Michigan Balance Sheet Deposits refer to the financial assets held by banks and financial institutions in the state of Michigan. These deposits are typically categorized and reported in a balance sheet as a liability, representing the amount of money that customers have entrusted to the bank for safekeeping or to earn interest. In Michigan, different types of balance sheet deposits exist, catering to a wide range of needs and preferences of customers. They include: 1. Checking Account Deposits: These are the most common type of balance sheet deposits, offering customers a convenient and easily accessible way to manage their day-to-day transactions. Account holders can deposit and withdraw money as needed, often via checks, debit cards, or electronic transfers. 2. Savings Account Deposits: These deposits provide customers with a secure place to store their money while earning a modest amount of interest. Savings accounts usually have restrictions on the number of withdrawals allowed per month, encouraging individuals to save for the long term. 3. Money Market Account Deposits: Money market accounts are similar to savings accounts but typically offer higher interest rates in exchange for higher minimum balance requirements. These accounts often include limited check-writing privileges, combining features of both checking and savings accounts. 4. Certificates of Deposit (CDs): CDs are time deposits that offer higher interest rates than savings accounts. Depositors agree to keep the funds in the account for a specified period, known as the maturity period, ranging from a few months to several years. Withdrawals made before the maturity date may incur penalties. 5. Individual Retirement Account (IRA) Deposits: IRAs are special retirement savings accounts that offer tax advantages to individuals planning for their retirement. In Michigan, banks also classify IRA deposits as balance sheet deposits, allowing customers to benefit from potential investment growth while enjoying tax benefits. 6. Corporate and Institutional Deposits: Banks in Michigan also hold deposits from corporations and institutional clients. These deposits are typically larger and involve more complex terms and conditions compared to retail deposits. They serve as an important source of funding for financial institutions. Michigan Balance Sheet Deposits play a critical role in the state's economy, as they provide banks with funds to lend to individuals, businesses, and government entities. These deposits are backed by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000 per depositor, per insured bank, ensuring the security of customers' funds. By offering a variety of deposit products, Michigan banks cater to the diverse needs of individuals, families, and businesses, promoting financial stability and growth in the community.

Michigan Balance Sheet Deposits

Description

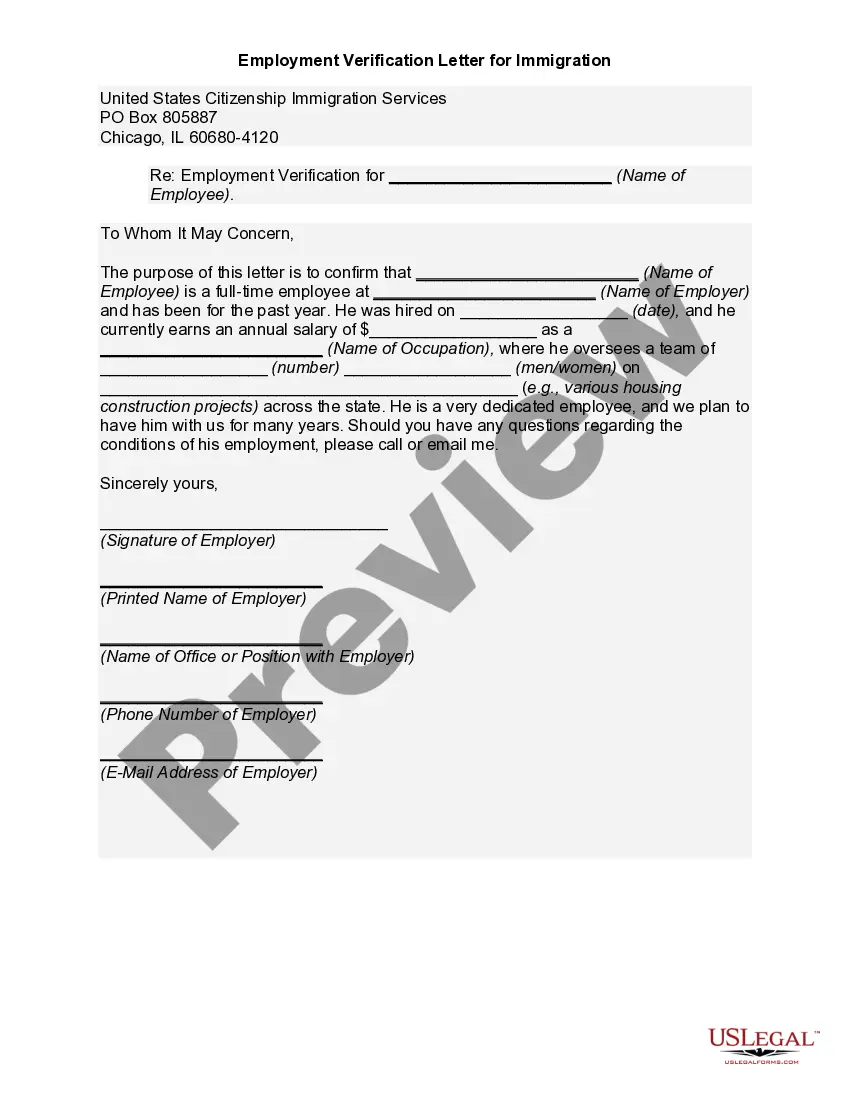

How to fill out Michigan Balance Sheet Deposits?

You can commit hours on-line looking for the lawful document design that suits the federal and state requirements you will need. US Legal Forms supplies a large number of lawful types that happen to be evaluated by professionals. It is possible to acquire or print the Michigan Balance Sheet Deposits from your support.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Obtain key. Following that, it is possible to full, modify, print, or signal the Michigan Balance Sheet Deposits. Every single lawful document design you acquire is the one you have permanently. To acquire yet another copy of any obtained form, proceed to the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms internet site initially, follow the straightforward instructions beneath:

- Initially, ensure that you have selected the correct document design to the area/metropolis of your liking. Look at the form information to make sure you have picked out the appropriate form. If offered, utilize the Review key to search from the document design also.

- If you wish to discover yet another variation from the form, utilize the Lookup field to discover the design that suits you and requirements.

- Once you have identified the design you desire, just click Purchase now to continue.

- Pick the costs prepare you desire, type in your qualifications, and register for a merchant account on US Legal Forms.

- Complete the transaction. You should use your bank card or PayPal accounts to fund the lawful form.

- Pick the format from the document and acquire it to the gadget.

- Make alterations to the document if necessary. You can full, modify and signal and print Michigan Balance Sheet Deposits.

Obtain and print a large number of document themes making use of the US Legal Forms website, which offers the most important assortment of lawful types. Use professional and state-specific themes to deal with your small business or personal requires.