A Michigan Loan Agreement for Personal Loan is a legally binding document that outlines the terms and conditions of a personal loan between a lender and a borrower in the state of Michigan. This agreement governs the rights and responsibilities of both parties, ensuring transparency and clarity throughout the loan process. The Michigan Loan Agreement for Personal Loan is designed to protect both the lender and the borrower. It includes key details such as the loan amount, interest rate, payment schedule, and any additional fees or charges. By signing this agreement, both the lender and the borrower agree to abide by these terms and fulfill their obligations as stated. Michigan offers various types of personal loan agreements to cater to different borrowing needs. Some common types include: 1. Fixed-Rate Personal Loan Agreement: This type of agreement establishes a fixed interest rate for the entire loan term. The borrower knows exactly how much they need to repay each month, which helps with budgeting and financial planning. 2. Variable-Rate Personal Loan Agreement: Unlike fixed-rate agreements, this type of agreement allows the interest rate to fluctuate over time. The rate is usually tied to a specific market index. Borrowers should carefully consider the risks associated with potential rate increases when opting for this type of loan. 3. Secured Personal Loan Agreement: With a secured personal loan, the borrower provides collateral, such as a car or house, to secure the loan. This collateral acts as security for the lender, reducing the risk of default. In the case of non-payment, the lender may seize the collateral to recover any outstanding balance. 4. Unsecured Personal Loan Agreement: Unlike a secured loan, an unsecured personal loan does not require collateral. The borrower is approved based on their creditworthiness and income. Since there is no collateral involved, lenders typically have stricter eligibility criteria and higher interest rates for unsecured loans. When entering into a Michigan Loan Agreement for Personal Loan, it is crucial for both parties to carefully review and understand the terms and conditions. Consulting a legal professional or financial advisor can provide further guidance to ensure the loan agreement is fair and suitable for both the borrower and the lender. Keywords: Michigan, loan agreement, personal loan, terms and conditions, legally binding, lender, borrower, loan amount, interest rate, payment schedule, additional fees, fixed-rate, variable-rate, secured, unsecured.

Michigan Loan Agreement for Personal Loan

Description

How to fill out Michigan Loan Agreement For Personal Loan?

If you wish to complete, acquire, or produce authorized record themes, use US Legal Forms, the greatest selection of authorized varieties, that can be found on-line. Utilize the site`s basic and hassle-free search to find the paperwork you will need. Numerous themes for business and person functions are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to find the Michigan Loan Agreement for Personal Loan in just a couple of click throughs.

When you are previously a US Legal Forms buyer, log in in your accounts and then click the Download key to obtain the Michigan Loan Agreement for Personal Loan. You can also access varieties you formerly acquired in the My Forms tab of your accounts.

If you use US Legal Forms the very first time, follow the instructions beneath:

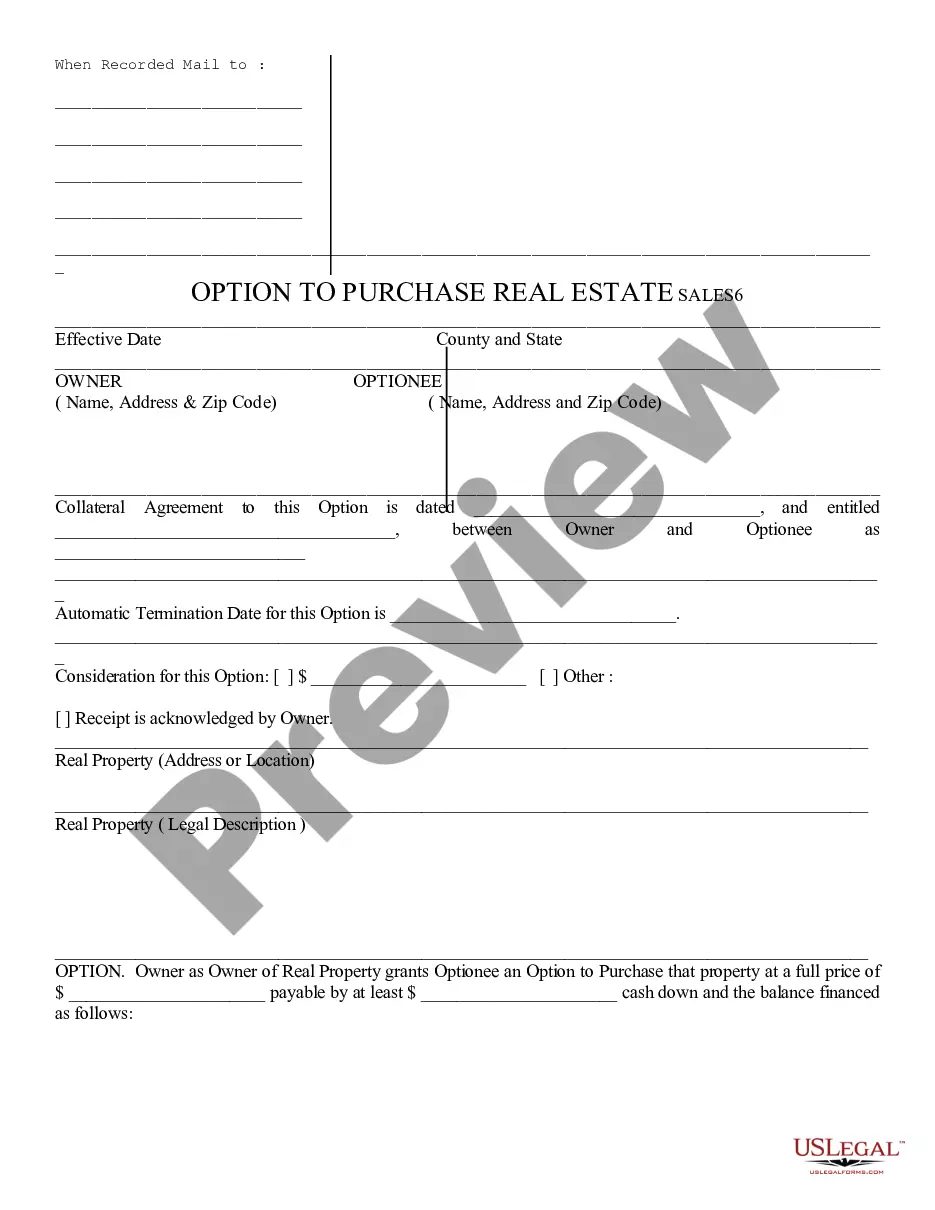

- Step 1. Be sure you have chosen the form for the appropriate metropolis/nation.

- Step 2. Make use of the Preview solution to check out the form`s content. Never forget about to read through the description.

- Step 3. When you are unsatisfied with all the develop, utilize the Research area near the top of the monitor to find other models from the authorized develop design.

- Step 4. Upon having found the form you will need, click on the Get now key. Select the costs program you favor and put your accreditations to register on an accounts.

- Step 5. Method the purchase. You should use your credit card or PayPal accounts to accomplish the purchase.

- Step 6. Find the formatting from the authorized develop and acquire it on your gadget.

- Step 7. Total, change and produce or indication the Michigan Loan Agreement for Personal Loan.

Every single authorized record design you buy is your own property for a long time. You may have acces to each and every develop you acquired in your acccount. Go through the My Forms section and select a develop to produce or acquire once again.

Contend and acquire, and produce the Michigan Loan Agreement for Personal Loan with US Legal Forms. There are thousands of skilled and status-certain varieties you may use to your business or person requirements.

Form popularity

FAQ

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

First and foremost, understand that personal loan agreements fall into the classification of contracts. Technically, you don't have to notarize these documents. But if you want to make this document legally binding, then notarization is the best course of action.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.