Michigan Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate

Description

How to fill out Indemnity Bond To Replace Lost, Destroyed, Or Stolen Stock Certificate?

Have you been in the placement that you need documents for sometimes enterprise or personal purposes almost every day? There are plenty of legal file web templates accessible on the Internet, but discovering versions you can trust is not simple. US Legal Forms provides thousands of type web templates, such as the Michigan Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate, which are published to meet federal and state needs.

Should you be already informed about US Legal Forms web site and also have a free account, just log in. Next, you may acquire the Michigan Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate design.

Unless you provide an account and would like to begin using US Legal Forms, adopt these measures:

- Find the type you will need and make sure it is to the proper area/state.

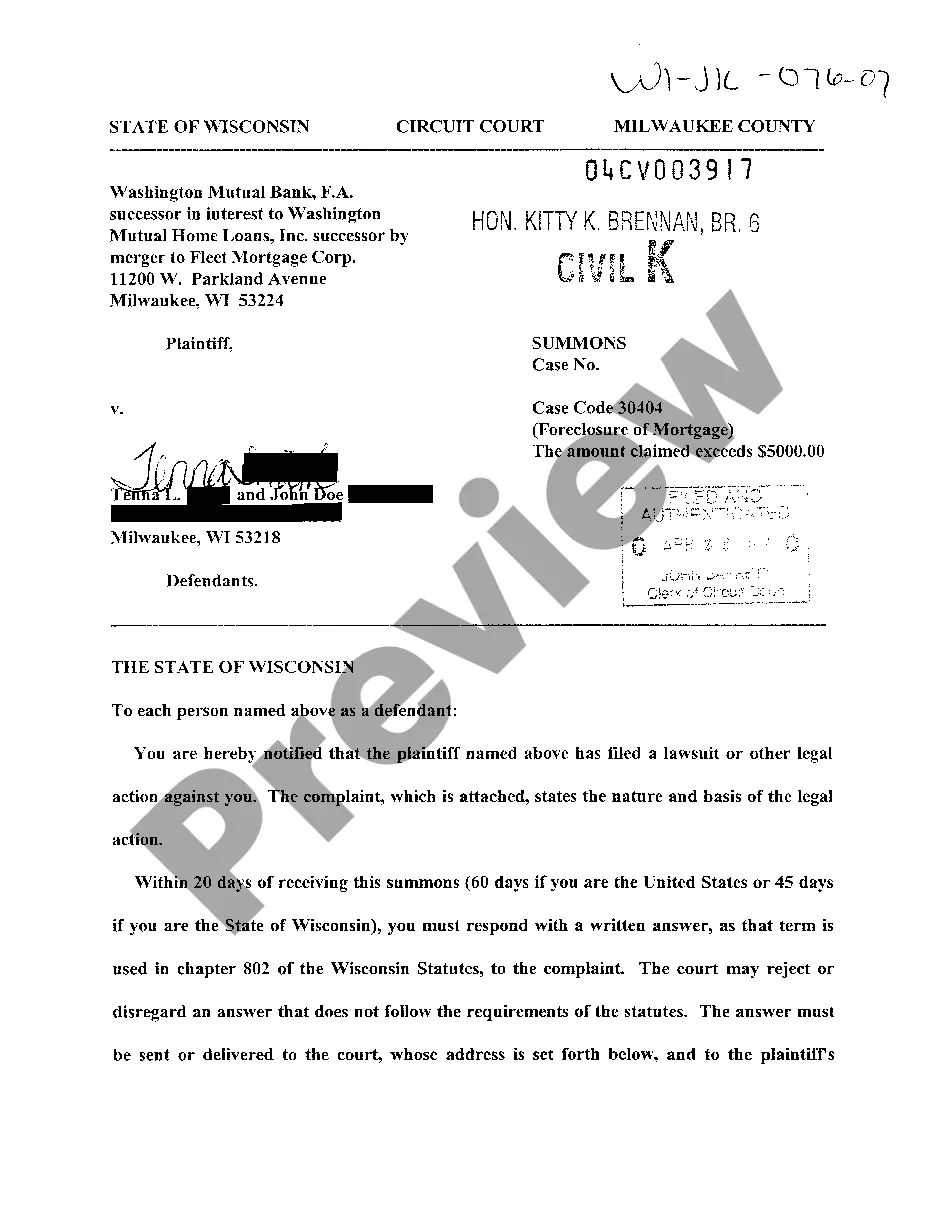

- Make use of the Review switch to examine the form.

- Read the explanation to ensure that you have chosen the appropriate type.

- If the type is not what you are trying to find, utilize the Lookup discipline to obtain the type that suits you and needs.

- Whenever you find the proper type, click Buy now.

- Pick the rates plan you need, fill out the desired info to generate your bank account, and pay for the transaction making use of your PayPal or charge card.

- Pick a practical data file file format and acquire your copy.

Locate all of the file web templates you may have purchased in the My Forms food selection. You can get a additional copy of Michigan Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate anytime, if possible. Just select the necessary type to acquire or print out the file design.

Use US Legal Forms, the most extensive collection of legal kinds, to save efforts and avoid mistakes. The services provides expertly made legal file web templates that you can use for a variety of purposes. Produce a free account on US Legal Forms and start generating your lifestyle easier.

Form popularity

FAQ

If an investor does not have or loses their stock certificate, they are still the owner of their shares and entitled to all the rights that come with them. If an investor wants a stock certificate, or if it is lost, stolen, or damaged, they can receive a new one by contacting a company's transfer agent.

A Lost Securities surety bond is a bond required by banks or other financial instrument transfer agents for persons who have lost or misplaced bond or stock certificates or a payment check.

Replacing a Stock Certificate A share certificate can be replaced if it is lost, stolen, or damaged. In order to replace the physical certificate, the shareholder will need to contact the company's stock transfer agent. 1 They may also be required to complete an affidavit of loss document.

Record the loss of the share certificate and the approval of issuing a replacement certificate at a directors' meeting. Issue a new share certificate and send it to the shareholder. If the replacement share certificate has a new number, the register of members should be updated to reflect this change.

When dealing with an estate that includes shares without a certificate, a new one can be requested from the registrars of the company (if known). However, they may impose conditions before granting you with a replacement certificate.

If you want to sell or transfer stock but have lost your paper stock certificate, you have no legal proof of ownership?but that doesn't mean you've lost your investment. With a properly completed lost stock certificate affidavit, you can transfer or sell the stock even if you can't find the original certificate.

The owner must buy an indemnity bond to protect the corporation and the transfer agent against the possibility that the lost certificate may be presented later by an innocent purchaser. The bond usually costs between two or three percent of the current market value of the missing certificates; and.