Title: Michigan Sample Letter for Organization Audit Form: Comprehensive Guide and Types Explained Introduction: In Michigan, conducting a thorough organization audit is crucial for ensuring compliance with various laws and regulations. To aid organizations in this process, the Michigan Department of Treasury provides sample letters that facilitate communication between auditors and organizations. This article will delve into the detailed description of the Michigan Sample Letter for Organization Audit Form, highlighting its purpose, format, and possible types. Key Points: 1. Purpose of the Michigan Sample Letter for Organization Audit Form: — The primary purpose of the form is to initiate the audit process and notify the organization about the examination of their financial records. — It aims to establish proper communication, provide instructions, and request required documents and information from the organization. — The letter also outlines the relevant laws and obligations the organization must adhere to during the audit. 2. Format and Structure: — The form follows a professional and formal tone, ensuring clarity and specificity in its content. — It typically includes a header with relevant agency names, addresses, and contact information. — The body of the letter consists of distinct sections, including an introduction, purpose statement, timeline, document request list, and concluding instructions. — Each section is carefully tailored to convey specific information and indicate the organization's responsibilities. 3. Types of Michigan Sample Letter for Organization Audit Forms: a. General Organization Audit Form: — This type of letter is commonly used for auditing organizations that are subject to general tax laws and regulations in Michigan. — It covers a wide range of requirements, including income tax, sales tax, payroll tax, etc. — The document request list associated with this form may include financial statements, ledgers, bank statements, payroll records, and other relevant documents. b. Specialized Organization Audit Form: — Certain industries or organizations might require specialized audits to comply with industry-specific laws and regulations. — For instance, nonprofits and charitable organizations may receive a specialized audit form addressing tax exemptions, donation records, and compliance with state-specific regulations. — This type of form targets organizations with unique reporting obligations, ensuring their audit aligns with specific legal requirements. Conclusion: Obtaining and utilizing the Michigan Sample Letter for Organization Audit Form is essential for organizations in Michigan to facilitate the smooth communication and documentation process during audits. By understanding the detailed description and various types of these forms, organizations can better prepare themselves for a comprehensive audit that adheres to Michigan's tax laws and regulatory requirements.

Michigan Sample Letter for Organization Audit Form

Description

How to fill out Michigan Sample Letter For Organization Audit Form?

Choosing the best legitimate record web template might be a struggle. Obviously, there are tons of web templates available on the net, but how do you discover the legitimate form you will need? Use the US Legal Forms internet site. The support gives 1000s of web templates, for example the Michigan Sample Letter for Organization Audit Form, that can be used for company and personal demands. All the types are checked out by specialists and satisfy state and federal demands.

When you are presently listed, log in to your bank account and then click the Down load option to get the Michigan Sample Letter for Organization Audit Form. Utilize your bank account to appear with the legitimate types you possess purchased in the past. Go to the My Forms tab of your bank account and have one more copy of your record you will need.

When you are a whole new end user of US Legal Forms, allow me to share straightforward directions that you can stick to:

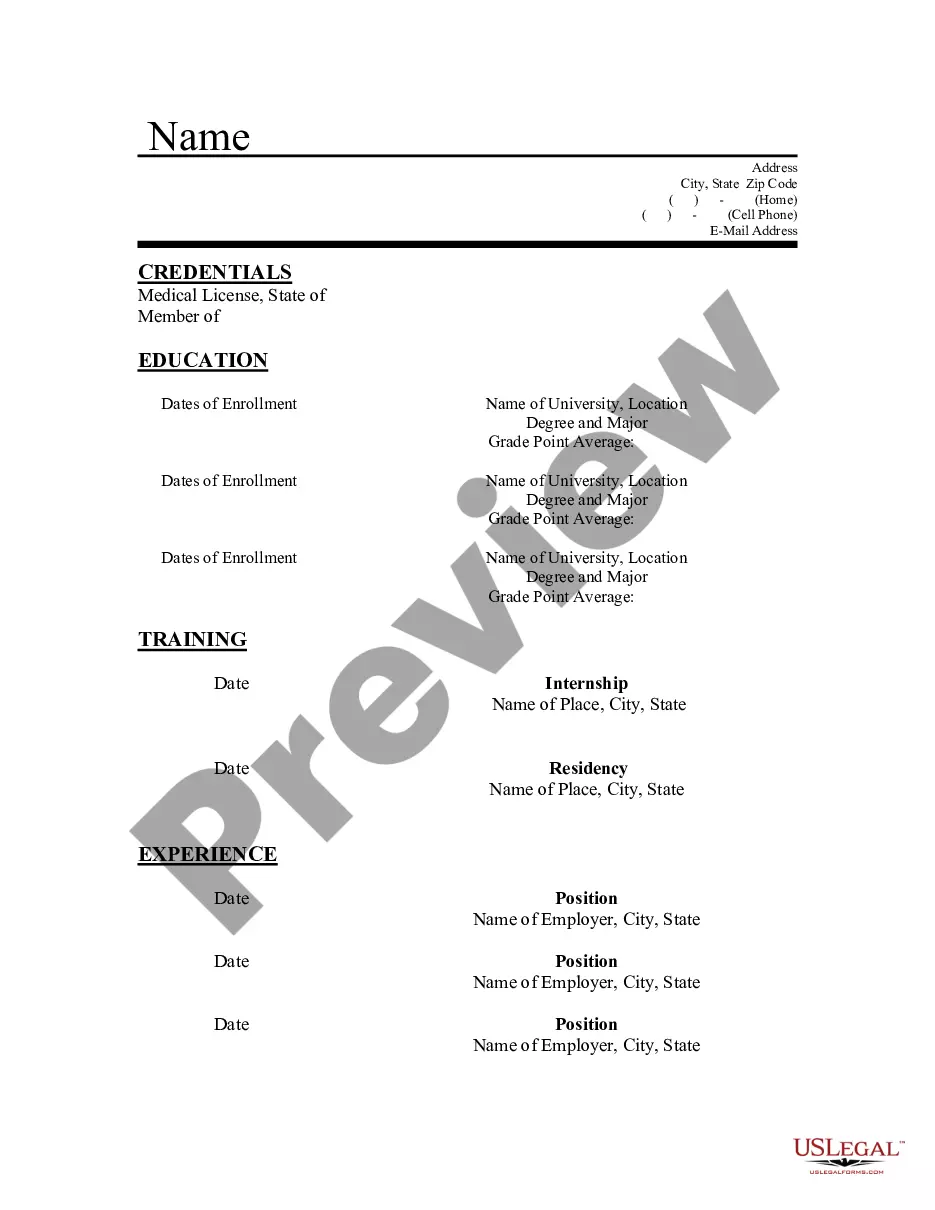

- Very first, be sure you have chosen the correct form for your personal area/state. You are able to check out the shape using the Preview option and study the shape outline to make certain it is the best for you.

- When the form is not going to satisfy your needs, utilize the Seach industry to get the right form.

- Once you are certain that the shape is acceptable, go through the Buy now option to get the form.

- Opt for the prices plan you want and type in the needed information and facts. Build your bank account and pay for an order utilizing your PayPal bank account or bank card.

- Opt for the document format and download the legitimate record web template to your system.

- Full, modify and print and indicator the received Michigan Sample Letter for Organization Audit Form.

US Legal Forms is definitely the largest library of legitimate types that you can see numerous record web templates. Use the service to download skillfully-produced files that stick to state demands.