Subject: Comprehensive Michigan Sample Letter for Closing of Estate with Breakdown of Assets and Expenses Dear [Executor/Administrator's Name], We hope this letter finds you well. As the [Attorney/Executor/Administrator] overseeing the estate settlement process for the late [Deceased's Name], we are writing to provide you with a detailed breakdown of the assets and expenses associated with the estate's closing. Michigan Sample Letter for Closing of Estate: [Note: Depending on the specific circumstances, you may choose one or more of the following types of letters to address in your content.] 1. Michigan Sample Letter for Closing of Estate — Simple: This letter is suitable when the estate has a simple asset structure and minimal expenses involved. It covers the essential components required for closing the estate competently. 2. Michigan Sample Letter for Closing of Estate — Complex: This letter is designed for situations where the estate has intricate asset classifications or various investments, businesses, real estate, or other complex holdings. It provides a more comprehensive breakdown of assets and expenses, ensuring a meticulous closure. Now, let's dive into the key elements typically included in a Michigan Sample Letter for Closing of Estate with Breakdown of Assets and Expenses: 1. Introduction: Begin with a formal salutation and state your role as an attorney, executor, or administrator. Express your condolences for the loss and emphasize your dedication to handling the estate matters efficiently. 2. Overview of the Estate: Provide a concise summary of the estate, including the deceased's full name and date of death, along with any pertinent identification numbers, such as tax identification or estate file numbers. Briefly mention the purpose of the letter, i.e., to provide detailed information regarding the estate's assets and expenses to facilitate its closing. 3. Asset Inventory: List all the significant assets held by the decedent at the time of their passing. Be as thorough as possible, including real estate, vehicles, bank and investment accounts, life insurance policies, retirement accounts, stocks, bonds, businesses, and any other valuable assets. Specify the value of each item, if known or estimated. 4. Outstanding Debts and Liabilities: Document any outstanding liabilities or debts associated with the estate, such as mortgages, loans, credit card debts, medical bills, taxes owed, or any other financial obligations. Clearly outline the amounts owed, account numbers, and whom the debts are payable to. 5. Executor/Administrator Fees and Expenses: Break down the fees and expenses incurred during the settlement process. This may include legal fees, executor fees, court filing fees, appraisal costs, accounting fees, and any other relevant expenses. Ensure each item is labeled correctly, and provide the associated costs. 6. Distribution Plan: State whether the estate will be distributed according to the provisions outlined in the decedent's will or, in the case of intestacy, according to Michigan state laws. If applicable, describe how the assets have been divided among the beneficiaries or provide an estimation of each beneficiary's share. 7. Final Approval and Closing Steps: Address any final procedures required to close the estate. Explain the need for approval from beneficiaries or creditors, if applicable, and provide instructions on the necessary documentation to conclude the settlement process successfully. 8. Contact Information: Conclude the letter by reaffirming your willingness to answer any questions or concerns from the executor/administrator, beneficiaries, or creditors. Include your contact details, such as phone number, email address, and office address, for easy communication. Please note that this content is intended as a general guideline and should be tailored to the specific circumstances of each estate. Always seek professional legal advice when drafting and finalizing such letters. We trust that this Michigan Sample Letter for Closing of Estate with Breakdown of Assets and Expenses will be useful to you throughout the estate administration process. If you require any further assistance or have specific inquiries, please do not hesitate to contact us. Sincerely, [Your Name] [Your Title] [Law Firm/Organization Name]

Michigan Sample Letter for Closing of Estate with Breakdown of Assets and Expenses

Description

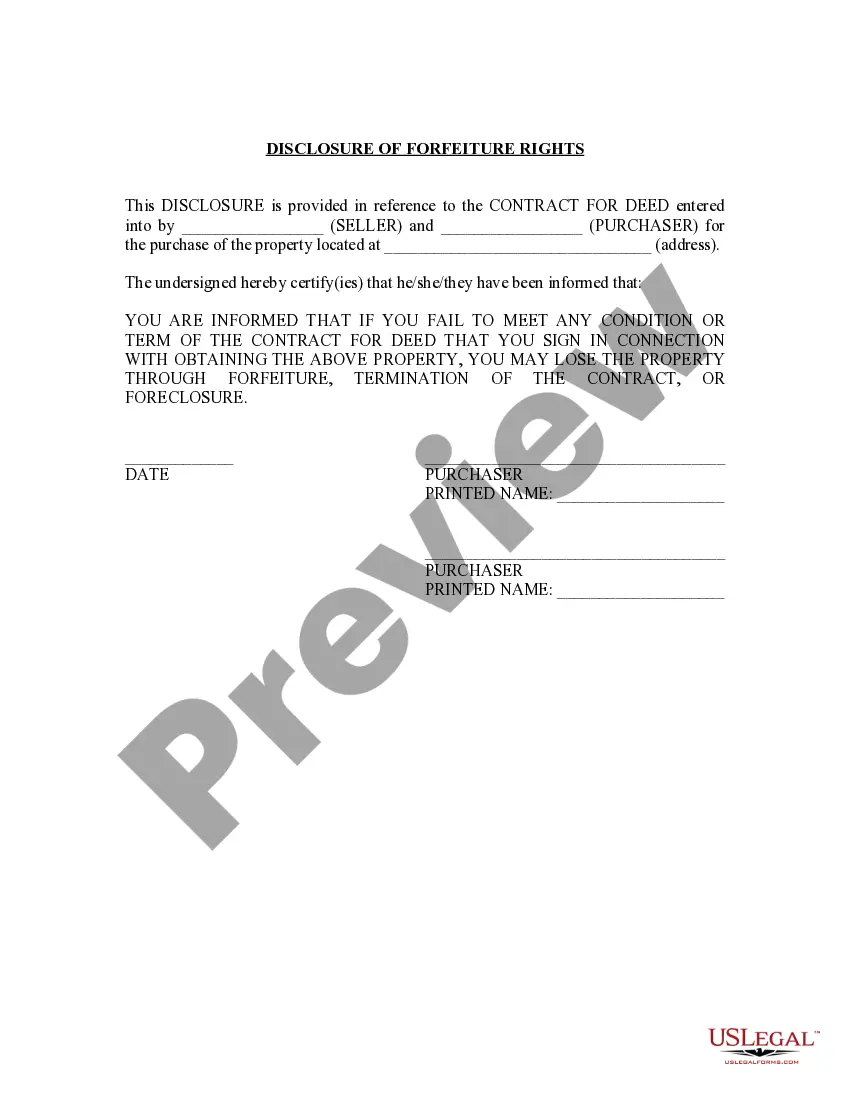

How to fill out Sample Letter For Closing Of Estate With Breakdown Of Assets And Expenses?

US Legal Forms - one of several greatest libraries of authorized forms in the United States - provides a wide range of authorized papers templates it is possible to acquire or print. Utilizing the internet site, you may get a large number of forms for company and individual uses, sorted by categories, claims, or keywords.You can find the latest variations of forms much like the Michigan Sample Letter for Closing of Estate with Breakdown of Assets and Expenses in seconds.

If you currently have a membership, log in and acquire Michigan Sample Letter for Closing of Estate with Breakdown of Assets and Expenses from the US Legal Forms catalogue. The Down load option will appear on each and every develop you look at. You have accessibility to all previously saved forms in the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, listed below are straightforward instructions to help you started off:

- Be sure to have picked out the correct develop to your town/area. Click on the Review option to examine the form`s information. Browse the develop information to actually have chosen the proper develop.

- When the develop does not match your specifications, use the Search industry towards the top of the display screen to obtain the one who does.

- In case you are satisfied with the form, verify your decision by visiting the Acquire now option. Then, select the prices program you want and offer your accreditations to register on an accounts.

- Procedure the financial transaction. Make use of bank card or PayPal accounts to accomplish the financial transaction.

- Pick the structure and acquire the form on your system.

- Make adjustments. Fill out, edit and print and indicator the saved Michigan Sample Letter for Closing of Estate with Breakdown of Assets and Expenses.

Each format you included with your account lacks an expiration day and is also yours eternally. So, in order to acquire or print yet another duplicate, just check out the My Forms segment and then click around the develop you want.

Get access to the Michigan Sample Letter for Closing of Estate with Breakdown of Assets and Expenses with US Legal Forms, one of the most considerable catalogue of authorized papers templates. Use a large number of expert and state-particular templates that satisfy your organization or individual requirements and specifications.

Form popularity

FAQ

An estate in unsupervised administration can be closed by filing a ?Sworn Statement to Close Unsupervised Administration? (PC591), or a ?Petition for Adjudication of Testacy and Complete Estate Settlement? (PC594), or a ?Petition for Complete Estate Settlement, Testacy Previously Adjudicated? (PC593).

In the State of Michigan, probate is necessary when someone passes away while owning property or assets that are listed under their name alone. If the deceased individual has joint ownership over certain property, it's possible the assets may be transferred to the other owner with little to no court involvement.

Although Michigan does not stipulate a legal timeframe, filing a probate petition as soon as possible will be in everybody's best interests. The probate process takes a minimum of five months in Michigan, but most probate cases take between six months and a full year. In contested cases, probate may take far longer.

If the estate is not settled within a year of the first personal representative's appointment, file a Notice of Continued Administration with the court stating why the estate must remain open. A copy of this notice must be given to all interested persons.

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs. What determines how long a Trustee takes will depend on the complexity of the estate where properties and other assets may have to be bought or sold before distribution to the Beneficiaries.

Affidavit of Decedent's Successor for Delivery of Certain Assets Owned by Decedent (PC 598) may be used to affirm the following: More than 28 days have passed since the death of the decedent. The estate does not include real property.

Closing the Estate The estate must be open for at least five months. Required notice to creditors must be published at least four months before closing.

Seeking Legal Recourse If you believe that the executor is not living up to their duties, you have two legal options: petition the court or file a civil lawsuit.