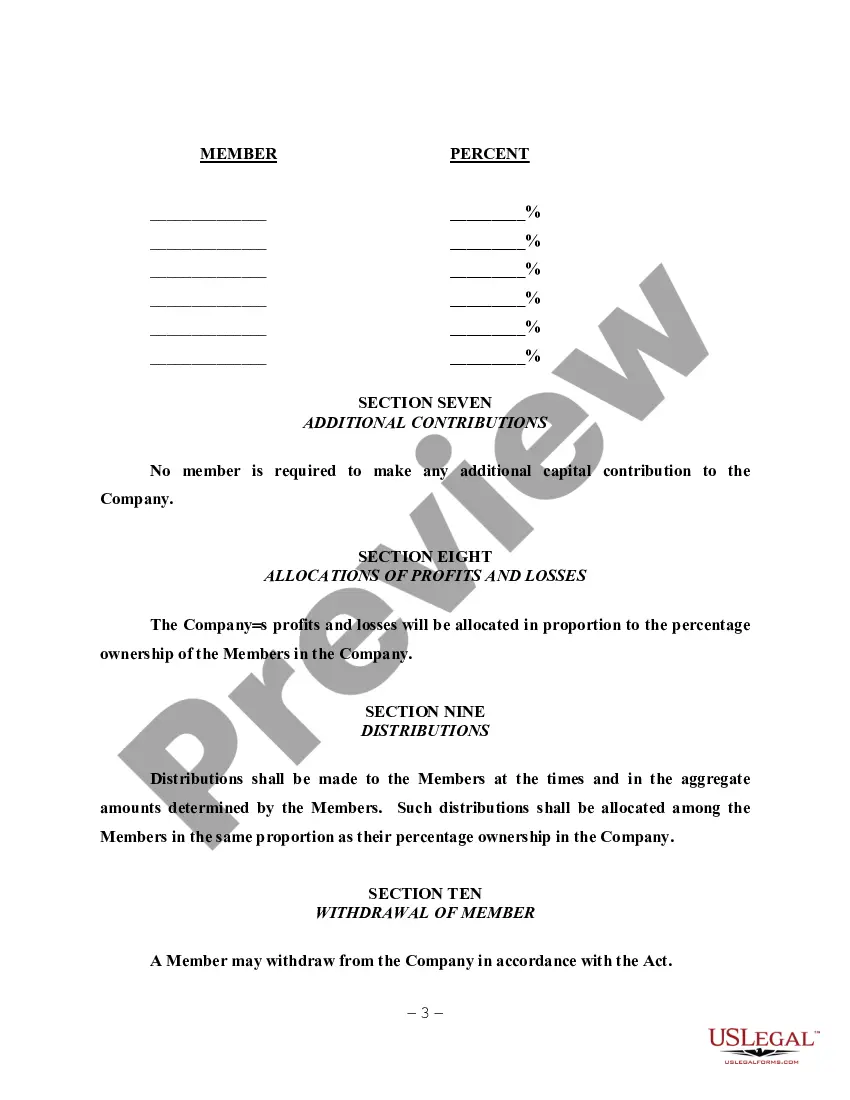

Title: Exploring Michigan Sample LLC Operating Agreements: A Comprehensive Guide Introduction: In the realm of business, limited liability companies (LCS) have become a popular choice for entrepreneurs, providing liability protection while offering flexibility in management and taxation. This article aims to delve into the Michigan Sample LLC Operating Agreement, presenting a detailed description and shedding light on any variations or types available. 1. Understanding the Michigan LLC Operating Agreement: The Michigan LLC Operating Agreement is a legally binding document that outlines the rights, responsibilities, and obligations of LLC members. It addresses various aspects, including member management, profit distribution, voting rights, capital contributions, dispute resolutions, dissolution procedures, and more. 2. Key Components of the Michigan Sample LLC Operating Agreement: a. Member Details: An operating agreement typically includes the names and addresses of LLC members, their respective ownership percentages, and their roles within the company. b. Member Contributions: This section outlines the capital contributions made by the members, such as cash, property, or services, and how those contributions impact ownership percentages and distributions. c. Management Structure: The operating agreement determines the management structure of the LLC, whether it is member-managed or manager-managed. It defines the decision-making powers and responsibilities of each member or manager. d. Profit Distribution: This section outlines how profits and losses will be distributed among members, including sharing ratios and provisions for reinvestment or residual distribution. e. Voting Rights: The agreement establishes the voting rights of LLC members, covering major decisions, such as approving amendments, admitting new members, or dissolving the business. f. Dispute Resolution: In cases of conflicts or disagreements, this section outlines the process for resolving disputes, such as mediation, arbitration, or litigation. g. Dissolution and Termination: The Michigan LLC operating agreement addresses circumstances that may lead to dissolution, providing guidelines for the distribution of remaining assets and liabilities. 3. Types of Michigan Sample LLC Operating Agreements: While the core components remain similar, Michigan offers flexibility in drafting LLC operating agreements to reflect unique requirements. Variations may include: a. Single-Member LLC Operating Agreement: Specifically designed for a single member LLC, it identifies the sole member's ownership rights, management responsibilities, and compensation structure. b. Multi-Member LLC Operating Agreement: Suitable when multiple members are involved, it outlines the distribution of ownership, voting rights, and procedures for admitting or removing members. c. Series LLC Operating Agreement: A series LLC is a unique structure in Michigan that allows the creation of individual series or subclass. Each series can have separate assets, liabilities, and members, requiring an operating agreement for each series. Conclusion: The Michigan Sample LLC Operating Agreement serves as a crucial document for LCS, defining the framework for member relations, management, and operations. Understanding its components and potential variations can empower entrepreneurs to tailor their agreements according to their specific business needs.

Title: Exploring Michigan Sample LLC Operating Agreements: A Comprehensive Guide Introduction: In the realm of business, limited liability companies (LCS) have become a popular choice for entrepreneurs, providing liability protection while offering flexibility in management and taxation. This article aims to delve into the Michigan Sample LLC Operating Agreement, presenting a detailed description and shedding light on any variations or types available. 1. Understanding the Michigan LLC Operating Agreement: The Michigan LLC Operating Agreement is a legally binding document that outlines the rights, responsibilities, and obligations of LLC members. It addresses various aspects, including member management, profit distribution, voting rights, capital contributions, dispute resolutions, dissolution procedures, and more. 2. Key Components of the Michigan Sample LLC Operating Agreement: a. Member Details: An operating agreement typically includes the names and addresses of LLC members, their respective ownership percentages, and their roles within the company. b. Member Contributions: This section outlines the capital contributions made by the members, such as cash, property, or services, and how those contributions impact ownership percentages and distributions. c. Management Structure: The operating agreement determines the management structure of the LLC, whether it is member-managed or manager-managed. It defines the decision-making powers and responsibilities of each member or manager. d. Profit Distribution: This section outlines how profits and losses will be distributed among members, including sharing ratios and provisions for reinvestment or residual distribution. e. Voting Rights: The agreement establishes the voting rights of LLC members, covering major decisions, such as approving amendments, admitting new members, or dissolving the business. f. Dispute Resolution: In cases of conflicts or disagreements, this section outlines the process for resolving disputes, such as mediation, arbitration, or litigation. g. Dissolution and Termination: The Michigan LLC operating agreement addresses circumstances that may lead to dissolution, providing guidelines for the distribution of remaining assets and liabilities. 3. Types of Michigan Sample LLC Operating Agreements: While the core components remain similar, Michigan offers flexibility in drafting LLC operating agreements to reflect unique requirements. Variations may include: a. Single-Member LLC Operating Agreement: Specifically designed for a single member LLC, it identifies the sole member's ownership rights, management responsibilities, and compensation structure. b. Multi-Member LLC Operating Agreement: Suitable when multiple members are involved, it outlines the distribution of ownership, voting rights, and procedures for admitting or removing members. c. Series LLC Operating Agreement: A series LLC is a unique structure in Michigan that allows the creation of individual series or subclass. Each series can have separate assets, liabilities, and members, requiring an operating agreement for each series. Conclusion: The Michigan Sample LLC Operating Agreement serves as a crucial document for LCS, defining the framework for member relations, management, and operations. Understanding its components and potential variations can empower entrepreneurs to tailor their agreements according to their specific business needs.