Michigan Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

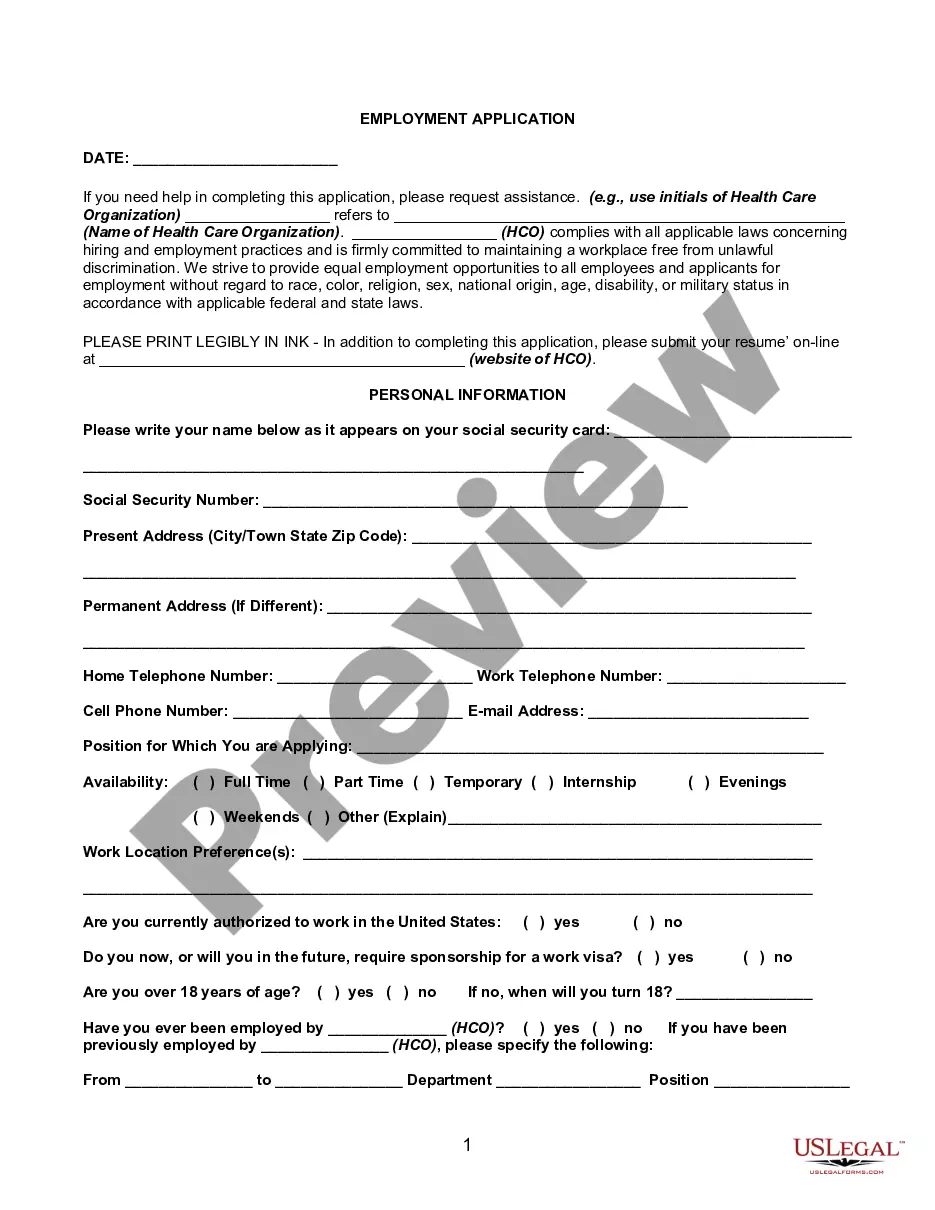

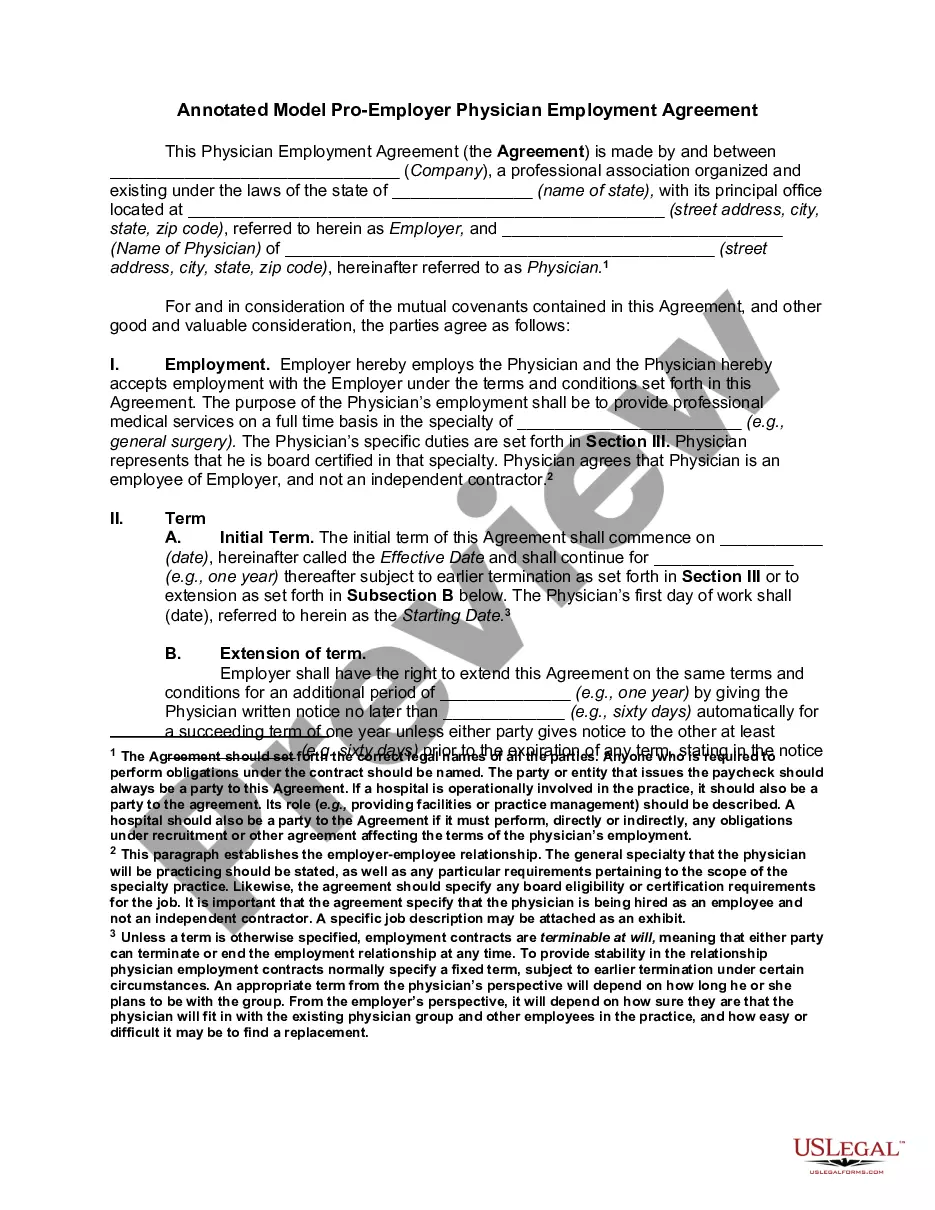

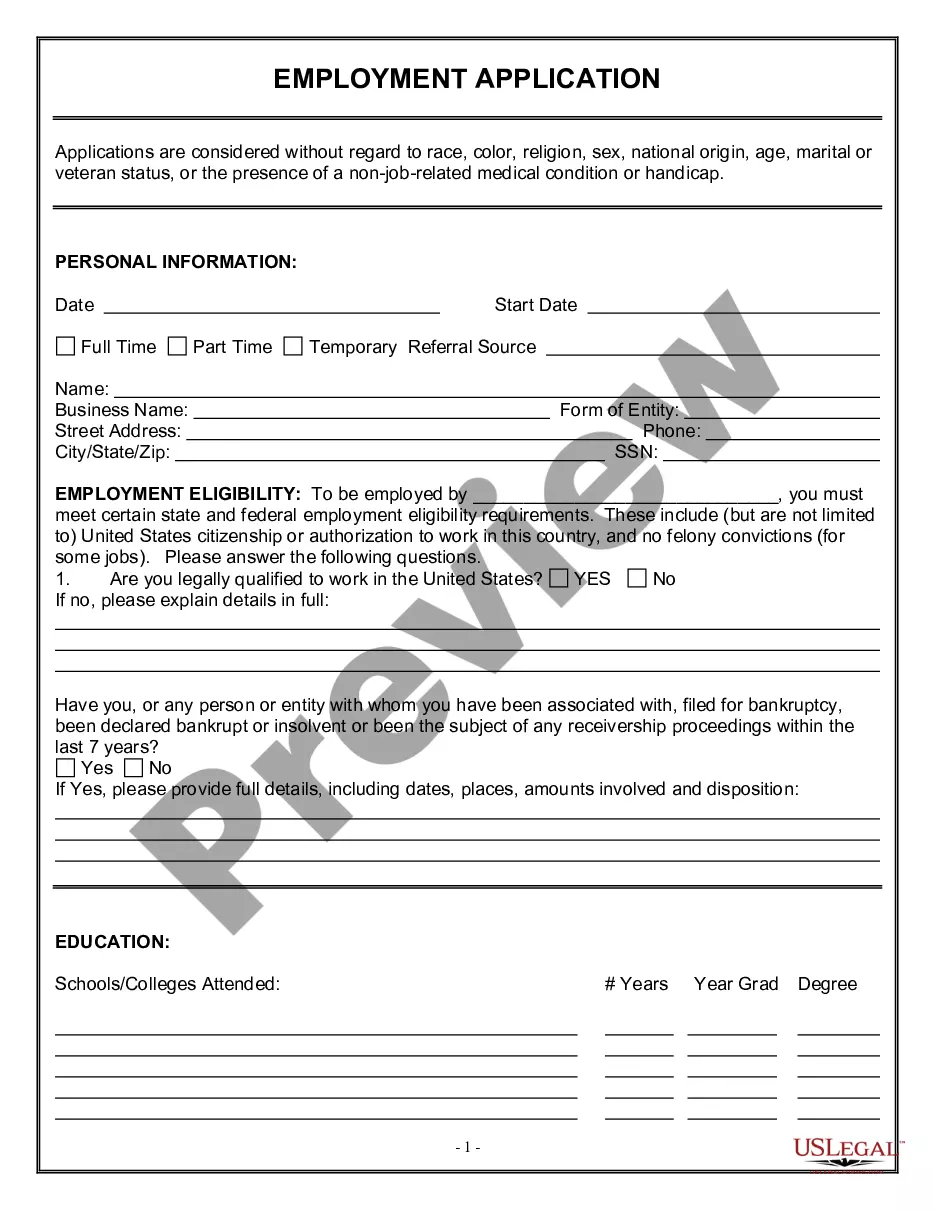

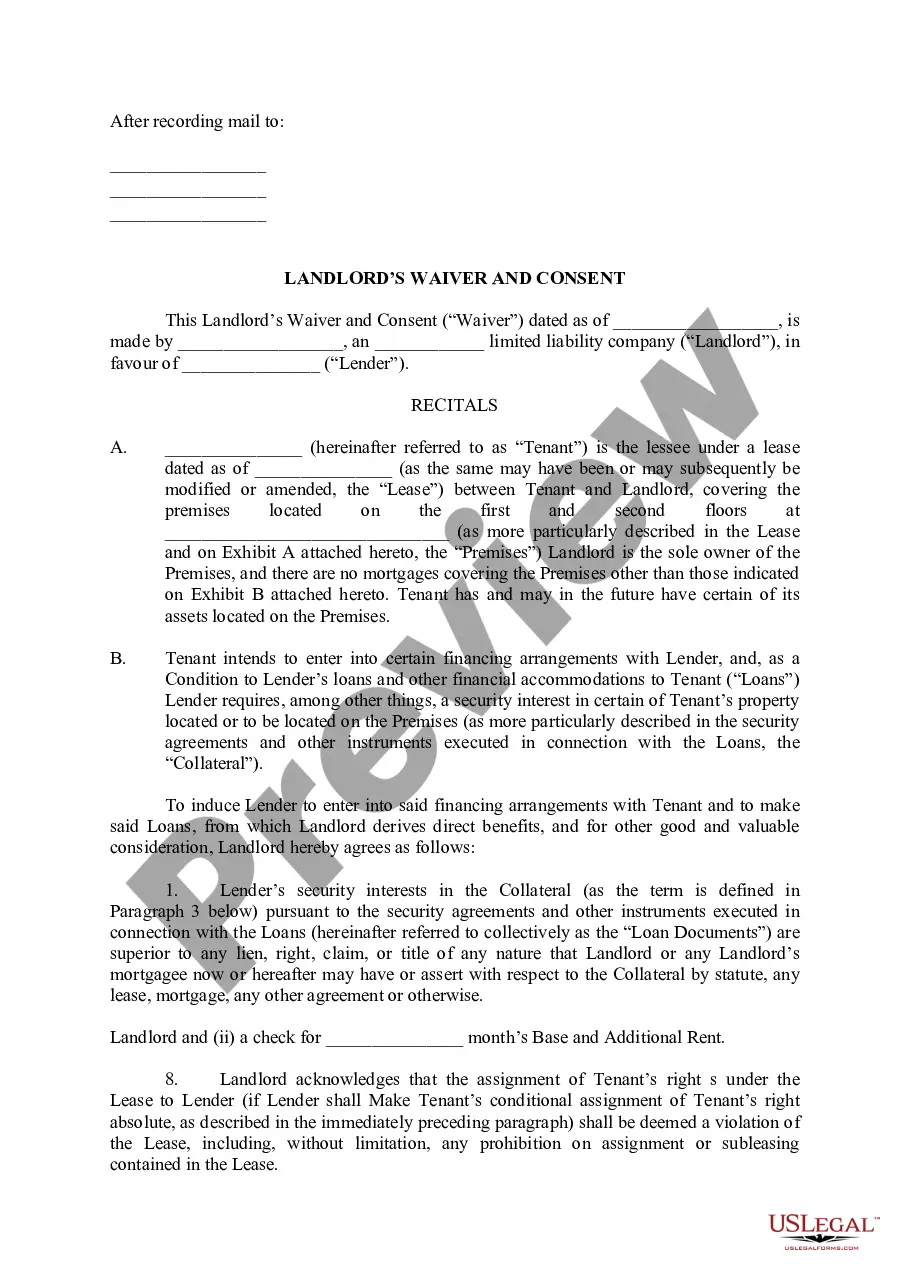

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

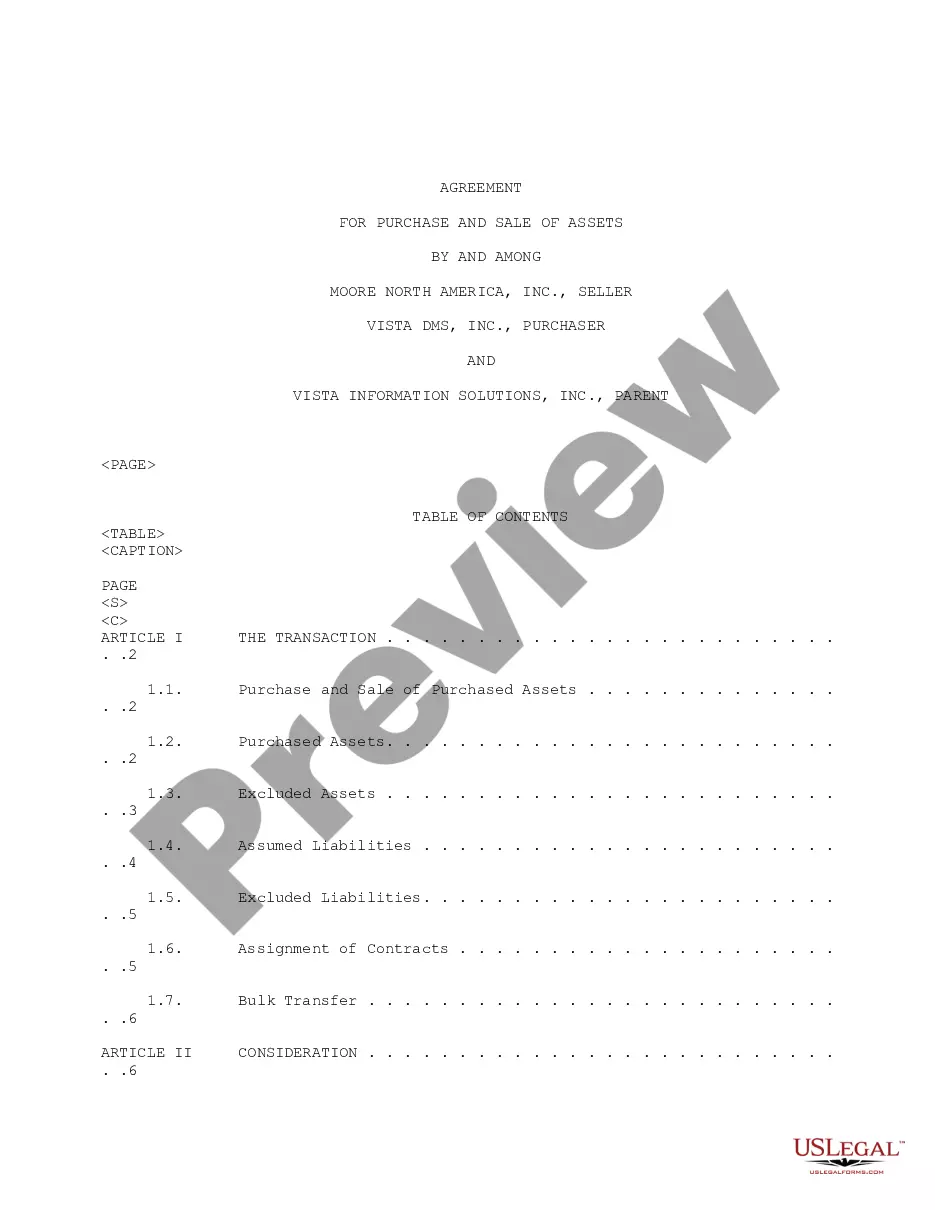

US Legal Forms - one of many most significant libraries of lawful varieties in the States - provides an array of lawful record themes you can down load or print out. While using website, you will get thousands of varieties for company and individual purposes, sorted by groups, suggests, or search phrases.You can find the latest models of varieties just like the Michigan Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code in seconds.

If you already possess a registration, log in and down load Michigan Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code in the US Legal Forms catalogue. The Obtain option will show up on each kind you see. You have access to all formerly delivered electronically varieties within the My Forms tab of the bank account.

If you wish to use US Legal Forms the first time, here are basic recommendations to help you get began:

- Make sure you have chosen the best kind for the city/region. Go through the Review option to examine the form`s content. Look at the kind description to ensure that you have chosen the appropriate kind.

- When the kind doesn`t fit your requirements, take advantage of the Search field at the top of the display screen to obtain the one who does.

- When you are content with the form, validate your choice by visiting the Get now option. Then, pick the rates prepare you want and provide your references to register for the bank account.

- Procedure the deal. Utilize your bank card or PayPal bank account to perform the deal.

- Choose the format and down load the form on the device.

- Make changes. Load, revise and print out and sign the delivered electronically Michigan Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

Each and every design you included in your bank account lacks an expiry time and is your own permanently. So, in order to down load or print out an additional backup, just proceed to the My Forms portion and click about the kind you require.

Get access to the Michigan Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code with US Legal Forms, the most considerable catalogue of lawful record themes. Use thousands of expert and express-particular themes that meet up with your business or individual requirements and requirements.

Form popularity

FAQ

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test. Common stock does not include securities convertible into common stock, nor common stock convertible into other securities.

1244, losses on the sale or worthlessness of stock in certain C and S corporations are treated, to a certain extent, as ordinary losses. Because LLCs are not corporations under Federal tax law and because they do not issue stock, they have nothing comparable to Sec. 1244 stock.

Section 1244 of the Internal Revenue Code allows eligible shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than a capital loss. Eligible investors include individuals, partnerships and LLCs taxed as partnerships.

1244 losses are allowed for NOL purposes without being limited by nonbusiness income. An annual limitation is imposed on the amount of Sec. 1244 ordinary loss that is deductible. The maximum deductible loss is $50,000 per year ($100,000 if a joint return is filed) (Sec.

To qualify under Section 1244, these five requirements must be adhered to:The stock must be acquired in exchange for cash or property contributed to the corporation.The corporation must issue the stock directly to the investors.The corporation must be an actual, operating company.More items...?

The determination of whether stock qualifies as Section 1244 stock is made at the time of issuance. Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test.

Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test.

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...