The Michigan Partnership Agreement for Investment Club is a legally binding document that outlines the terms and conditions for individuals or entities looking to form an investment club in the state of Michigan. This agreement allows individuals to pool their financial resources and invest collectively in various securities and other investment opportunities. Key elements included in the Michigan Partnership Agreement for Investment Club may include: 1. Purpose: The agreement will clearly define the purpose of the investment club, whether it is focused on long-term growth, income generation, or a combination of both. It will also specify the types of investments the club will consider, such as stocks, bonds, mutual funds, real estate, or other investment vehicles. 2. Membership: The document will outline the eligibility requirements for individuals or entities to become members of the investment club. It may specify the minimum age, financial contribution, or other criteria that potential members must meet. Additionally, it may establish processes for admitting new members or removing existing members from the club. 3. Contributions: The agreement will describe how contributions to the investment club will be made and tracked. This may include specifying the frequency and amount of contributions, as well as outlining any restrictions or obligations members must adhere to in terms of their financial commitments. 4. Governance: The partnership agreement will establish the governance structure of the investment club, including the roles and responsibilities of members, officers, and any committees that may be formed. It may also outline rules regarding decision-making processes, voting rights, and the distribution of profits or losses among club members. 5. Meetings: The partnership agreement will detail the frequency, location, and format of meetings held by the investment club. It may also provide procedures for calling special meetings, documenting meeting minutes, and setting the agenda for discussions. 6. Dissolution: The agreement should address circumstances under which the investment club may be dissolved. This could include consensus among the members, expiration of a predetermined time period, or other specified events. Provisions regarding the distribution of assets and liabilities upon dissolution should also be included. Different types of Michigan Partnership Agreements for Investment Clubs may include: 1. General Partnership Agreement: This is the most common type of partnership agreement where all members have equal rights, responsibilities, and liability for the club's actions and decisions. 2. Limited Partnership Agreement: In this type of agreement, there are general partners who have management control and unlimited liability, while limited partners contribute capital but have limited liability and minimal involvement in the club's operations. 3. Limited Liability Partnership Agreement: This agreement provides limited liability protection to all partners and is often chosen to shield individual members from personal financial losses incurred by the investment club. 4. Limited Liability Company (LLC) Partnership Agreement: This type of agreement establishes the investment club as an LLC, providing limited liability protection to its members while offering flexibility in management and structure. These various types of partnership agreements offer different levels of liability protection and flexibility, allowing investment club members in Michigan to choose the agreement that best suits their needs and preferences. It is always advisable to consult with legal professionals or financial advisors specializing in investment clubs to ensure compliance with state laws and regulations.

Michigan Partnership Agreement for Investment Club

Description

How to fill out Michigan Partnership Agreement For Investment Club?

You can commit several hours on the Internet looking for the legal document format that fits the federal and state specifications you require. US Legal Forms offers a huge number of legal kinds that happen to be examined by professionals. You can actually down load or print out the Michigan Partnership Agreement for Investment Club from my assistance.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Download key. Next, it is possible to comprehensive, revise, print out, or indicator the Michigan Partnership Agreement for Investment Club. Each legal document format you get is the one you have eternally. To obtain an additional backup for any bought type, go to the My Forms tab and then click the related key.

If you use the US Legal Forms site for the first time, keep to the easy instructions listed below:

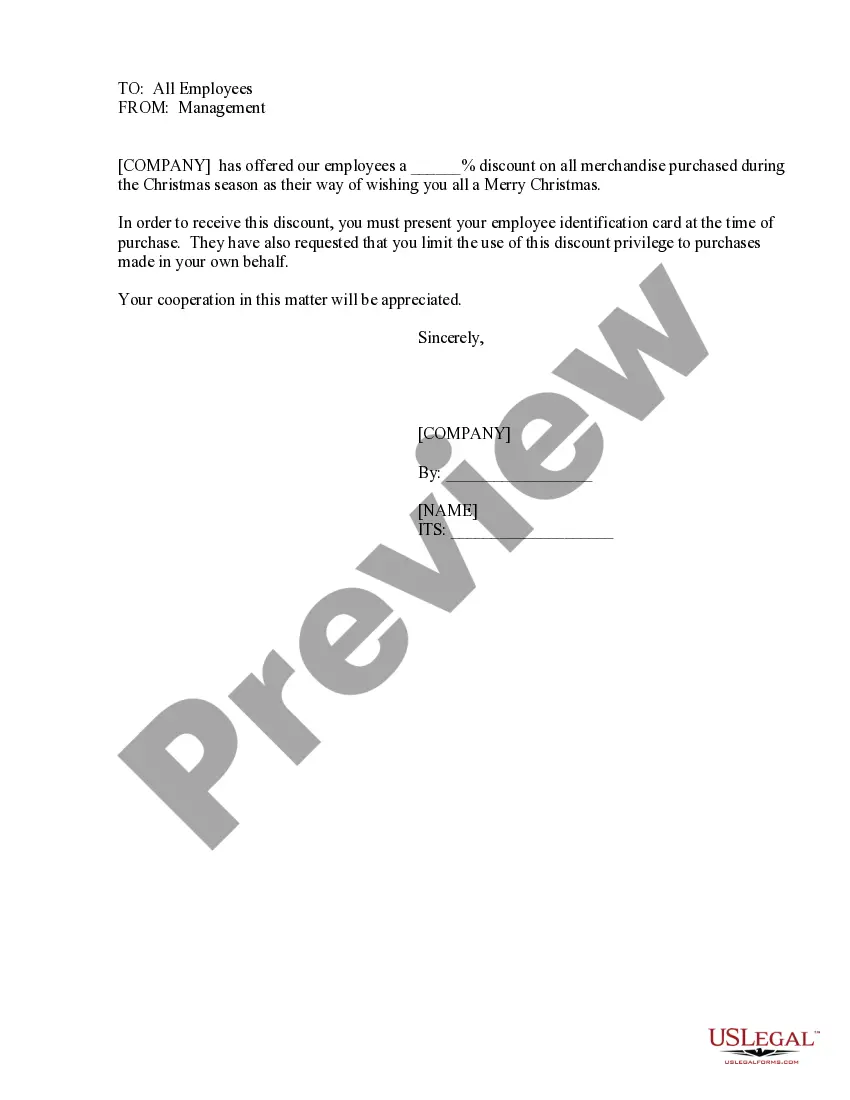

- Initial, ensure that you have selected the best document format for that county/metropolis of your choosing. Look at the type outline to ensure you have picked out the right type. If accessible, take advantage of the Preview key to check from the document format at the same time.

- If you wish to discover an additional version in the type, take advantage of the Research discipline to find the format that suits you and specifications.

- Upon having discovered the format you need, click on Buy now to carry on.

- Choose the pricing program you need, enter your references, and register for your account on US Legal Forms.

- Full the purchase. You can use your charge card or PayPal bank account to purchase the legal type.

- Choose the file format in the document and down load it to your system.

- Make changes to your document if possible. You can comprehensive, revise and indicator and print out Michigan Partnership Agreement for Investment Club.

Download and print out a huge number of document templates making use of the US Legal Forms site, that offers the largest selection of legal kinds. Use skilled and status-certain templates to tackle your organization or personal needs.