The Michigan Loan Agreement for Investment is a legal and binding document that outlines the terms and conditions of a loan provided by an investor to an individual or business entity in the state of Michigan. This agreement is essential for both parties involved, as it ensures clarity and protection throughout the loan process. The Michigan Loan Agreement for Investment includes specific details such as the loan amount, interest rate, repayment terms, collateral (if applicable), and any additional fees or charges. This agreement is designed to provide a framework for the loan transaction and protect the rights and interests of both the investor and the borrower. There are several types of Michigan Loan Agreement for Investment, depending on the nature and purpose of the loan. Some of the most common types include: 1. Business Loan Agreement: This type of agreement is specifically tailored to loan agreements between investors and businesses. It outlines the purpose of the loan, the potential use of funds, and any specific conditions or requirements related to the business's financial performance or milestones. 2. Personal Loan Agreement: This agreement is used when an individual borrows money from an investor for personal use. It typically includes provisions regarding personal liability, repayment schedule, and any applicable interest rates or charges. 3. Real Estate Investment Loan Agreement: When an investor provides financing for a real estate investment project, this type of agreement is used. It outlines the loan amount, repayment terms, and any specific conditions related to the property or real estate project. 4. Start-up Investment Loan Agreement: Start-up businesses often require investment loans to fund their initial operations or growth. This agreement is customized to meet the unique needs of start-ups, including provisions related to equity stakes, repayment schedules, and performance milestones. 5. Equipment Financing Loan Agreement: This type of agreement is used when an investor loans money to a business for the purchase or lease of equipment. It typically outlines the agreed-upon terms for equipment financing, including loan amount, interest rate, and repayment period. Overall, the Michigan Loan Agreement for Investment is a crucial legal tool that safeguards the interests of both investors and borrowers in various financial transactions, ensuring transparency, accountability, and protection for all parties involved.

Michigan Loan Agreement for Investment

Description

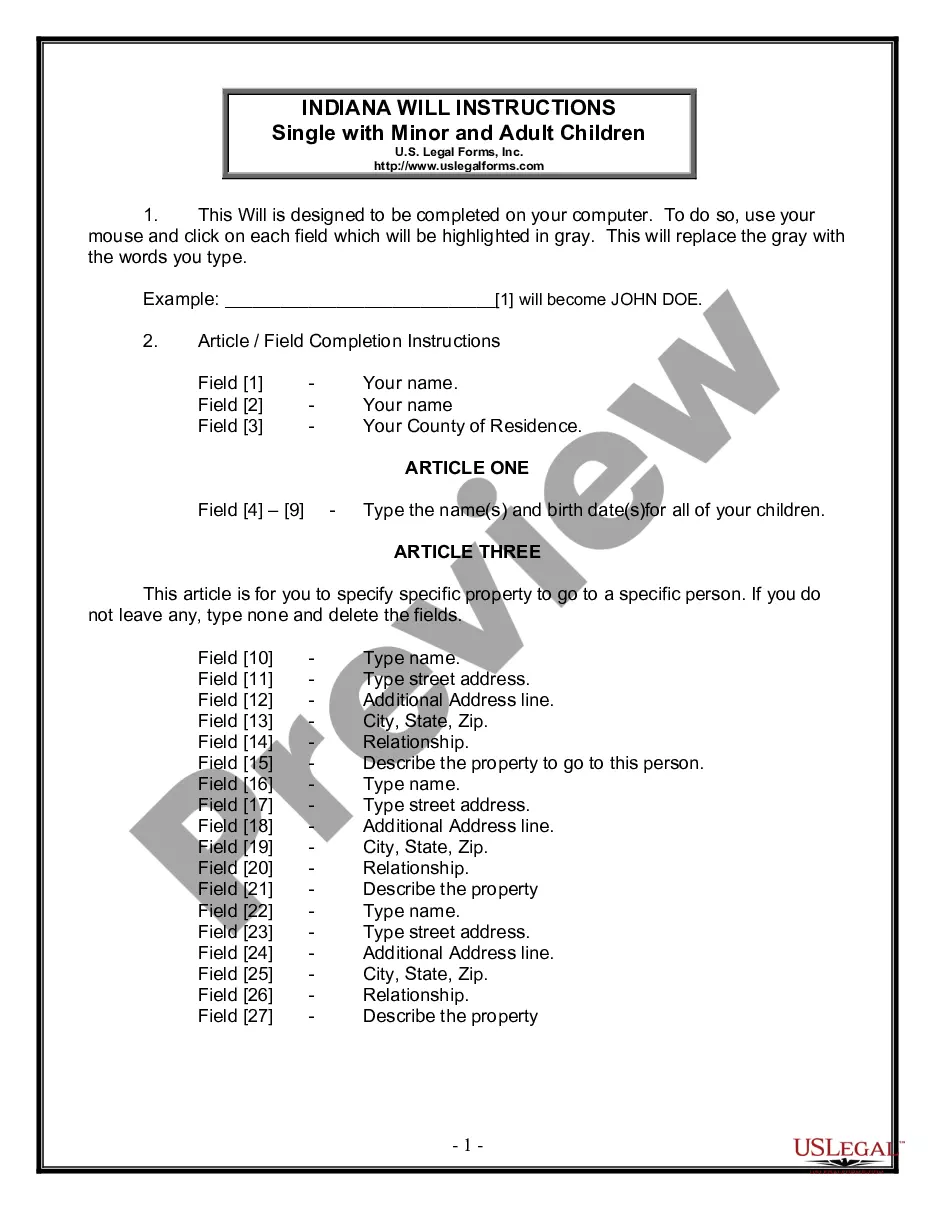

How to fill out Loan Agreement For Investment?

It is possible to devote several hours on-line attempting to find the legitimate papers template that suits the federal and state requirements you will need. US Legal Forms supplies a large number of legitimate forms that happen to be analyzed by specialists. You can actually download or print the Michigan Loan Agreement for Investment from your services.

If you already possess a US Legal Forms profile, you can log in and click the Down load option. After that, you can full, modify, print, or signal the Michigan Loan Agreement for Investment. Every single legitimate papers template you purchase is your own for a long time. To get another version of the obtained develop, check out the My Forms tab and click the corresponding option.

If you are using the US Legal Forms internet site the first time, stick to the basic instructions below:

- Initial, ensure that you have selected the proper papers template for the region/area of your liking. Browse the develop explanation to ensure you have selected the correct develop. If accessible, make use of the Preview option to check with the papers template as well.

- In order to find another variation of the develop, make use of the Research discipline to discover the template that fits your needs and requirements.

- Upon having identified the template you want, just click Purchase now to continue.

- Find the pricing prepare you want, enter your credentials, and register for a merchant account on US Legal Forms.

- Total the deal. You should use your charge card or PayPal profile to cover the legitimate develop.

- Find the format of the papers and download it in your product.

- Make adjustments in your papers if possible. It is possible to full, modify and signal and print Michigan Loan Agreement for Investment.

Down load and print a large number of papers templates utilizing the US Legal Forms web site, that provides the greatest collection of legitimate forms. Use expert and condition-particular templates to take on your company or specific demands.

Form popularity

FAQ

A Loan Agreement, also known as a term loan, demand loan, or loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the loan amount, any interest charges, the repayment plan, and payment dates.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

The difference between whether money is a loan which must be paid back and an investment can be a crucial difference, as it can be the difference between being paid back or not. If you are the one paying the money back, you may want money to be an investment to avoid having to pay money back if the business goes under.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

Mortgage. a legal agreement to borrow money. for the purchase of a home.

You can write up a personal loan agreement by hand, with pen and paper, or draft it on your computer. Once the document looks good, it can be printed out and signed by both parties.

Promissory notes have set terms, or repayment periods, ranging from a few months to several years. Even legitimate promissory notes involve risks: competition, bad management or severe market conditions can impact the issuer's ability to carry out its promise to pay interest and principal to note buyers.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.