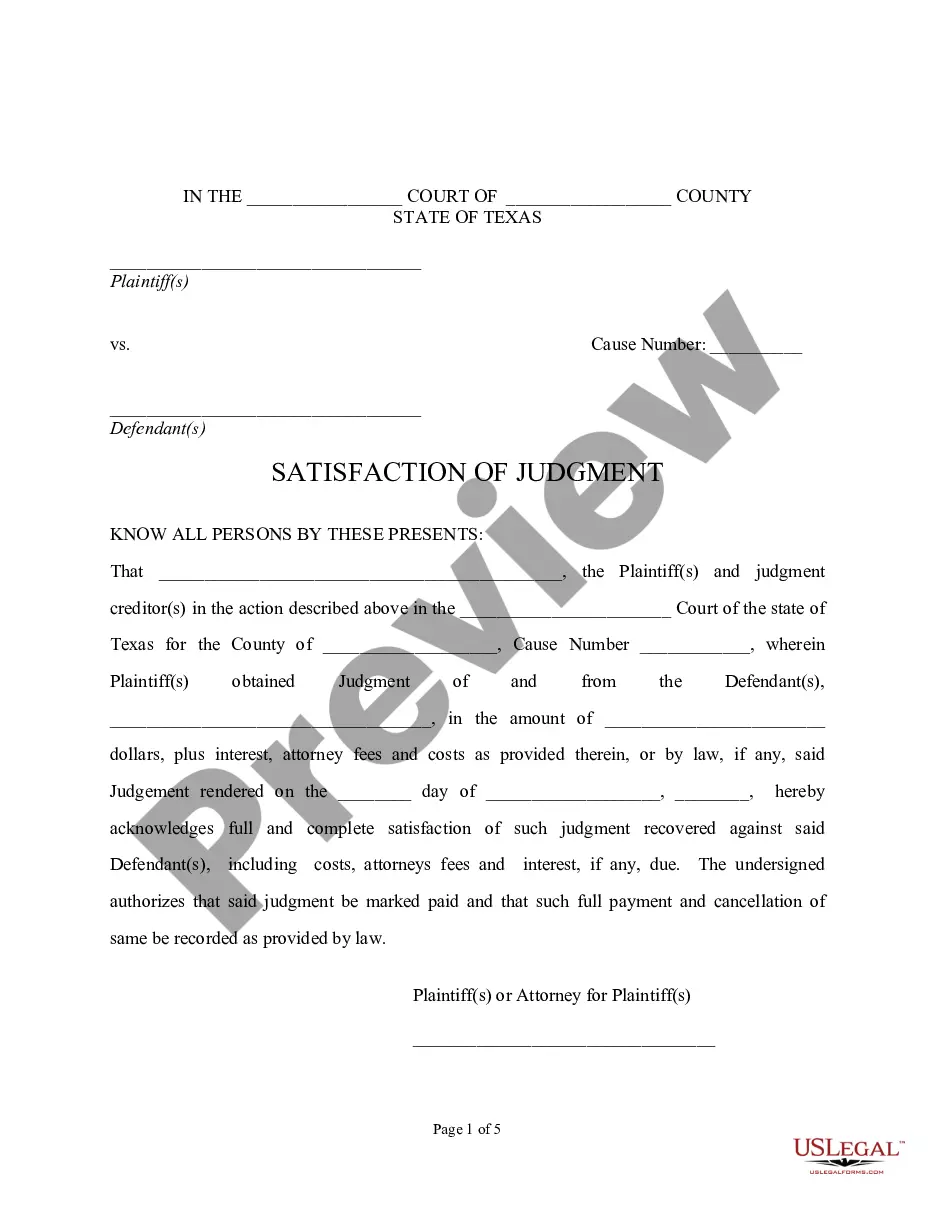

- Initially, be sure you have chosen the correct develop for the city/county. You are able to look through the shape utilizing the Preview option and browse the shape description to make certain it is the right one for you.

- When the develop will not meet up with your requirements, utilize the Seach area to get the right develop.

- Once you are certain that the shape is acceptable, go through the Acquire now option to obtain the develop.

- Choose the rates program you want and enter the needed info. Build your accounts and buy the order using your PayPal accounts or Visa or Mastercard.

- Pick the submit structure and obtain the authorized record design to the product.

- Comprehensive, revise and produce and indication the attained Michigan Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws.

US Legal Forms is definitely the biggest collection of authorized varieties for which you can find different record layouts. Use the company to obtain expertly-manufactured documents that follow express demands.