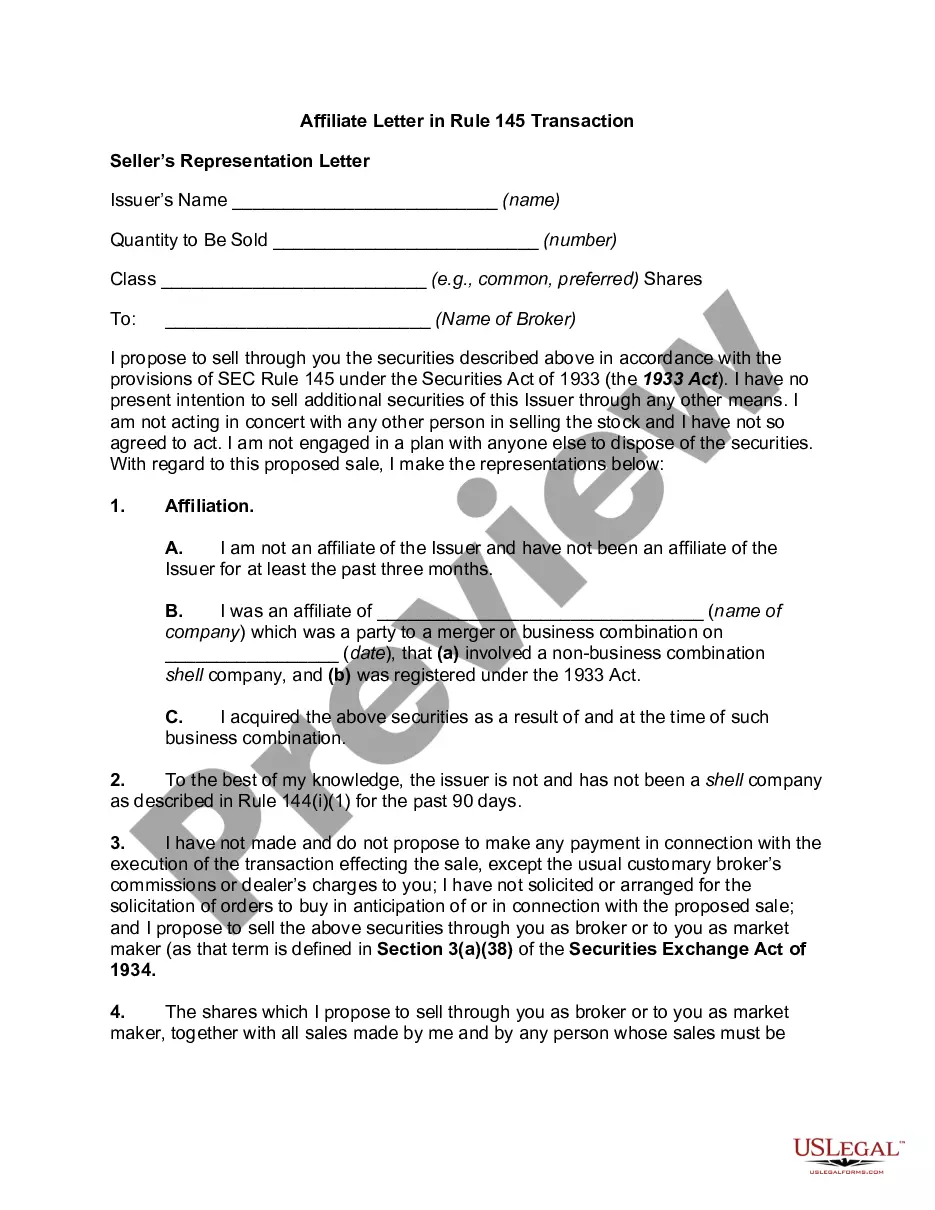

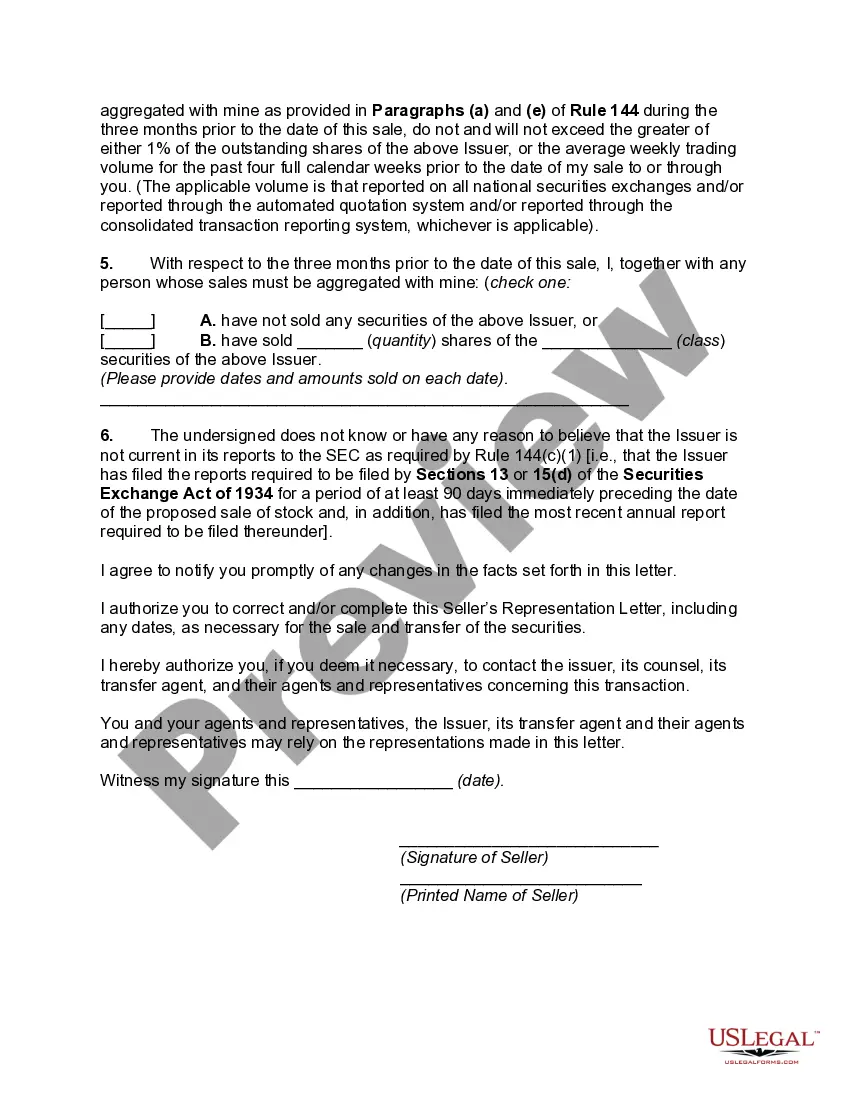

The Michigan Affiliate Letter in Rule 145 Transaction is an important document that is required to be filed under certain circumstances during a corporate transaction governed by Rule 145 of the Securities Act. This rule pertains to the reclassification of securities, mergers, consolidations, and other similar transactions involving affiliates of the company. When a Michigan corporation is involved in a Rule 145 Transaction, it must comply with the requirements outlined by the Michigan Department of Licensing and Regulatory Affairs (LARA). One of these requirements is the submission of an Affiliate Letter, also known as an Affiliate Statement or Affiliation Certification, which provides detailed information about the affiliates involved in the transaction. The Michigan Affiliate Letter is intended to ensure transparency and protect the interests of shareholders during corporate transactions. By disclosing the affiliations between different parties, potential conflicts of interest can be identified and addressed appropriately. The content of the Michigan Affiliate Letter may vary depending on the specific circumstances of the transaction. However, it typically includes important information such as: 1. Identification of the parties involved: The letter should clearly identify the corporation initiating the transaction and any affiliated companies that are participating. 2. Description of the transaction: A comprehensive explanation of the nature of the transaction, including whether it involves a merger, reclassification, consolidation, or other similar action. 3. Affiliation details: The letter should list all affiliates involved in the transaction, including their names, addresses, and the nature of their relationship with the corporation. This information allows regulators and shareholders to understand any potential conflicts of interest. 4. Shareholder details: A summary of the number and class of shares held by each affiliate should be included. This helps determine the impact of the transaction on individual shareholders and ensures compliance with securities regulations. 5. Legal representations and certifications: Affiliates participating in the transaction may need to provide legal representations or certifications, affirming that they meet the necessary regulatory requirements and that the information provided in the letter is accurate and complete. 6. Signature and notarization: The Michigan Affiliate Letter must be signed by an authorized representative of the corporation and notarized to validate its authenticity. It is important to note that there may be different variations or subtypes of the Michigan Affiliate Letter in Rule 145 Transactions, depending on the specific transaction and circumstances involved. These variations might include specific requirements or additional information requested by LARA, or modifications due to the unique nature of the corporate transaction being undertaken. In conclusion, the Michigan Affiliate Letter is a crucial document in Rule 145 Transactions, ensuring transparency and compliance with regulations governing corporate transactions. By providing detailed information about affiliates, potential conflicts of interest can be addressed, protecting the interests of shareholders and promoting fair dealings in the business community.

Michigan Affiliate Letter in Rule 145 Transaction

Description

How to fill out Michigan Affiliate Letter In Rule 145 Transaction?

If you have to total, obtain, or produce legal document layouts, use US Legal Forms, the biggest selection of legal varieties, which can be found on-line. Make use of the site`s easy and convenient search to find the documents you need. A variety of layouts for enterprise and individual functions are categorized by groups and says, or keywords. Use US Legal Forms to find the Michigan Affiliate Letter in Rule 145 Transaction in a number of click throughs.

If you are already a US Legal Forms buyer, log in in your profile and click on the Obtain option to obtain the Michigan Affiliate Letter in Rule 145 Transaction. Also you can access varieties you in the past acquired inside the My Forms tab of your respective profile.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have selected the shape for your right area/country.

- Step 2. Take advantage of the Preview choice to look over the form`s information. Do not overlook to read the information.

- Step 3. If you are unsatisfied with the type, make use of the Search discipline near the top of the display screen to get other models of the legal type format.

- Step 4. Upon having identified the shape you need, select the Buy now option. Pick the pricing prepare you favor and include your credentials to register on an profile.

- Step 5. Method the purchase. You can utilize your bank card or PayPal profile to complete the purchase.

- Step 6. Pick the formatting of the legal type and obtain it in your device.

- Step 7. Full, change and produce or indicator the Michigan Affiliate Letter in Rule 145 Transaction.

Each and every legal document format you acquire is your own eternally. You have acces to each and every type you acquired with your acccount. Click the My Forms section and select a type to produce or obtain again.

Compete and obtain, and produce the Michigan Affiliate Letter in Rule 145 Transaction with US Legal Forms. There are many specialist and express-certain varieties you can utilize for your personal enterprise or individual demands.

Form popularity

FAQ

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.

Rule 144(a)(3) identifies what sales produce restricted securities. Control securities are those held by an affiliate of the issuing company. An affiliate is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144 at (a)(1) defines an affiliate of an issuing company as a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

Rule 144 provides an exemption and permits the public resale of restricted or control securities if a number of conditions are met, including how long the securities are held, the way in which they are sold, and the amount that can be sold at any one time.

Counsel delivering an opinion as part of a Rule 144 sale typically relies on, among other things, a representation letter from the seller to establish certain facts underlying the opinion, and the seller's broker and the issuer's transfer agent may require a similar representation letter.

Rule 145 is an SEC rule that allows companies to sell certain securities without first having to register the securities with the SEC. This specifically refers to stocks that an investor has received because of a merger, acquisition, or reclassification.

Rule 147, as amended, has the following requirements: the company must be organized in the state where it offers and sells securities. the company must have its principal place of business in-state and satisfy at least one doing business requirement that demonstrates the in-state nature of the company's business.

The term affiliate is defined in Rule 405 under the Act as a person that directly, or indirectly through one or more intermediaries, controls, is controlled by, or is under common control with, an issuer.