Michigan Renunciation of Legacy is a legal document that allows an individual to voluntarily give up their right to receive any inheritance or legacy from someone's estate. This renunciation can be made only by individuals who have a potential claim to the inheritance, such as beneficiaries, heirs, or devises. By renouncing the legacy, they effectively remove themselves as recipients and surrender any rights, interests, or entitlements associated with the inheritance. The Michigan Renunciation of Legacy is governed by the Michigan Compiled Laws, specifically the Estates and Protected Individuals Code (EPIC) Section 700.2804. This statute outlines the requirements and procedures for making a valid renunciation. It is important to note that this renunciation must be made in writing and signed by the renouncing party. There are two main types of Michigan Renunciation of Legacy that individuals can utilize: 1. Full Renunciation: This type of renunciation involves completely giving up all rights and claims to the inheritance. By renouncing the legacy in its entirety, the renouncing party will not receive any portion of the estate or any assets designated for them. This can be a strategic decision if the individual wishes to disclaim their inheritance due to personal reasons, tax-related concerns, or other legal considerations. 2. Partial Renunciation: In some cases, the renouncing party may choose to renounce only a portion of their potential inheritance. This partial renunciation allows the individual to specify which assets or portions of the estate they do not wish to receive. By doing so, they may redirect those assets or portions to other beneficiaries or devises as outlined in the estate planning documents or will. Renouncing a legacy can have significant implications, and it is crucial for individuals considering a renunciation to consult with an attorney experienced in probate and estate planning laws. Legal advice will help ensure that the renunciation is properly executed, that all legal requirements are met, and that any potential tax or distribution consequences are fully understood. It is recommended to carefully review the specific provisions of the Michigan Compiled Laws and seek professional guidance to navigate the complexities of the Michigan Renunciation of Legacy process effectively. By doing so, individuals can make informed decisions regarding their inheritance and ensure their wishes align with their long-term financial and personal goals.

Michigan Renunciation of Legacy

Description

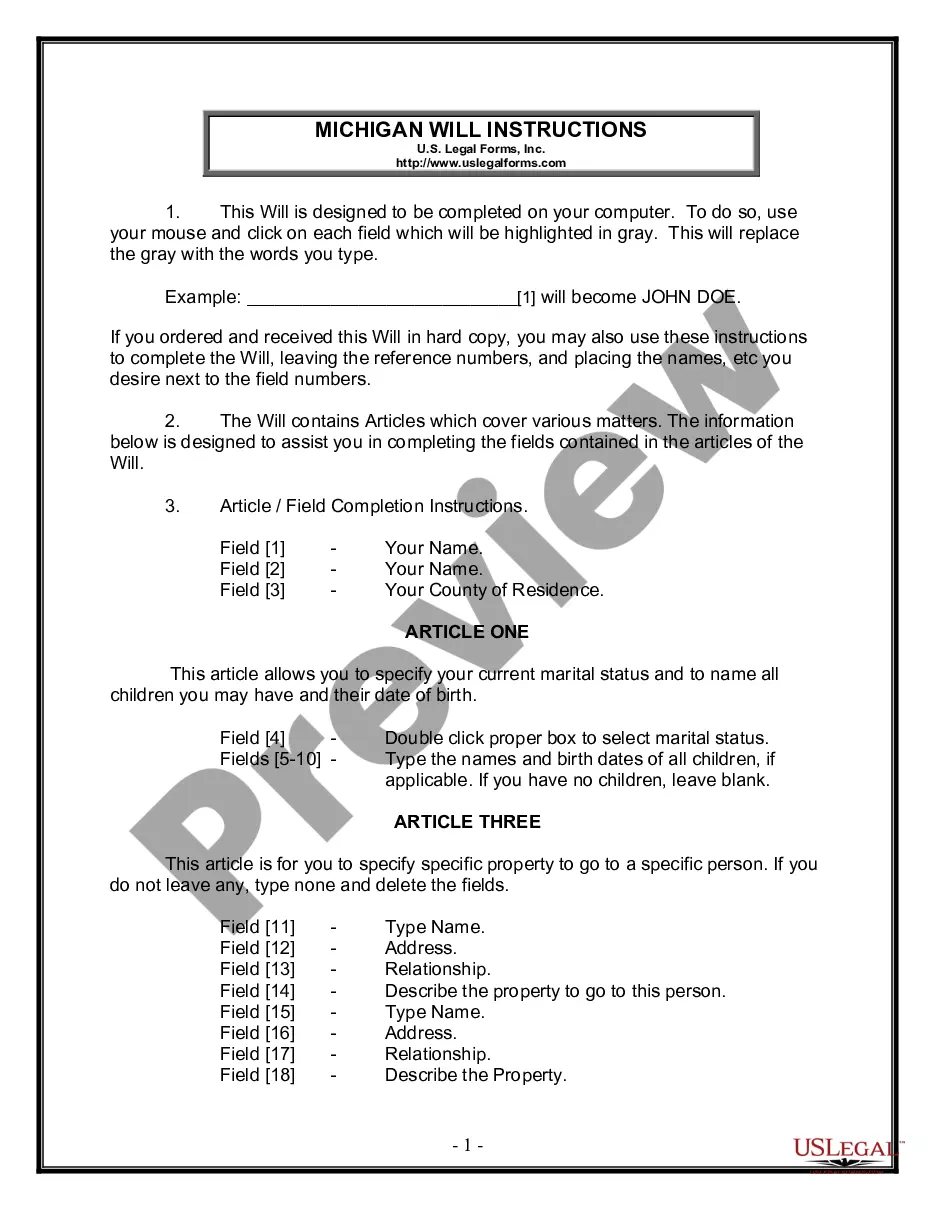

How to fill out Michigan Renunciation Of Legacy?

US Legal Forms - one of many biggest libraries of legitimate forms in the States - delivers a wide array of legitimate record themes you may download or printing. Utilizing the web site, you will get a large number of forms for enterprise and individual reasons, sorted by groups, claims, or keywords and phrases.You will find the newest versions of forms like the Michigan Renunciation of Legacy in seconds.

If you already possess a subscription, log in and download Michigan Renunciation of Legacy from the US Legal Forms library. The Down load key can look on each and every type you view. You gain access to all previously acquired forms from the My Forms tab of the bank account.

If you would like use US Legal Forms the first time, here are straightforward guidelines to get you started out:

- Be sure to have chosen the right type for the city/state. Select the Review key to examine the form`s articles. Read the type description to ensure that you have chosen the right type.

- When the type doesn`t fit your specifications, make use of the Look for field towards the top of the display to obtain the one which does.

- In case you are content with the form, confirm your choice by visiting the Buy now key. Then, select the prices strategy you prefer and give your credentials to register to have an bank account.

- Procedure the transaction. Use your bank card or PayPal bank account to finish the transaction.

- Find the formatting and download the form on the gadget.

- Make changes. Fill out, change and printing and indication the acquired Michigan Renunciation of Legacy.

Each format you put into your account lacks an expiration day which is your own property permanently. So, if you would like download or printing another backup, just go to the My Forms segment and click around the type you require.

Gain access to the Michigan Renunciation of Legacy with US Legal Forms, one of the most considerable library of legitimate record themes. Use a large number of skilled and condition-specific themes that satisfy your organization or individual requirements and specifications.

Form popularity

FAQ

MI Form PC 567, which may also referred to as Renunciation Of Right To Appointment, Nomination Of Personal Representative And Waiver Of Notice, is a probate form in Michigan. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

A claim that arises at or after the death of the decedent is barred unless it is presented within the following time limits: For a claim based on a contract with the personal representative, within 4 months after the performance by the personal representative is due.

In order to get a Letter of Authority, you must open a Probate Estate and petition the Probate Court to become the Estate's Personal Representative. Once the court appoints you as the Personal Representative, you will be issued your Letter of Authority.

(1) An interested person may petition for removal of a personal representative for cause at any time. Upon filing of the petition, the court shall fix a time and place for hearing. The petitioner shall give notice to the personal representative and to other persons as the court orders.

Letters of Authority are the legal document signed by the probate court stating that the Personal Representative is the legal representative of the estate and authorized to sign on behalf of the estate.

A Letter of Authority (LOA) is a legal document that authorises a third party to correspond with service providers on behalf of you and your business.

How to file Form PC 572 Step 1 - Download the correct Michigan form based on the name and ID if applicable. ... Step 2 - Complete the Document. ... Step 3 - Have Form PC 572 witnessed or notarized (if required) ... Step 4 - Submit Letters Of Authority For Personal Representative to the relevant office.

This document gives the Executor the authority he or she will need to formally act on behalf of the decedent. It gives the right to handle financial and other affairs related to closing out the estate.