Michigan Post Bankruptcy Petition Discharge Letter

Description

How to fill out Post Bankruptcy Petition Discharge Letter?

US Legal Forms - one of many largest libraries of legitimate types in the USA - delivers a wide range of legitimate document templates you may download or printing. Using the website, you can get a huge number of types for business and personal reasons, categorized by classes, states, or keywords and phrases.You can find the latest versions of types just like the Michigan Post Bankruptcy Petition Discharge Letter in seconds.

If you currently have a membership, log in and download Michigan Post Bankruptcy Petition Discharge Letter from your US Legal Forms catalogue. The Down load key will appear on every single form you see. You get access to all in the past delivered electronically types inside the My Forms tab of your own account.

In order to use US Legal Forms the very first time, allow me to share straightforward guidelines to get you began:

- Make sure you have selected the right form to your town/area. Click the Review key to check the form`s articles. See the form information to ensure that you have selected the proper form.

- In the event the form doesn`t match your needs, make use of the Search discipline on top of the monitor to get the one that does.

- If you are satisfied with the shape, verify your choice by clicking on the Acquire now key. Then, opt for the rates program you like and give your qualifications to sign up on an account.

- Approach the purchase. Use your credit card or PayPal account to perform the purchase.

- Select the formatting and download the shape on the product.

- Make changes. Load, revise and printing and sign the delivered electronically Michigan Post Bankruptcy Petition Discharge Letter.

Each web template you included in your money lacks an expiration day and it is your own property permanently. So, if you wish to download or printing an additional copy, just go to the My Forms section and click on in the form you need.

Gain access to the Michigan Post Bankruptcy Petition Discharge Letter with US Legal Forms, probably the most substantial catalogue of legitimate document templates. Use a huge number of skilled and condition-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

To obtain copies of these documents, you have the following options:Make a request by phone. Call the clerk's office to request copies of documents.Internet (PACER)Visit the Clerk's office.Mail a request to the Clerk's office.Review the archived file at the Bankruptcy Court.Phone NARA.Mail or fax NARA.NARA's website.

Requests must be made by filling out a Copy Request form and then mailing to the court with payment. To determine the number of pages for copies, you may contact the court by calling (616) 456-2693, M-F, 8AM 4PM or by emailing MIWBCaseInfo@miwb.uscourts.gov.

Assuming that everything goes according to schedule, you can expect to receive your bankruptcy discharge (the court order that wipes out your debts) about 60 days after your 341 meeting of creditors hearing, plus a few days for mailing.

Since a chapter 12 or chapter 13 plan may provide for payments to be made over three to five years, the discharge typically occurs about four years after the date of filing.

Closing a Chapter 7 Bankruptcy After DischargeA Chapter 7 case will remain open after the discharge if the Chapter 7 trustee appointed to the matter needs additional time to sell assets or if the case involves litigation.

How to Find If Someone Has Filed for Bankruptcy in MichiganVisit the PACER website and register for an account.Log in once you verify your account, and locate the "Find a Case" tab located near the top of the window.Enter in the person's first and last name if possible.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

A bankruptcy discharge, also known as a discharge in bankruptcy, refers to a permanent court order that releases a debtor from personal liability for certain types of debts. It is sometimes referred to simply as a discharge and comes at the end of a bankruptcy.

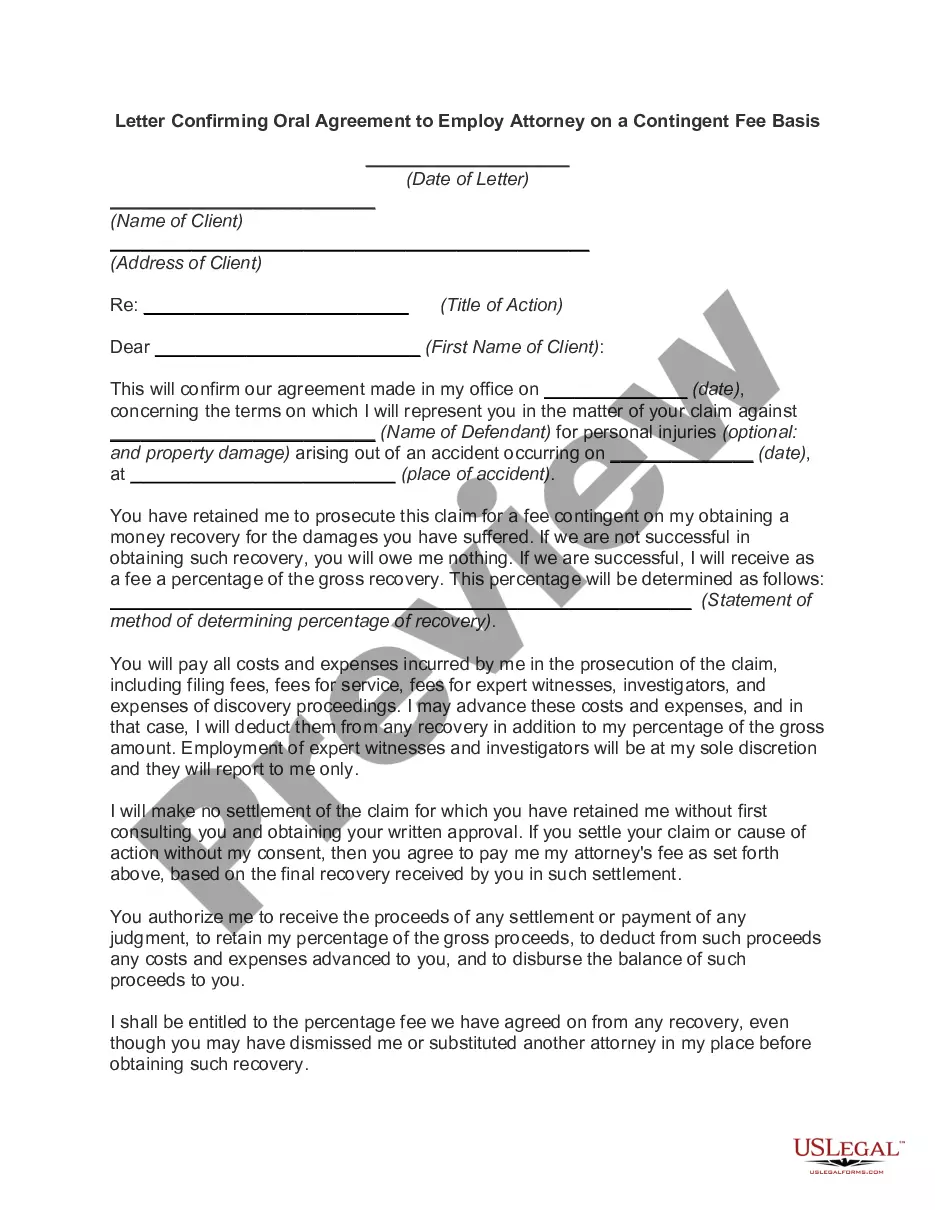

A "discharge letter" is a term used to describe the order that the bankruptcy court mails out toward the end of the case. The order officially discharges (wipes out) qualifying debt, such as credit card and utility bill balances, medical debt, and personal loans.