Michigan Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice

Description

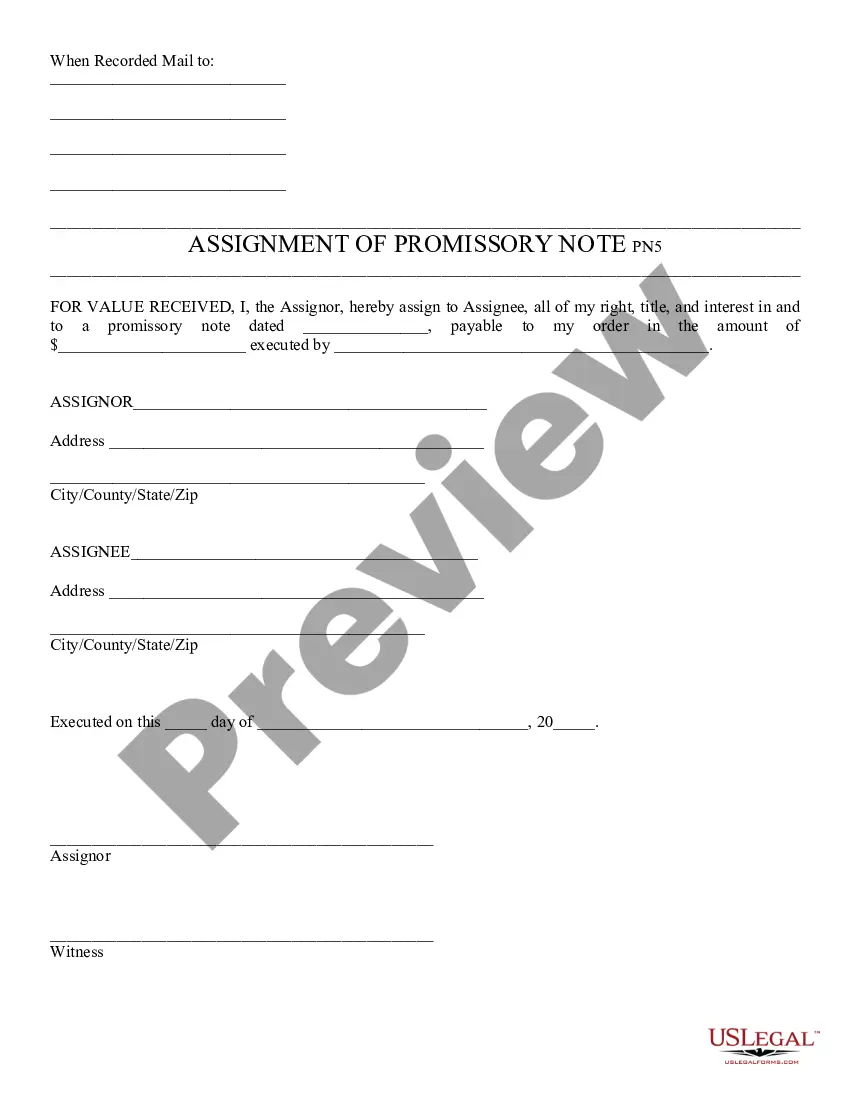

How to fill out Sample Letter To Foreclosure Attorney - After Foreclosure - Did Not Receive Notice?

If you need to complete, obtain, or produce authorized document themes, use US Legal Forms, the largest variety of authorized kinds, which can be found on the web. Use the site`s easy and handy search to get the paperwork you require. Different themes for organization and person functions are sorted by types and suggests, or search phrases. Use US Legal Forms to get the Michigan Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice in a couple of click throughs.

In case you are already a US Legal Forms customer, log in for your profile and click the Download option to find the Michigan Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice. You can also gain access to kinds you previously saved in the My Forms tab of your own profile.

If you are using US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the shape to the correct town/country.

- Step 2. Use the Preview method to examine the form`s content material. Do not overlook to see the outline.

- Step 3. In case you are unhappy together with the form, utilize the Research industry at the top of the screen to find other versions of the authorized form web template.

- Step 4. When you have identified the shape you require, click on the Get now option. Choose the costs plan you like and add your qualifications to register for an profile.

- Step 5. Method the deal. You can utilize your credit card or PayPal profile to perform the deal.

- Step 6. Choose the structure of the authorized form and obtain it in your system.

- Step 7. Total, edit and produce or indication the Michigan Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice.

Every authorized document web template you buy is yours eternally. You may have acces to every single form you saved within your acccount. Click the My Forms area and choose a form to produce or obtain yet again.

Compete and obtain, and produce the Michigan Sample Letter to Foreclosure Attorney - After Foreclosure - Did not Receive Notice with US Legal Forms. There are thousands of expert and status-certain kinds you can use for your personal organization or person needs.

Form popularity

FAQ

Tips for Writing a Hardship Letter Keep it original. ... Be honest. ... Keep it concise. ... Don't cast blame or shirk responsibility. ... Don't use jargon or fancy words. ... Keep your objectives in mind. ... Provide the creditor an action plan. ... Talk to a Financial Coach.

Make sure to include not just your difficulties in your letter, but also your plans to improve your situation and get back on track with your loan payment. Remember you are writing to an organization, not an individual, you must write in respect to their desire to make money and give them reasons to trust you.

Redemption Period ? starts day of Sheriff Sale -Six (6) months is most common. -If the amount claimed to be due on the mortgage at the date of foreclosure is less than 2/3 of the original indebtedness, the redemption period is 12 months.

Most foreclosures in Michigan are nonjudicial, which means the bank does not have to go through court. Judicial foreclosures are allowed, too. In a judicial foreclosure, the bank forecloses through the state court system.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Dear Madam, I am Nisha Mittal, and I currently have a home loan against my account number (mention your account number). I want to foreclose my home loan this month by paying the outstanding amount in a single payment. I have paid 8 EMIs as of now, and there are 5 EMIs pending until this year.

There are two ways lenders in Michigan can foreclose: Judicial Foreclosure where the lender must take the borrower to court (this type of foreclosure is not common), and. Foreclosure by Advertisement where the lender may foreclose by scheduling a Sheriff's sale and advertising the sale in a local paper.

Personal Loan Closure Letter Format Dear Sir/Ma'am, I am Sudharshana Karthik, and I have a personal loan in my account in your bank. I am writing this letter to request you to close my personal loan account with the number 1526xx4656. I have paid all my EMIs, and the loan tenure is complete.