Michigan Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust refers to a legal process involving the revocation or termination of a Granter Retained Annuity Trust (GREAT) in the state of Michigan. This termination is done in favor of an existing Life Insurance Trust, which allows the granter to potentially pass on their assets to beneficiaries while minimizing estate taxes. A Granter Retained Annuity Trust (GREAT) is an estate planning tool that allows an individual (the granter) to transfer assets, such as real estate, cash, or securities, into an irrevocable trust. The granter retains an annuity payment for a specified period, usually a number of years, while any remaining assets pass to the trust beneficiaries at the end of the term. In Michigan, there are different types of Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust. These include: 1. GREAT Termination by the Granter: The granter has the option to terminate the GREAT if they decide they want a change in their estate planning strategy. By terminating the GREAT, the granter can redirect the assets into an existing Life Insurance Trust, thereby altering the intended asset distribution. 2. GREAT Termination due to Death of the Granter: If the granter passes away during the term of the GREAT, the trust may terminate, and the assets remaining in the trust are distributed to the Life Insurance Trust as specified in the original trust agreement. The Life Insurance Trust would then continue with its purpose of providing financial protection to the beneficiaries through the life insurance policy. 3. GREAT Termination by Mutual Agreement: In some cases, the beneficiaries of the GREAT and the existing Life Insurance Trust may mutually agree to terminate the GREAT and transfer the remaining assets to the Life Insurance Trust. This could occur if all parties involved believe it would be more beneficial for the assets to be held in the Life Insurance Trust rather than in the GREAT. 4. GREAT Termination for Estate Tax Planning Purposes: The termination of a GREAT may be done strategically for estate tax planning purposes. If there have been changes in tax laws or the granter's financial circumstances, it may be advantageous to terminate the GREAT and transfer the assets to an existing Life Insurance Trust to minimize estate taxes and maximize the assets passing on to beneficiaries. In summary, the Michigan Termination of Granter Retained Annuity Trust in Favor of Existing Life Insurance Trust refers to the revocation or termination of a GREAT in favor of an existing Life Insurance Trust. There are various reasons and circumstances that may lead to this termination, including changes in estate planning strategies, the death of the granter, mutual agreement among beneficiaries, or for estate tax planning purposes. By terminating the GREAT and transferring assets to the Life Insurance Trust, the granter can ensure the efficient distribution of their assets and potentially minimize estate taxes.

Michigan Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

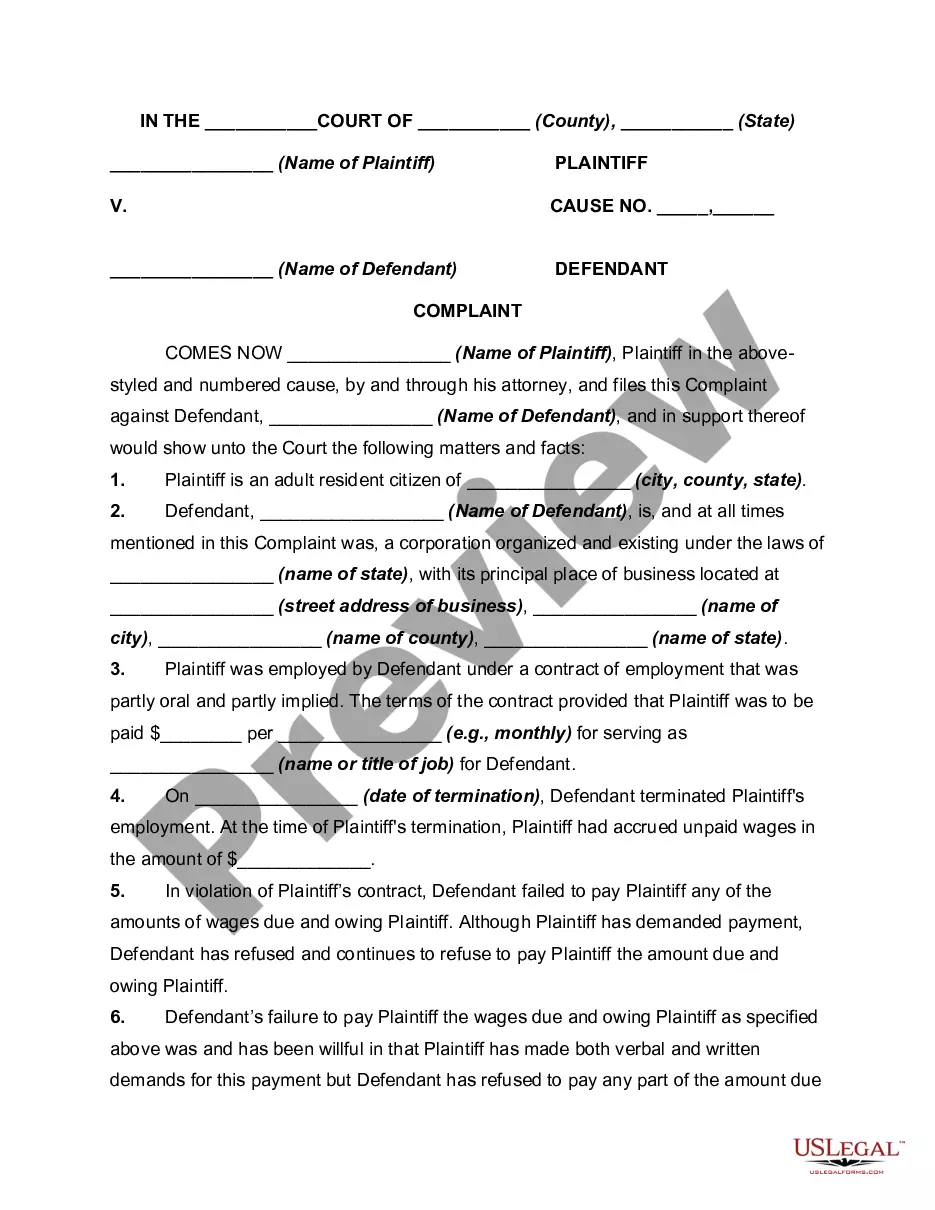

How to fill out Michigan Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

Choosing the best authorized papers web template could be a battle. Of course, there are a variety of templates available on the net, but how can you obtain the authorized develop you need? Make use of the US Legal Forms site. The support provides 1000s of templates, including the Michigan Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, which you can use for business and private requires. Each of the varieties are inspected by specialists and meet up with state and federal needs.

In case you are already listed, log in for your account and then click the Obtain switch to get the Michigan Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust. Make use of account to check through the authorized varieties you have purchased previously. Check out the My Forms tab of the account and get an additional version of the papers you need.

In case you are a whole new customer of US Legal Forms, allow me to share basic recommendations that you should comply with:

- Very first, ensure you have selected the right develop for your personal metropolis/state. It is possible to look over the form utilizing the Review switch and look at the form information to guarantee this is the right one for you.

- In the event the develop will not meet up with your needs, utilize the Seach field to get the appropriate develop.

- Once you are sure that the form would work, select the Buy now switch to get the develop.

- Pick the costs program you desire and enter the needed details. Create your account and pay for the order utilizing your PayPal account or bank card.

- Opt for the data file formatting and obtain the authorized papers web template for your product.

- Complete, change and print out and indicator the received Michigan Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

US Legal Forms will be the most significant library of authorized varieties in which you can see a variety of papers templates. Make use of the company to obtain skillfully-created paperwork that comply with status needs.

Form popularity

FAQ

A grantor retained annuity trust is a type of irrevocable gifting trust that allows a grantor or trustmaker to potentially pass a significant amount of wealth to the next generation with little or no gift tax cost. GRATs are established for a specific number of years.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

If the grantor does not survive the term, the GRAT will fail, but again no assets are lostthey will simply be included in the grantor's taxable estate.

GRATs may provide payments for a term of years or for the life of the Grantor.

To implement this strategy, you zero out the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

When a GRAT is created, you also set the term, or lifetime, of the trust. Once the term expires, the remaining assets transfer to your beneficiaries. However, if you pass away before the term expires, then all assets in the trust revert back to you and are included in your taxable estate.

The minimum duration for a GRAT is two years, and that is a very popular choice for many clients. But longer GRATs are also common, and some clients decide to establish GRATs that last 3, 5 or 10 years. The choice of an optimal GRAT term is driven by several factors.

Thus, the trustee cannot terminate the GRAT before expiration of the term of the grantor's qualified interest by distributing to the grantor and the remainder beneficiaries the actuarial value of their term and remainder interests, respectively.