The Michigan Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a legal document that establishes a lender's rights to collect income from leased properties as collateral for a commercial loan. It provides added security to lenders by allowing them to have a claim on the rental income generated by the property in case of borrower default. Keywords: Michigan Assignment of Leases and Rents, Collateral Security, Commercial Loan, Lender's Rights, Rental Income, Borrower Default. There are different types of Michigan Assignment of Leases and Rents as Collateral Security for a Commercial Loan, including: 1. Absolute Assignment: Under this type, the borrower assigns all leases and rents related to the property to the lender as collateral security. The lender gains complete rights to collect and apply the rental income towards the loan balance. 2. Conditional Assignment: In a conditional assignment, the borrower assigns leases and rents as collateral, but the assignment becomes effective only upon certain conditions, typically borrower default or failure to repay the loan. Once triggered, the lender can collect the rental income to satisfy the outstanding debt. 3. Revocable Assignment: A revocable assignment allows the borrower to retain some control over the leases and rents. The borrower can revoke the assignment at any time, though this might require the lender's consent. In case of default, the lender's rights become irrevocable. 4. Equitable Assignment: This type of assignment provides the lender with the right to collect rental income as an equitable interest in the property, even if the assignment is not legally recorded. It offers additional protection to lenders if the borrower tries to sell or transfer the property without satisfying the loan obligation. 5. Absolute Assignment with Recapture Provision: Here, the lender receives an absolute assignment of leases and rents, but there is a provision that allows the borrower to recapture the assignment by repaying the outstanding loan balance within a specified timeframe. This provision offers the borrower an opportunity to regain control of the rental income. By utilizing the Michigan Assignment of Leases and Rents as Collateral Security for a Commercial Loan, lenders can secure their investment by having a legal claim on the income generated by the leased property. It acts as a safeguard in case the borrower defaults on the loan and provides lenders with an additional recourse to recover their funds.

Michigan Assignment of Leases and Rents as Collateral Security for a Commercial Loan

Description

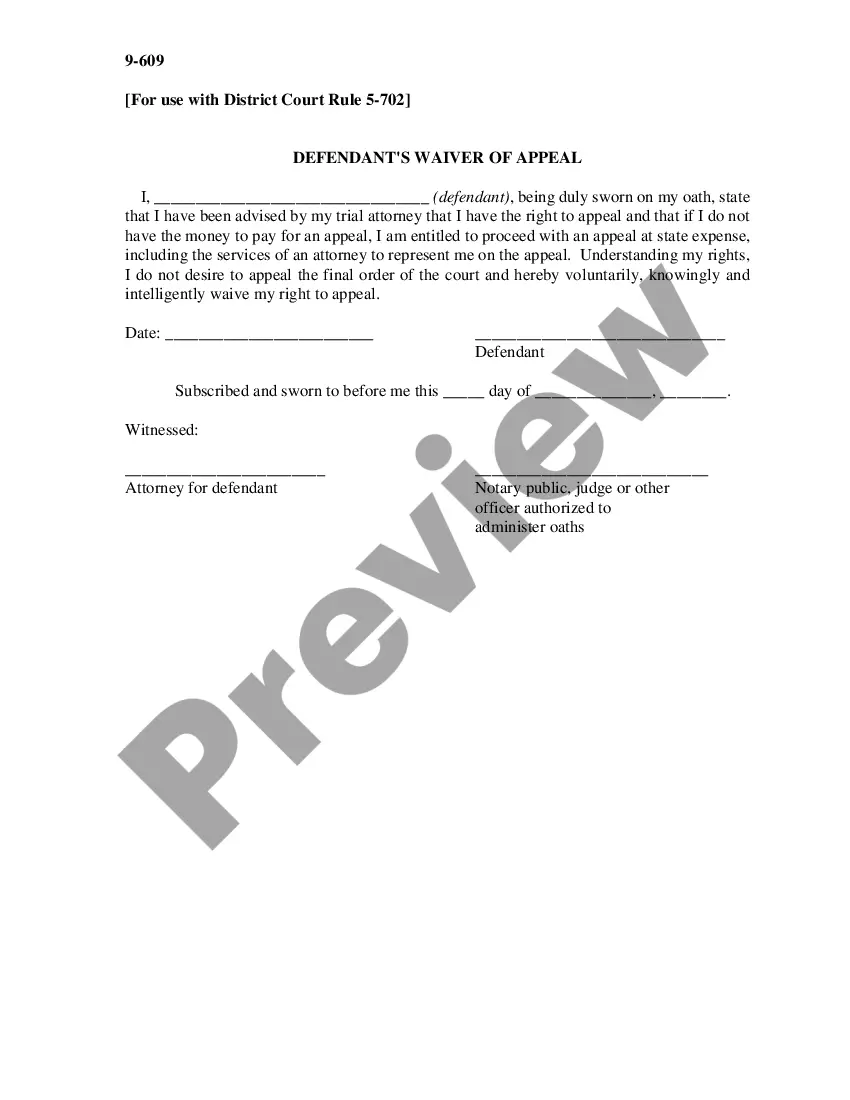

How to fill out Michigan Assignment Of Leases And Rents As Collateral Security For A Commercial Loan?

US Legal Forms - among the greatest libraries of lawful types in the States - gives a variety of lawful papers web templates you may down load or printing. While using website, you can find a large number of types for organization and personal uses, categorized by groups, says, or keywords and phrases.You will find the latest versions of types such as the Michigan Assignment of Leases and Rents as Collateral Security for a Commercial Loan within minutes.

If you currently have a subscription, log in and down load Michigan Assignment of Leases and Rents as Collateral Security for a Commercial Loan from the US Legal Forms local library. The Acquire button will appear on each and every develop you view. You have access to all formerly downloaded types inside the My Forms tab of your account.

In order to use US Legal Forms the first time, here are basic directions to obtain started off:

- Be sure to have picked the best develop for the city/county. Go through the Review button to review the form`s content. Browse the develop description to actually have chosen the right develop.

- In case the develop doesn`t suit your needs, use the Lookup area near the top of the screen to obtain the one which does.

- Should you be satisfied with the form, validate your decision by simply clicking the Get now button. Then, select the costs strategy you want and give your credentials to sign up for the account.

- Procedure the purchase. Make use of charge card or PayPal account to complete the purchase.

- Pick the file format and down load the form on your gadget.

- Make changes. Complete, change and printing and signal the downloaded Michigan Assignment of Leases and Rents as Collateral Security for a Commercial Loan.

Each template you added to your account does not have an expiry date which is your own for a long time. So, in order to down load or printing yet another version, just go to the My Forms portion and click on on the develop you will need.

Get access to the Michigan Assignment of Leases and Rents as Collateral Security for a Commercial Loan with US Legal Forms, one of the most comprehensive local library of lawful papers web templates. Use a large number of skilled and state-certain web templates that fulfill your small business or personal requirements and needs.