Michigan Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement is a legally binding agreement that outlines the terms and conditions of the sale and purchase of a manufacturing facility in the state of Michigan. This agreement is specifically designed for use in Michigan and complies with the state's laws and regulations governing such transactions. The contract includes detailed provisions and clauses that protect the interests of both the buyer and the seller. It covers various aspects of the sale, including the purchase price, payment terms, conditions precedent, representations and warranties, indemnification, and dispute resolution. The agreement also addresses the transfer of assets, liabilities, and intellectual property rights associated with the manufacturing facility. The Michigan Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement is commonly used in the business and industrial sectors to facilitate the acquisition or divestiture of manufacturing facilities. It provides a comprehensive framework for the parties involved to negotiate and finalize the terms of the transaction. Different types of Michigan Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement may include: 1. Standard Agreement: This is a general contract template that can be tailored to specific transaction requirements. It offers flexibility and covers all essential elements of the sale and purchase of a manufacturing facility. 2. Confidentiality Agreement: This type of contract is used when the buyer needs access to confidential information about the manufacturing facility before the sale is finalized. It ensures that the buyer maintains the confidentiality of the disclosed information and prohibits its unauthorized use or disclosure. 3. Letter of Intent (LOI) Agreement: In some cases, parties may first enter into a non-binding LOI agreement to outline their intentions and key terms before proceeding with a full Asset Purchase Agreement. This LOI agreement serves as a roadmap for further negotiations and due diligence. 4. Bulk Sale Agreement: When purchasing a manufacturing facility, the buyer may also assume the responsibility for any outstanding debts or liabilities associated with the business. A Bulk Sale Agreement is specifically designed to address the transfer of these obligations, ensuring a smooth transition for both parties. It is important for parties involved in the sale and purchase of a manufacturing facility in Michigan to consult legal professionals to ensure compliance with state laws and regulations. These contracts provide a solid foundation for a successful transaction while protecting the interests of both buyers and sellers.

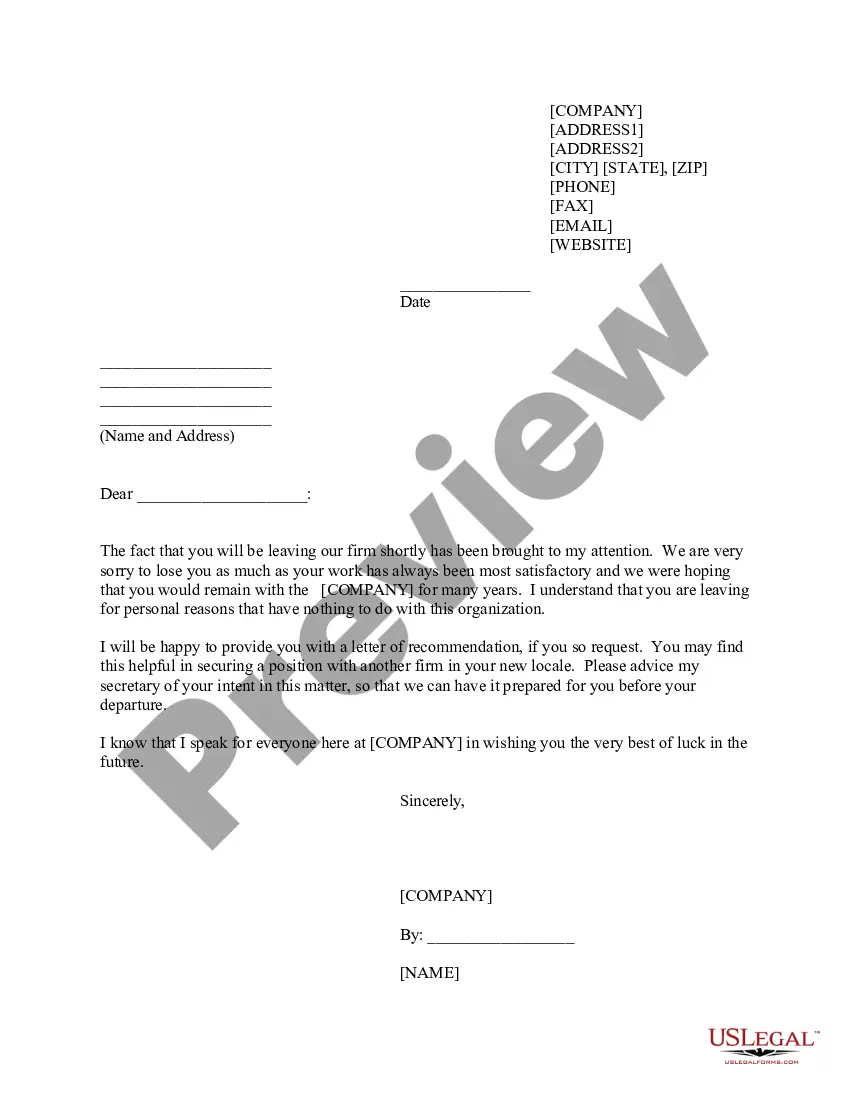

Michigan Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement

Description

How to fill out Michigan Contract For Sale Of Manufacturing Facility Pursuant To Asset Purchase Agreement?

It is possible to spend hours on-line attempting to find the lawful file design which fits the state and federal requirements you want. US Legal Forms offers a large number of lawful varieties that happen to be reviewed by specialists. You can actually acquire or printing the Michigan Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement from our services.

If you already have a US Legal Forms profile, you may log in and click on the Obtain option. Afterward, you may total, change, printing, or indicator the Michigan Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement. Each and every lawful file design you acquire is your own eternally. To have an additional backup associated with a acquired develop, check out the My Forms tab and click on the related option.

Should you use the US Legal Forms website the very first time, follow the straightforward guidelines below:

- Very first, be sure that you have selected the right file design for the area/metropolis of your choice. See the develop information to make sure you have picked out the right develop. If accessible, use the Preview option to check through the file design too.

- If you would like find an additional model in the develop, use the Look for field to find the design that meets your requirements and requirements.

- After you have identified the design you need, click Buy now to proceed.

- Pick the rates plan you need, key in your qualifications, and register for your account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal profile to fund the lawful develop.

- Pick the formatting in the file and acquire it to your device.

- Make changes to your file if needed. It is possible to total, change and indicator and printing Michigan Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement.

Obtain and printing a large number of file web templates making use of the US Legal Forms website, which provides the greatest collection of lawful varieties. Use expert and express-certain web templates to tackle your company or specific requires.

Form popularity

FAQ

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

Also known as a sales contract or a purchase contract, a purchase agreement is a legal document that establishes the parameters of the sale of goods between a buyer and a seller. Typically, they are used when the value is more than $500.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

A purchase agreement is a type of contract that outlines terms and conditions related to the sale of goods. As a legally binding contract between buyer and seller, the agreements typically relate to buying and selling goods rather than services.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

A contract must be signed by both parties involved in the purchase and sale of a property to be legally enforceable. All parties signing must be of legal age and must enter into the contract voluntarily, not by force, to be enforceable.