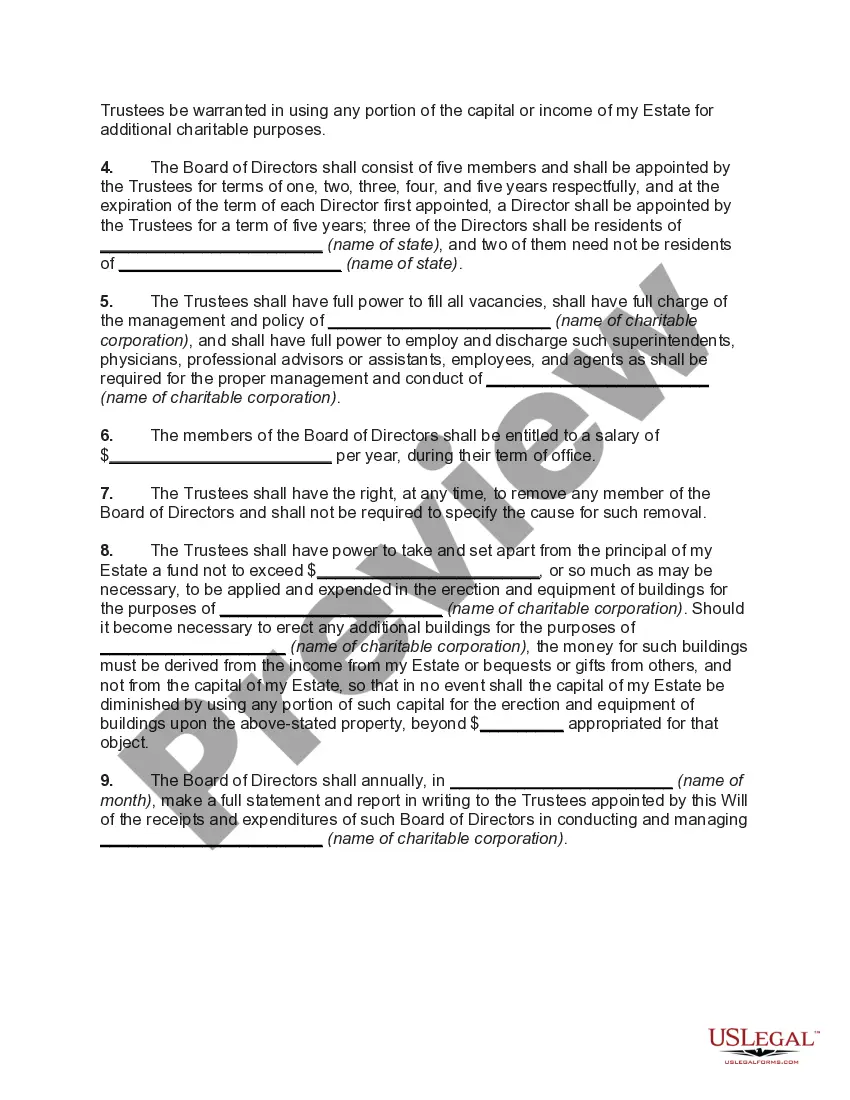

Michigan Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children

Description

How to fill out Testamentary Trust Provision For The Establishment Of A Trust For A Charitable Institution For The Care And Treatment Of Disabled Children?

You have the capability to invest hours online looking for the legal document format that aligns with the federal and state requirements you need.

US Legal Forms offers a vast array of legal documents that can be evaluated by professionals.

It is easy to download or print the Michigan Testamentary Trust Provision for the Creation of a Trust for a Charitable Organization for the Support and Treatment of Disabled Children from your resources.

If available, use the Review button to take a look at the document format as well.

- If you already possess a US Legal Forms account, you can Log In and then select the Obtain button.

- Next, you can fill out, modify, print, or sign the Michigan Testamentary Trust Provision for the Creation of a Trust for a Charitable Organization for the Support and Treatment of Disabled Children.

- Every legal document format you purchase is yours indefinitely.

- To acquire another copy of a purchased document, navigate to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document format for your state/city of choice.

- Review the document description to confirm you have selected the correct document.

Form popularity

FAQ

Setting up a trust in Michigan involves drafting a trust document that outlines the terms and conditions. Individuals may benefit from engaging with professionals familiar with the Michigan Testamentary Trust Provision for the Establishment of a Trust for a Charitable Institution for the Care and Treatment of Disabled Children. Platforms like uslegalforms can provide valuable resources and templates to simplify this process.

For a valid trust to be created the founder must intend to create one, he must express his intention in a mode apt to create an obligation, the property subject to the trust must be defined with reasonable certainty, the trust object, which may either be personal or impersonal must be defined with reasonable certainty

Ten of the most effective ways to build trustValue long-term relationships. Trust requires long-term thinking.Be honest.Honor your commitments.Admit when you're wrong.Communicate effectively.Be vulnerable.Be helpful.Show people that you care.More items...?

Living trusts and testamentary trustsA living trust (sometimes called an inter vivos trust) is one created by the grantor during his or her lifetime, while a testamentary trust is a trust created by the grantor's will.

A testamentary trust is a trust contained in a last will and testament. It provides for the distribution of all or part of an estate and often proceeds from a life insurance policy held on the person establishing the trust. There may be more than one testamentary trust per will.

The Trusts Act 2019 (Act) comes into force on 30 January 2021. The Act codifies the obligations of trustees and the rights of beneficiaries, with the aim of making trustees more accountable and trust law more understandable. The Act applies to charitable trusts and other permitted purpose trusts.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

All trusts are required to contain at least the following elements:Trusts must identify the grantor, trustee and beneficiary. The grantor and trustee must be identified because they are parties to the contract.The trust res must be identified.The trust must contain the signature of both the grantor and the trustee.

Testamentary trusts are discretionary trusts established in Wills, that allow the trustees of each trust to decide, from time to time, which of the nominated beneficiaries (if any) may receive the benefit of the distributions from that trust for any given period.

One of the drawbacks of a testamentary trust is the considerable responsibility it puts on the trustee. He must meet regularly with the probate court to demonstrate his safe handling of the trust, and depending on your wishes, his tasks may go on for many years.