Title: Michigan Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions Keywords: Michigan, consultant agreement, services, finances, financial reporting, company, confidentiality provisions, types Introduction: A Michigan Consultant Agreement for Services Relating to Finances and Financial Reporting of a Company with Confidentiality Provisions is a legally binding document that outlines the terms and conditions between a consultant and a company based in Michigan. This agreement governs the provision of financial consultancy services and financial reporting assistance while maintaining strict confidentiality regarding sensitive company information. Here, we will explore the essential components of such an agreement and the potential types that may exist. 1. Purpose and Scope: The agreement clearly defines the purpose of the consultant's services and the scope of their responsibilities. It outlines the specific financial areas the consultant will address, such as accounting, tax planning, budgeting, financial analysis, or strategic planning. 2. Compensation: This section covers the agreed-upon compensation structure, which may include hourly rates, fixed fees, project-based fees, or a combination thereof. It lays out the consultant's payment terms, invoicing procedures, and any additional expenses that may be reimbursed. 3. Confidentiality Provisions: This pivotal area highlights the need for maintaining strict confidentiality regarding the company's financial information and trade secrets throughout the duration of the agreement. The provisions usually include non-disclosure and non-use clauses to prevent the sharing, copying, or usage of confidential information for personal or competitive purposes. 4. Term and Termination: This section specifies the duration of the agreement, either through a fixed term or until the completion of specific services. It outlines the circumstances that may lead to termination, such as breach of agreement, failure to perform obligations, or upon mutual agreement. 5. Intellectual Property: In situations where the consultant may develop or contribute to intellectual property during their services, this section clarifies the ownership rights and licensing terms associated with such creations. 6. Indemnification and Liability: To protect both parties from potential liabilities arising from the services, this portion outlines the consultant's indemnification obligations against any claims, damages, losses, or lawsuits resulting from their negligent actions. 7. Governing Law and Jurisdiction: This clause identifies the jurisdiction under which the agreement will be governed and interpreted, usually the state of Michigan, ensuring compliance with the relevant laws and regulations. Types of Michigan Consultant Agreement for Services Relating to Finances and Financial Reporting of the Company with Confidentiality Provisions: 1. General Financial Consulting Agreement: Covers a wide range of financial consulting services, including financial statement analysis, cash flow management, and forecasting. 2. Tax Planning and Compliance Agreement: Specified to consultants offering tax-related advice, helping companies with tax planning, compliance, and regulatory obligations. 3. Mergers and Acquisitions Consulting Agreement: Hired for their expertise in financial analysis, due diligence, and structuring deals in mergers, acquisitions, or corporate reorganizations. 4. Internal Controls Assessment Agreement: Focuses on reviewing and strengthening a company's internal control framework, ensuring compliance with accounting standards, and identifying potential risks. 5. Financial Reporting and Audit Preparation Agreement: Assists in the preparation of financial statements, ensuring accuracy, adherence to accounting principles, and facilitating the audit process. 6. Budgeting and Forecasting Agreement: Engaged to develop comprehensive budgeting and forecasting models to help improve financial planning, target-setting, and decision-making. Conclusion: Michigan Consultant Agreements for Services Relating to Finances and Financial Reporting of a Company with Confidentiality Provisions are vital for protecting the interests of both the consultant and the hiring company. With various types available to cater to specific financial areas, companies in Michigan can engage consultants to address their unique financial needs while ensuring confidentiality and contractual obligations are met.

Michigan Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions

Description

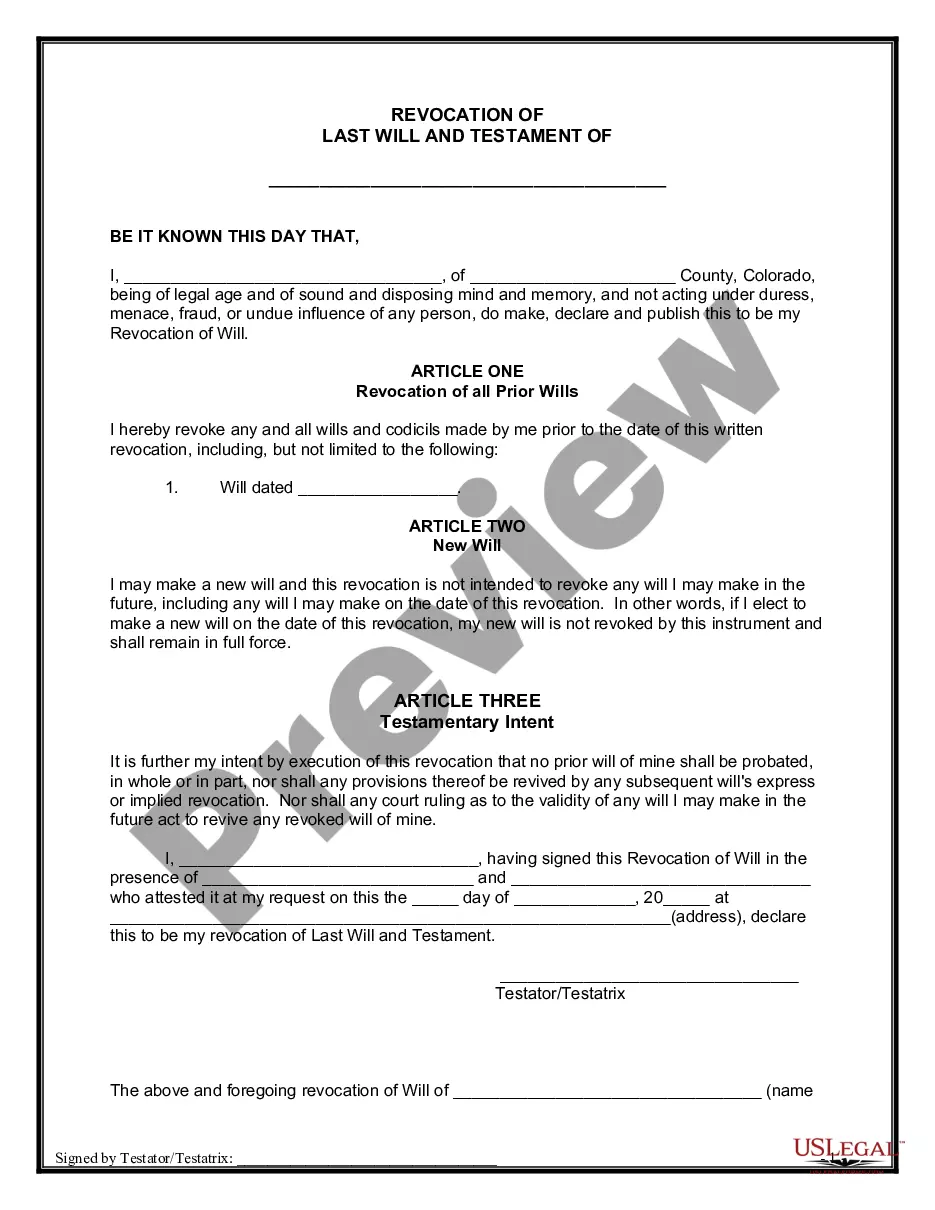

How to fill out Michigan Consultant Agreement For Services Relating To Finances And Financial Reporting Of Company With Confidentiality Provisions?

Choosing the right legal papers format might be a struggle. Naturally, there are a variety of templates available on the Internet, but how will you discover the legal form you want? Make use of the US Legal Forms site. The support provides thousands of templates, for example the Michigan Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions, that you can use for business and private requires. All of the varieties are examined by experts and satisfy federal and state needs.

In case you are presently registered, log in for your account and click the Download button to get the Michigan Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions. Use your account to search through the legal varieties you may have bought earlier. Proceed to the My Forms tab of your own account and acquire another copy of the papers you want.

In case you are a new consumer of US Legal Forms, listed here are straightforward guidelines for you to follow:

- Initial, make sure you have chosen the right form for your personal area/county. You may examine the form using the Review button and read the form outline to make sure it will be the best for you.

- When the form fails to satisfy your expectations, make use of the Seach area to get the right form.

- Once you are certain the form is acceptable, go through the Buy now button to get the form.

- Pick the prices program you want and enter in the required info. Design your account and buy the order using your PayPal account or charge card.

- Opt for the document formatting and acquire the legal papers format for your product.

- Full, change and produce and indicator the obtained Michigan Consultant Agreement for Services Relating to Finances and Financial Reporting of Company with Confidentiality Provisions.

US Legal Forms will be the most significant collection of legal varieties in which you will find numerous papers templates. Make use of the company to acquire skillfully-created papers that follow status needs.

Form popularity

FAQ

A consulting contract should offer a detailed description of the duties you will perform and the deliverables you promise the client. The agreement may also explain how much work you will perform at the client's office and how often you will work remotely.

Often, consultants are self-employed contract professionals who provide services to a range of industries or organizations as needed. Consultants often specialize in a specific area, and those who aren't independent contractors may work for larger consulting firms that hire out their services.

disclosure agreement is a legally binding contract that establishes a confidential relationship. The party or parties signing the agreement agree that sensitive information they may obtain will not be made available to any others. An NDA may also be referred to as a confidentiality agreement.

Key ingredients of a consulting agreement or contractThe scope of the work. A consulting contract should offer a detailed description of the duties you will perform and the deliverables you promise the client.Pay and invoicing rates.Timelines and deadlines.

Except as specifically required by law, Consultant may disclose Non-Public Information only with Client's prior written consent. Consultant shall have no authority to disclose Non-Public Information except in accordance with this section.

State Laws on Confidentiality AgreementsConfidentiality agreements are considered restrictive covenants because they restrict or limit the freedom of an individual. fefffeff In the case of the NDA, the restrictions might hinder someone from going into business, finding work, or making money.

Your consulting agreement should include:the commercial details of the specific project, including exactly what services you will provide;a clause outlining when and how much you should be paid;how you and your client will deal with pre-existing and new intellectual property;a dispute resolution process; and.More items...?17-Nov-2020

Service Provider's PromisesUnless authorized in writing by Client, Service Provider will keep all Confidential Information and will not copy, reproduce, or make notes of, divulge to anyone or any entity outside Client, or use any of the Confidential Information for Service Provider's or another's benefit or purpose.

Also known as an NDA or Confidentiality Agreement, this agreement is a legally binding contract where a party agrees to keep confidential information that's received private. For example, if you hire a partner and share a trade secret with him or her; you can ask that your secret remain confidential.

A consulting services agreement is a contract defining the terms of service between a client and a consultant. The document can also be referred to as a consulting contract, a business consulting agreement, an independent contractor agreement, or a freelance agreement.