A Michigan Irrevocable Life Insurance Trust (IIT) is a legal arrangement created to hold life insurance policies, providing various benefits and ensuring the efficient transfer of assets upon the insured's death. One crucial aspect of this trust is the inclusion of the Crummy powers, granting beneficiaries the right of withdrawal. The Crummy power is named after the historic Crummy v. Commissioner court case, which established that beneficiaries of an IIT have the right to withdraw gifts made to the trust for a limited time, typically 30 days. By utilizing this power, the IIT meets the criteria for annual exclusion gifts, allowing the granter to contribute funds without incurring gift tax liabilities. Michigan Slits offer several types, each with its specific features and benefits, tailored to meet individual needs. These include: 1. Generation-Skipping IIT: This trust is designed to bypass one or more generations of beneficiaries, ensuring that assets are transferred directly to grandchildren or future generations. It helps reduce estate taxes and offers long-term wealth preservation. 2. Credit Shelter IIT: Also known as a "Bypass trust," this type of IIT utilizes the available federal estate tax exemption to its maximum potential. By sheltering assets up to the exemption amount, the IIT minimizes estate taxes that would have been imposed on the policy proceeds. 3. Dynasty IIT: A Dynasty IIT is designed to last for many generations, creating a lasting legacy for the granter's family. By utilizing this trust, beneficiaries can enjoy the benefits of the trust assets without subjecting them to estate taxes at each generational transfer. 4. Special Needs IIT: This type of IIT is specifically created to provide for the needs of a beneficiary with special needs, such as a disability. By utilizing this trust, the granter can ensure that the beneficiary receives the necessary financial support without disrupting their eligibility for government assistance programs. In summary, a Michigan Irrevocable Life Insurance Trust with the Crummy right of withdrawal empowers beneficiaries by granting them the ability to withdraw gifted funds within a certain time frame. This arrangement allows the granter to make annual exclusion gifts, ultimately reducing gift tax liabilities. Different types of Michigan Slits cater to various requirements and goals, including generation-skipping, credit shelter, dynasty, and special needs trusts. Consulting with a qualified estate planning professional is vital to determine which type of Michigan IIT best suits an individual's circumstances.

Michigan Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal

Description

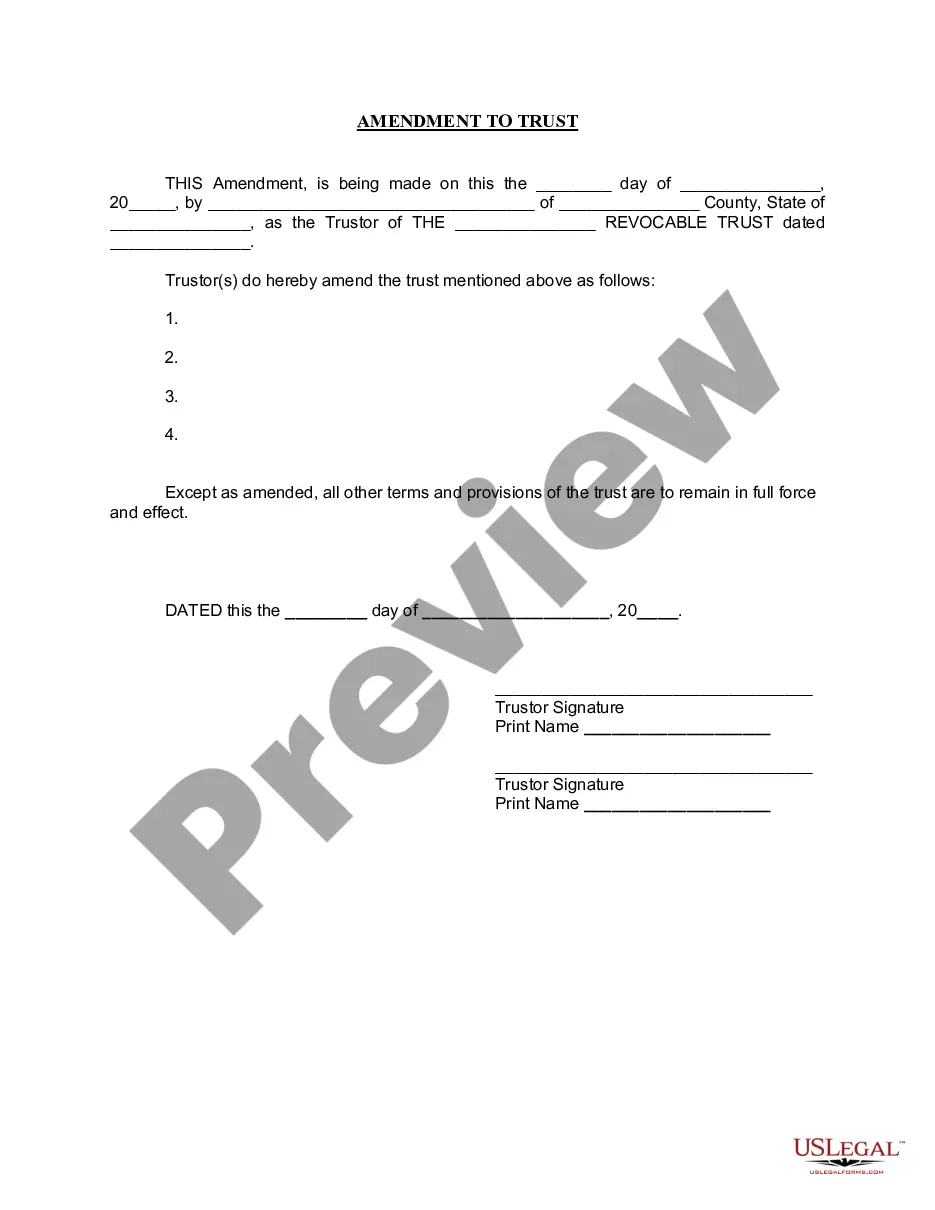

How to fill out Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right Of Withdrawal?

Finding the right legal papers format might be a have difficulties. Obviously, there are a variety of layouts available on the Internet, but how would you get the legal develop you want? Make use of the US Legal Forms site. The services gives a large number of layouts, such as the Michigan Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal, that can be used for company and personal needs. All of the varieties are checked by experts and meet state and federal specifications.

If you are previously signed up, log in to the account and then click the Download switch to obtain the Michigan Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal. Make use of account to search through the legal varieties you have purchased earlier. Go to the My Forms tab of your respective account and acquire one more backup in the papers you want.

If you are a brand new user of US Legal Forms, allow me to share simple instructions for you to stick to:

- First, make sure you have selected the correct develop for the area/region. You may examine the shape while using Preview switch and read the shape information to guarantee this is basically the best for you.

- When the develop does not meet your needs, take advantage of the Seach discipline to find the appropriate develop.

- Once you are positive that the shape is proper, click the Acquire now switch to obtain the develop.

- Pick the pricing plan you need and enter the essential information and facts. Design your account and pay for an order using your PayPal account or bank card.

- Choose the submit formatting and down load the legal papers format to the system.

- Complete, edit and print out and indication the attained Michigan Irrevocable Life Insurance Trust - Beneficiaries Have Crummey Right of Withdrawal.

US Legal Forms will be the greatest library of legal varieties for which you can find various papers layouts. Make use of the service to down load appropriately-produced documents that stick to status specifications.

Form popularity

FAQ

Yes, you could withdraw money from your own trust if you're the trustee. Since you have an interest in the trust and its assets, you could withdraw money as you see fit or as needed. You can also move assets in or out of the trust.

Crummey power allows a person to receive a gift that is not eligible for a gift-tax exclusion and then effectively transform the status of that gift into one that is eligible for a gift-tax exclusion. For Crummey power to work, individuals must stipulate that the gift is part of the trust when it is drafted.

When executing their trust, settlors generally name themselves as the sole trustee and beneficiary while they are living; this allows them to exercise full control over the trust and its assets during their lifetime, as well as to withdraw trust funds as they see fit.

A special type of irrevocable life insurance trust, called a Crummey trust (aka irrevocable gift trust), allows a wealthy grantor to fund the trust in such a way that payments are treated as gifts of present interest to the trust's beneficiaries, thereby qualifying for the annual gift exclusion, then using the payments

If you inherit from a simple trust, you must report and pay taxes on the money. By definition, anything you receive from a simple trust is income earned by it during that tax year. The trustee must issue you a Schedule K-1 for the income distributed to you, which you must submit with your tax return.

Can Creditors Garnish a Trust? Yes, judgment creditors may be able to garnish assets in some situations. However, the amount they can collect in California is limited to the distributions the debtor/beneficiary is entitled to receive from the trust.

Crummey Trusts and Crummey Powers Since the beneficiaries do not have to pay any income taxes when they receive the proceeds of the life insurance policy, the Crummey trust allows the transfer of considerable wealth tax-free.

When an irrevocable trust makes a distribution, it deducts the income distributed on its own tax return and issues the beneficiary a tax form called a K-1. This form shows the amount of the beneficiary's distribution that's interest income as opposed to principal.

Irrevocable Trusts Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust. But just as we mentioned earlier, the trustee must follow the rules of the legal document and can only take out income or principal when it's in the best interest of the trust.