Michigan Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder

Description

How to fill out Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder?

Are you currently inside a place in which you require papers for both organization or specific reasons nearly every time? There are a lot of legal record layouts available on the net, but discovering types you can depend on isn`t effortless. US Legal Forms gives thousands of develop layouts, like the Michigan Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder, that are composed to meet state and federal needs.

Should you be already acquainted with US Legal Forms web site and possess a merchant account, just log in. Afterward, you may download the Michigan Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder format.

If you do not come with an accounts and would like to begin using US Legal Forms, abide by these steps:

- Find the develop you need and ensure it is to the appropriate city/state.

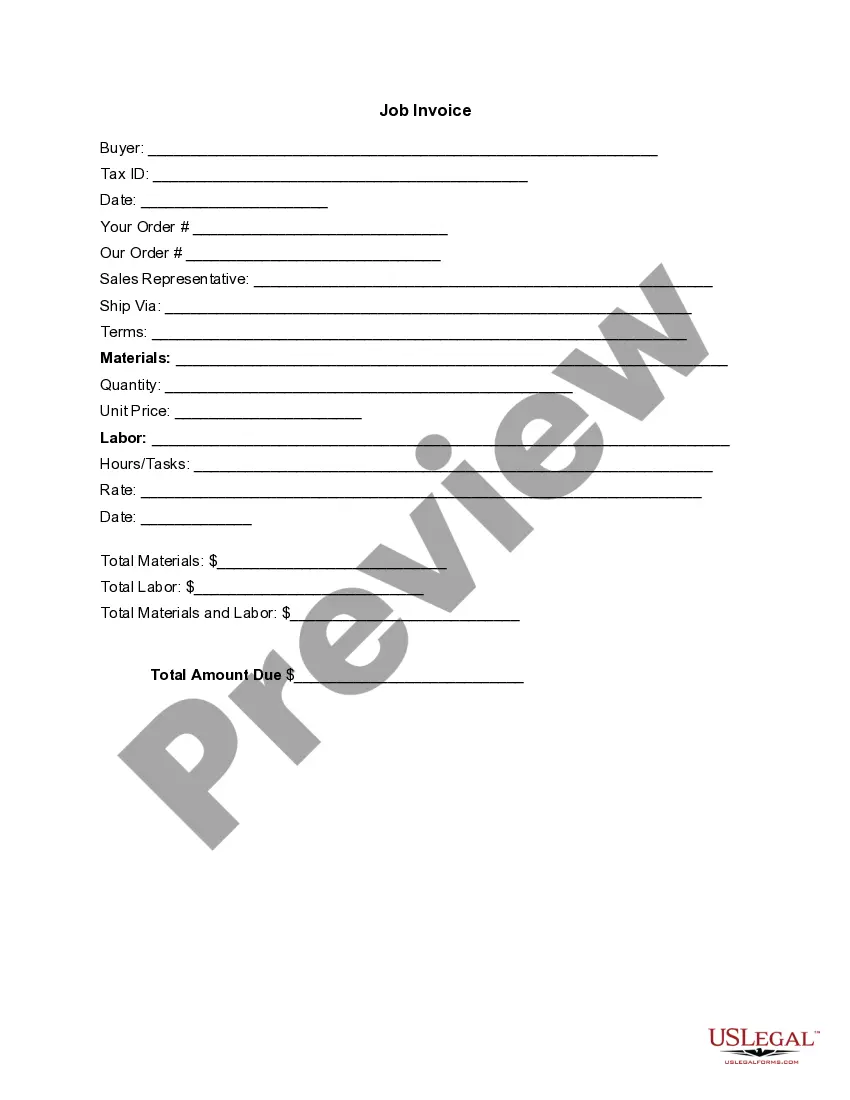

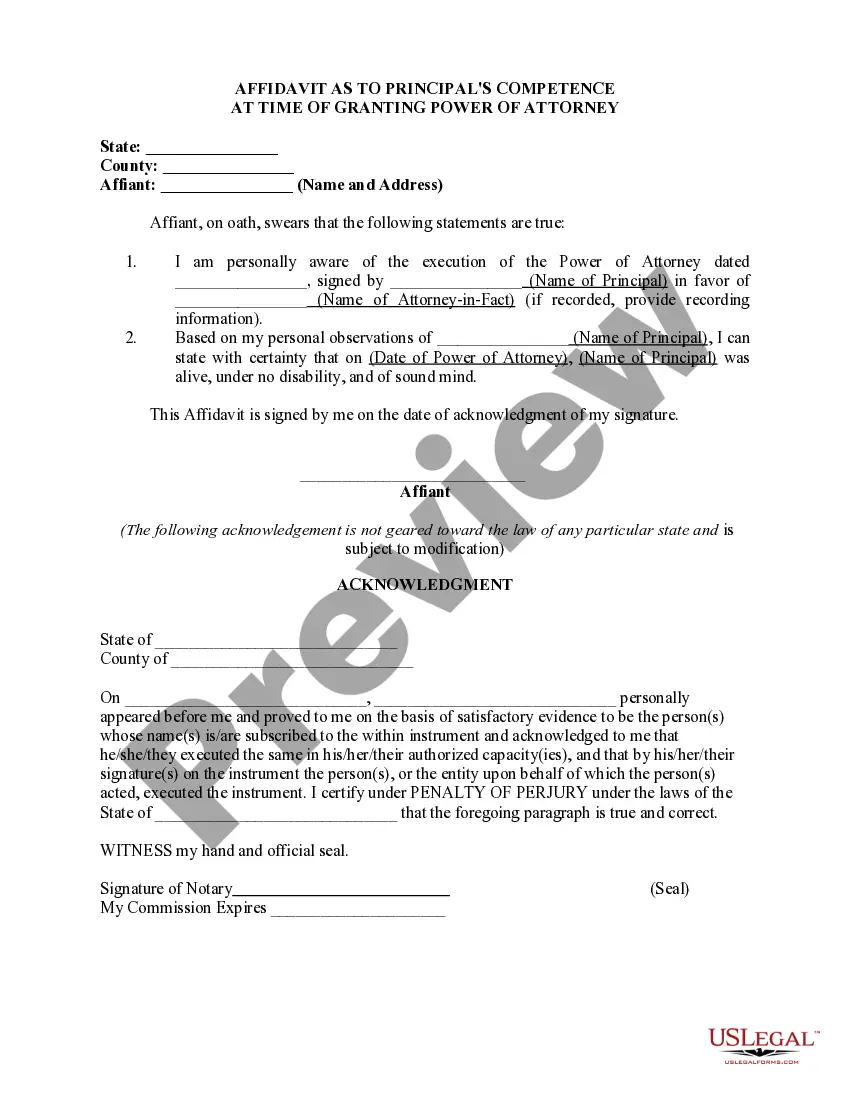

- Utilize the Preview switch to examine the shape.

- Look at the outline to actually have selected the right develop.

- In case the develop isn`t what you are looking for, utilize the Search field to obtain the develop that meets your requirements and needs.

- Once you discover the appropriate develop, click on Buy now.

- Select the rates prepare you desire, complete the specified details to create your account, and purchase the transaction utilizing your PayPal or credit card.

- Pick a handy document format and download your duplicate.

Discover each of the record layouts you may have purchased in the My Forms menus. You may get a extra duplicate of Michigan Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder any time, if necessary. Just go through the required develop to download or print out the record format.

Use US Legal Forms, by far the most considerable selection of legal varieties, to save time as well as stay away from faults. The assistance gives professionally produced legal record layouts that can be used for a selection of reasons. Create a merchant account on US Legal Forms and commence creating your lifestyle easier.