Title: Understanding Michigan Sample Letter for Attempt to Collect Debt before Acceleration Keywords: Michigan debt collection laws, Michigan sample letters, debt acceleration, debt collection process, collection agency, consumer rights, debt repayment Introduction: Michigan residents who find themselves struggling with debt may encounter debt collection efforts by creditors or collection agencies. In such cases, it is essential to understand the debt collection process and the corresponding legal protections provided by the state. This article aims to outline the significance of a Michigan Sample Letter for Attempt to Collect Debt before Acceleration, its purpose, and the various types available. 1. Overview of Debt Collection Laws in Michigan: Michigan has specific regulations and laws in place to protect consumers from abusive or unfair debt collection practices. Understanding these laws can empower individuals dealing with debt and help them exercise their rights effectively. 2. What is a Sample Letter for Attempt to Collect Debt before Acceleration? A Sample Letter for Attempt to Collect Debt before Acceleration is a written communication sent by a creditor or a collection agency to a debtor who has fallen behind on payment obligations. This letter serves as notification of the outstanding debt and provides the debtor with an opportunity to address the issue before the debt is accelerated or further collection actions are pursued. 3. The Purpose of the Letter: The primary purpose of the Michigan Sample Letter for Attempt to Collect Debt before Acceleration is to formally notify the debtor of: a. The existence of the debt. b. The total amount owed. c. The steps required to resolve the debt. d. The timeframe within which the debtor must respond. e. The consequences of non-payment or failure to respond. 4. Different Types of Michigan Sample Letters for Attempt to Collect Debt before Acceleration: While specific templates may vary, the following are common variations of the Michigan Sample Letter for Attempt to Collect Debt before Acceleration: a. Initial Attempt Letter: Sent as an initial communication to inform the debtor of the outstanding debt and provide an opportunity to address it before acceleration or further collection actions occur. b. Follow-up Letter: Sent if the debtor fails to respond to the initial attempt letter, emphasizing the urgency of the matter and resending the original information. c. Payment Reminder Letter: Sent when an initial attempt is made, but the debtor fails to respond or make payment as agreed. d. Past Due Notice: Sent to inform debtors that their payment is past due and urging prompt payment or communication. 5. Consumer Rights and Protections: Michigan law safeguards debtor rights during the debt collection process. Debtors have the right to request verification of the debt, dispute the debt's validity, or request that the collection agency cease communication. Understanding these rights is crucial to handling debt collection efforts properly. Conclusion: Michigan's Sample Letter for Attempt to Collect Debt before Acceleration serves as a transparent communication tool between creditors or collection agencies and debtors. Debtors facing financial hardships should be aware of their rights and obligations while utilizing these letters to address their debts. Consulting a legal professional or utilizing relevant sample letters can help individuals approach debt repayment in an informed and efficient manner, while safeguarding their consumer rights.

Michigan Sample Letter for Attempt to Collect Debt before Acceleration

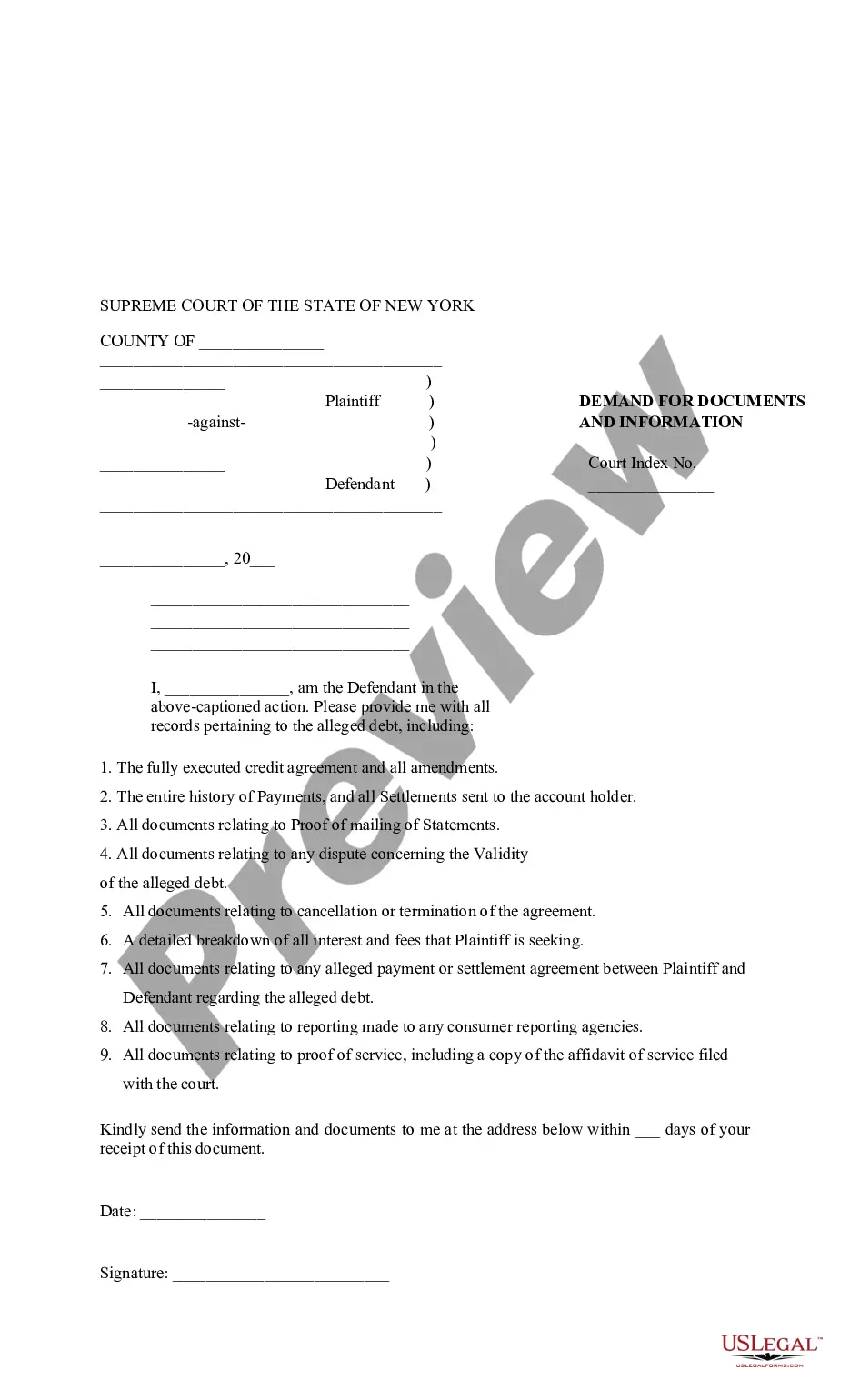

Description

How to fill out Michigan Sample Letter For Attempt To Collect Debt Before Acceleration?

You are able to invest hrs on the Internet attempting to find the authorized papers template that suits the federal and state needs you want. US Legal Forms gives a huge number of authorized kinds which can be examined by specialists. It is simple to download or print out the Michigan Sample Letter for Attempt to Collect Debt before Acceleration from my support.

If you have a US Legal Forms account, you are able to log in and click on the Download switch. Next, you are able to total, modify, print out, or indicator the Michigan Sample Letter for Attempt to Collect Debt before Acceleration. Each and every authorized papers template you buy is the one you have forever. To get an additional copy of the bought type, go to the My Forms tab and click on the related switch.

If you work with the US Legal Forms website for the first time, follow the simple instructions under:

- Initial, make certain you have selected the right papers template for your county/town of your choice. See the type description to ensure you have chosen the appropriate type. If available, make use of the Review switch to search throughout the papers template also.

- If you would like get an additional model of the type, make use of the Lookup discipline to discover the template that meets your needs and needs.

- Once you have identified the template you would like, just click Acquire now to continue.

- Choose the prices program you would like, enter your credentials, and sign up for a merchant account on US Legal Forms.

- Total the deal. You can use your Visa or Mastercard or PayPal account to fund the authorized type.

- Choose the format of the papers and download it to the gadget.

- Make alterations to the papers if possible. You are able to total, modify and indicator and print out Michigan Sample Letter for Attempt to Collect Debt before Acceleration.

Download and print out a huge number of papers web templates using the US Legal Forms website, that provides the greatest variety of authorized kinds. Use expert and state-particular web templates to handle your organization or individual requires.

Form popularity

FAQ

If you get a letter saying you owe money on a debt you don't recognise, or which you thought you had paid off, you need to challenge the creditor to prove that you do owe the money. Sometimes debt collectors have simply got the wrong person.

I am therefore asking you to consider writing off my debt as I can see no way of ever repaying it. If you are unable to agree to this, please explain your reasons. Thank you for your help and I look forward to hearing from you.

Once you have sent the letter, you may receive a response telling you that they have traced the debt to you. You can disregard this, as they need to provide proof, which should be the original credit agreement with your signature.

If you receive a notice from a debt collector, it's important to respond as soon as possible?even if you do not owe the debt?because otherwise the collector may continue trying to collect the debt, report negative information to credit reporting companies, and even sue you.

Dear Sir/Madam: I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it.

Formal legal proceedings being taken against you If you continually ignore the debt collection attempts, Lowell Solicitors or its clients may take legal action and seek a County Court Judgement (CCJ) against you.

Include your full name, company name, and mailing address. Address the letter to your client by their full name. State the problem: Specify and provide proof of the debt in question. Reference the original contract or agreement that states the services the client owes you for.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.