The Michigan LLC Operating Agreement for Two Partners is a legal document that outlines the rights, responsibilities, and obligations of the two partners in a limited liability company (LLC) in the state of Michigan. This agreement is crucial for establishing a clear framework for operating the LLC and protecting the interests of both partners. The agreement typically begins with basic information such as the names and addresses of the partners, followed by the purpose of the LLC and the activities it will engage in. It also includes details regarding the initial contributions made by each partner, such as capital, property, or services, which help determine their ownership percentage in the company. To ensure that both partners can effectively manage the business, the agreement usually outlines their management rights and responsibilities. This section discusses decision-making authority, voting rights, and the procedures for holding meetings and making important business choices. It may also specify if any special approvals or unanimous consent is required for certain actions. Another key aspect covered in the operating agreement is the allocation of profits and losses between the partners. This involves outlining how the profits and losses will be distributed among the partners based on their ownership percentage. It may also address how additional capital contributions can be made and how they would impact the partnership. The agreement may also address the issue of partner withdrawal, which outlines the process for a partner to leave the LLC, sell their interest, retire, or even pass away. It may also include provisions for the transfer of ownership interests, buyout agreements, and non-compete clauses to protect the LLC's interests in case of partner separation. In Michigan, there are different types of LLC operating agreements for two partners, depending on the nature of their partnership and the specific requirements they might have. Some common types include: 1. Standard Michigan LLC Operating Agreement for Two Partners: This is a typical agreement that covers the fundamental aspects mentioned above and is suitable for most LCS. 2. Michigan LLC Operating Agreement with Special Allocations: This agreement allows partners to allocate profits and losses in a way that doesn't strictly follow their ownership percentage. Instead, partners have the flexibility to distribute profits and losses based on certain agreed-upon criteria, such as the value of services provided or the level of involvement in the company. 3. Joint Venture Michigan LLC Operating Agreement for Two Partners: This agreement is ideal when two partners come together for a specific project or venture, rather than forming a long-term partnership. It addresses aspects such as the scope of work, duration of the partnership, and how profits and losses will be shared during the joint venture. In summary, the Michigan LLC Operating Agreement for Two Partners is a crucial legal document that outlines the responsibilities and expectations of both partners in an LLC. It covers aspects such as ownership, management, profit-sharing, partner withdrawal, and other important provisions. Different types of operating agreements exist to cater to the specific needs of the partners, including the standard agreement, special allocation agreement, and joint venture agreement.

Llc Operating Agreement Michigan Template

Description

How to fill out Michigan LLC Operating Agreement For Two Partners?

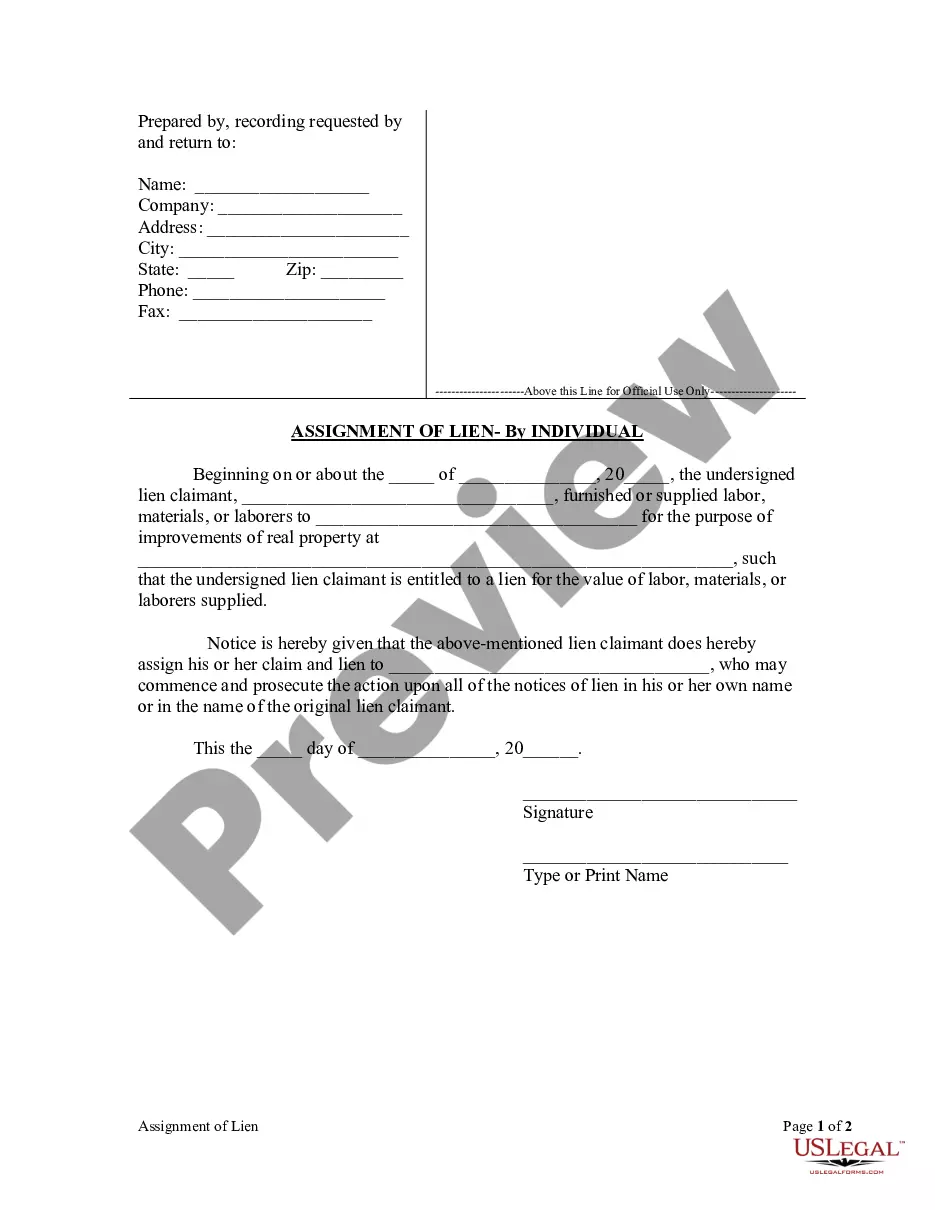

Are you currently inside a placement in which you need paperwork for possibly enterprise or specific reasons almost every working day? There are a variety of legal record themes available on the Internet, but finding kinds you can rely on isn`t simple. US Legal Forms offers 1000s of type themes, like the Michigan LLC Operating Agreement for Two Partners, which are published to fulfill federal and state specifications.

In case you are already familiar with US Legal Forms site and also have a free account, just log in. Next, it is possible to down load the Michigan LLC Operating Agreement for Two Partners design.

Should you not come with an accounts and would like to begin using US Legal Forms, follow these steps:

- Discover the type you want and make sure it is for that right town/region.

- Use the Review key to review the shape.

- Browse the explanation to ensure that you have selected the right type.

- If the type isn`t what you are trying to find, make use of the Lookup field to obtain the type that meets your requirements and specifications.

- If you obtain the right type, click Get now.

- Select the rates strategy you would like, complete the desired info to produce your bank account, and pay for the order with your PayPal or bank card.

- Select a convenient document structure and down load your duplicate.

Locate each of the record themes you might have bought in the My Forms food selection. You can aquire a more duplicate of Michigan LLC Operating Agreement for Two Partners at any time, if needed. Just click on the essential type to down load or print out the record design.

Use US Legal Forms, one of the most extensive assortment of legal varieties, to save time and prevent errors. The assistance offers expertly created legal record themes which can be used for an array of reasons. Create a free account on US Legal Forms and commence generating your daily life easier.

Form popularity

FAQ

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

Generally speaking, the process for how to add an LLC member involves amending the LLC's operating agreement that brings in the new member. Current LLC members must then vote on the amendment for it to passand most states, as well as many LLC operating agreements, require unanimous approval.

To make amendments to your Michigan limited liability company, file a Certificate of Amendment to the Articles of Organization with the Michigan Department of Licensing and Regulatory Affairs (LARA). Use of LARA forms is optional. Make sure you include the required information if you choose to draft your own documents.

How to Form an LLC in Michigan (6 steps)Step 1 Choose Registered Agent.Step 2 Which Type.Step 3 Attach the Filing Fee.Step 4 Submit your Application.Step 5 Operating Agreement (optional)Step 6 Employer Identification Number (EIN)

This agreement can be implied, written, or oral. If you're formingor have formedan LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

A Michigan LLC operating agreement is a legal document that is used by managing, contributing members of an entity or by a sole proprietor who wishes to establish their policies and procedures to file with the State.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

Follow these steps for a smooth process when you add an owner to an LLC.Understand the Consequences.Review Your Operating Agreement.Decide on the Specifics.Prepare and Vote on an Amendment to Add Owner to LLC.Amend the Articles of Organization (if Necessary)File any Required Tax Forms.

An LLC operating agreement is not required by the state of Michigan, but it is highly recommended. The agreement is an internal document that establishes how you will run your LLC.

Basic Steps to Form a Multi-Member LLCChoose a business name.Apply for an EIN (Employer Identification Number).File your LLC's articles of organization.Create an operating agreement.Apply for the necessary business licenses and permits.Open a separate bank account for your business.27 Sept 2017