A Michigan Private Annuity Agreement is a legal contract established between two parties, where one party transfers property or assets to another party in exchange for a stream of income payments over a designated period of time. This arrangement is commonly used for estate planning and wealth transfer purposes in Michigan. Under the agreement, the party who is transferring the assets, known as the "annuitant," transfers ownership of the property to the receiving party, the "purchaser" or "obliged." In return, the obliged promises to make periodic annuity payments to the annuitant for the rest of their life or a specified period. The Michigan Private Annuity Agreement provides flexibility and control to the annuitant over their assets while ensuring a guaranteed income stream. It helps individuals minimize their estate taxes, protect their wealth, and potentially qualify for Medicaid benefits in the future by reducing the value of their estate. Various types of Michigan Private Annuity Agreements exist: 1. Traditional Private Annuity: This is the most common type of private annuity agreement, where the annuitant transfers property to the obliged in exchange for regular income payments. The annuity payment amount is determined based on factors such as the value of the property, the annuitant's life expectancy, and prevailing interest rates at the time of the agreement. 2. Charitable Private Annuity: In this type of agreement, the annuitant transfers assets to a charitable organization instead of an individual obliged. The annuitant receives income payments for life, and upon their death, the remaining assets go to the designated charity. This is often used as a tax-efficient method for philanthropic individuals to support a cause while receiving a steady income during their lifetime. 3. Interfamily Private Annuity: This agreement involves the transfer of assets between family members, typically parents and children. It allows the older generation to transfer wealth while maintaining control over the income stream. This type of annuity can assist in estate planning by effectively transferring assets to the next generation, potentially reducing estate taxes and ensuring financial security for the annuitant. When entering into a Michigan Private Annuity Agreement, it is crucial to consult with legal and financial professionals who specialize in estate planning and tax law. They can help ensure that the agreement complies with all relevant laws and regulations, and tailor the agreement to your specific financial goals and circumstances.

Michigan Private Annuity Agreement

Description

How to fill out Michigan Private Annuity Agreement?

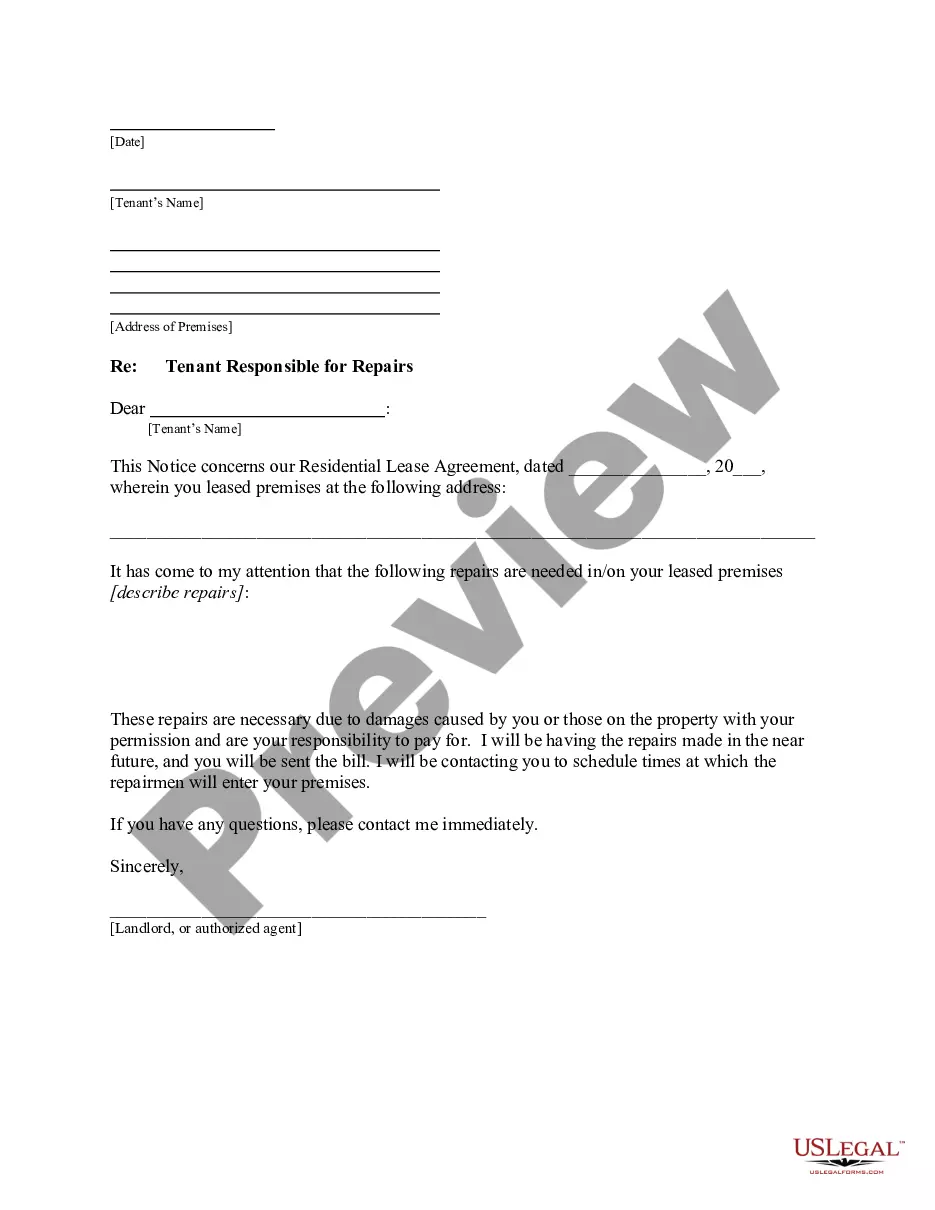

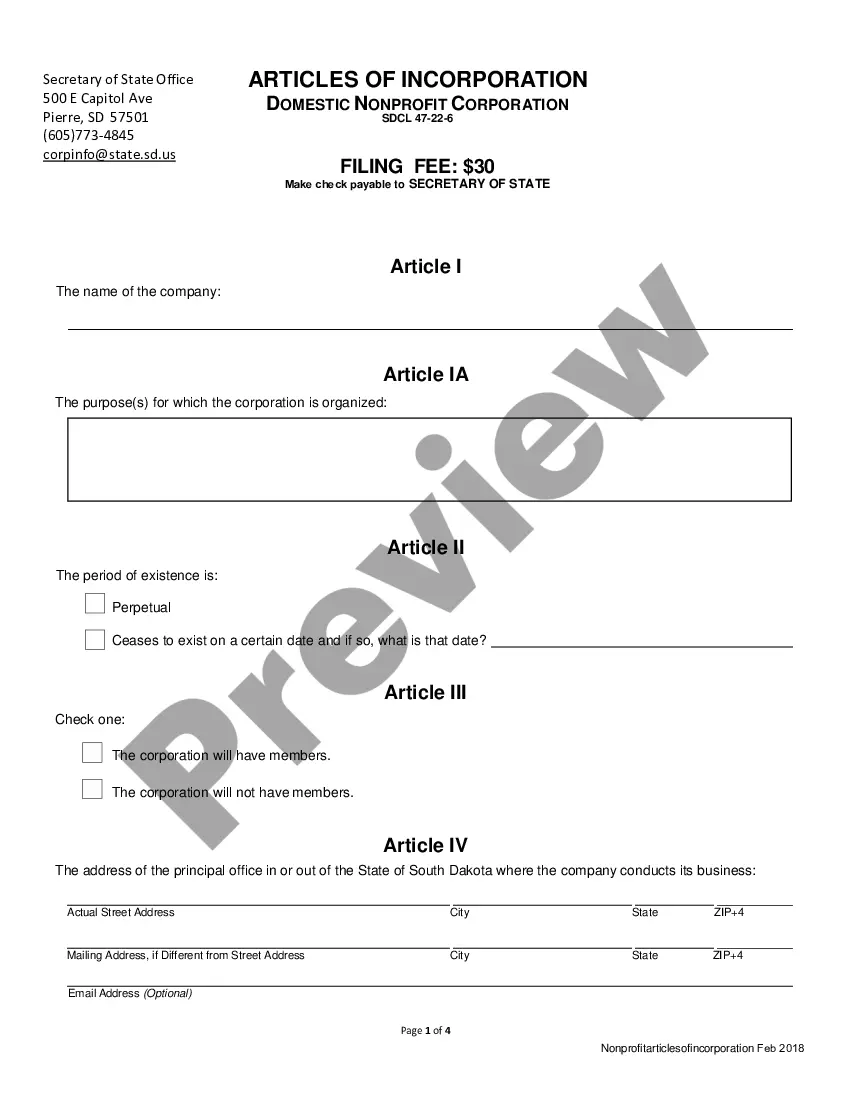

Have you been inside a placement in which you need paperwork for possibly enterprise or personal uses almost every day time? There are plenty of legal file web templates accessible on the Internet, but getting ones you can depend on isn`t easy. US Legal Forms offers a large number of kind web templates, such as the Michigan Private Annuity Agreement, which are composed to meet state and federal needs.

When you are currently knowledgeable about US Legal Forms website and also have a merchant account, basically log in. Next, you may acquire the Michigan Private Annuity Agreement template.

Unless you provide an accounts and wish to start using US Legal Forms, abide by these steps:

- Obtain the kind you require and ensure it is to the proper metropolis/state.

- Use the Preview option to examine the form.

- See the information to ensure that you have chosen the proper kind.

- In the event the kind isn`t what you are trying to find, make use of the Look for area to obtain the kind that suits you and needs.

- If you discover the proper kind, click on Buy now.

- Select the prices program you would like, submit the desired information to produce your money, and pay for an order with your PayPal or Visa or Mastercard.

- Pick a hassle-free document formatting and acquire your copy.

Find every one of the file web templates you may have purchased in the My Forms food list. You may get a extra copy of Michigan Private Annuity Agreement whenever, if possible. Just click the needed kind to acquire or produce the file template.

Use US Legal Forms, probably the most comprehensive variety of legal forms, to conserve time as well as prevent mistakes. The services offers expertly made legal file web templates which can be used for a selection of uses. Generate a merchant account on US Legal Forms and commence producing your life a little easier.

Form popularity

FAQ

Annuitization is a method of guaranteeing yourself a regular and set income over a specific period of time. When you annuitize, you are essentially turning your annuity into set payments that you will receive ensuring that you will never run out of money or not have income coming in.

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

If you have an annuity and are about to retire, you have an important decision to make. You can choose to annuitize your investments, creating a steady stream of income available to you throughout retirement. Or, you can cash out the annuity, and get money into your bank or taxable brokerage account.

You can create your own annuity with a carefully crafted mix of bonds that will immunize your income against market change, say experts at Asset Dedication financial consulting company.

If you purchase an immediate annuity or have annuitized a contract, your policy may not be terminated or changed in most scenarios.

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.