A Michigan Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner provides a comprehensive solution for the seamless transfer of ownership interests in a partnership in case of death, retirement, or withdrawal of a partner. This agreement incorporates life insurance policies on each partner, which are used to fund the purchase of the departing partner's interest. This ensures the financial stability and continuity of the partnership while protecting the interests of both the remaining partners and the departing partner or their beneficiaries. The Michigan Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death is a versatile agreement that offers several variations to choose from, depending on the specific needs of the partnership: 1. Cross-Purchase Agreement: In this type of agreement, each partner purchases a life insurance policy on the life of every other partner. If one partner passes away, the surviving partners use the life insurance proceeds to buy the deceased partner's interest. This agreement works well in partnerships with a few partners. 2. Entity Purchase Agreement (also known as Stock Redemption Agreement): In this agreement, the partnership itself buys life insurance policies on the lives of each partner. When a partner dies, the partnership uses the insurance proceeds to buy the deceased partner's interest. This agreement is beneficial for partnerships with many partners. 3. Wait-and-See Agreement: This type of agreement combines elements of both the cross-purchase and entity purchase agreements. Initially, each partner purchases a life insurance policy on the life of every other partner. On the death of a partner, the surviving partners have the option to purchase the deceased partner's interest using the life insurance proceeds, either through a cross-purchase or an entity purchase agreement. This agreement provides flexibility and allows for adjustment based on changing circumstances. 4. Retirement or Withdrawal Agreement: In addition to addressing death, this type of agreement also covers the potential retirement or voluntary withdrawal of a partner. It outlines the terms and conditions under which a partner can retire or withdraw and ensures a smooth transition of ownership by utilizing life insurance policies to fund the buyout. A Michigan Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death is a critical tool for partnerships to protect the business and the interests of all partners in the event of death, retirement, or withdrawal. It provides financial security, facilitates a seamless transition of ownership, and ensures the continuity and success of the partnership.

Michigan Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

How to fill out Michigan Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

Are you inside a position that you need paperwork for sometimes enterprise or specific reasons nearly every day? There are plenty of legal papers layouts available on the Internet, but getting versions you can trust isn`t simple. US Legal Forms provides 1000s of type layouts, like the Michigan Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, which can be created to fulfill state and federal requirements.

When you are currently informed about US Legal Forms internet site and get your account, simply log in. Next, you are able to obtain the Michigan Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death template.

If you do not have an profile and would like to begin to use US Legal Forms, follow these steps:

- Get the type you want and ensure it is for the proper metropolis/area.

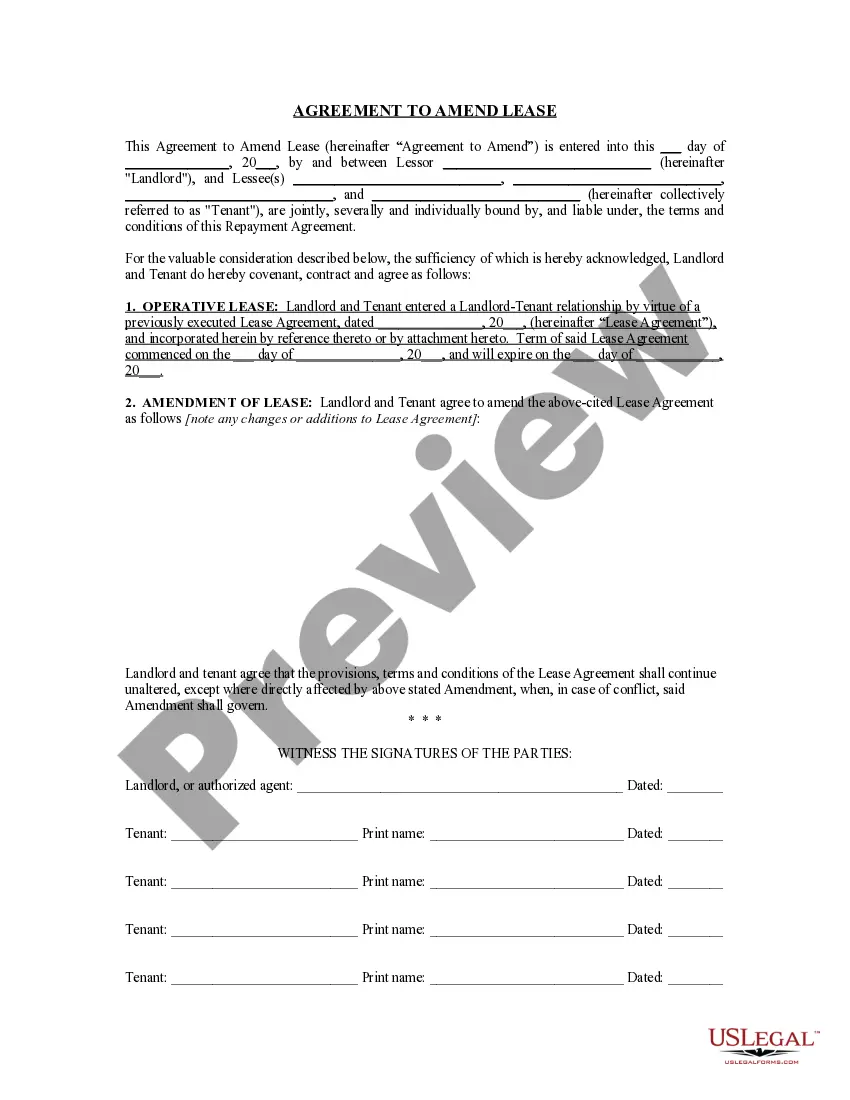

- Utilize the Review switch to analyze the form.

- Browse the information to ensure that you have selected the right type.

- If the type isn`t what you are seeking, take advantage of the Look for industry to discover the type that suits you and requirements.

- If you discover the proper type, just click Buy now.

- Select the rates prepare you desire, submit the desired details to make your bank account, and buy the transaction making use of your PayPal or charge card.

- Select a handy paper structure and obtain your copy.

Discover all of the papers layouts you may have bought in the My Forms food list. You can obtain a additional copy of Michigan Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death any time, if needed. Just select the necessary type to obtain or printing the papers template.

Use US Legal Forms, the most substantial collection of legal types, to conserve efforts and stay away from mistakes. The service provides appropriately manufactured legal papers layouts that can be used for a selection of reasons. Produce your account on US Legal Forms and commence creating your daily life a little easier.

Form popularity

FAQ

Life insurance proceeds provide liquidity for ordinary living expenses and estate tax liability. Buy-sell agreements can be structured under various forms, including 1) entity redemption, 2) cross purchase, 3) cross endorsement, 4) wait-and-see and 5) a one-way agreement.

The business owners individually own the policies insuring each other's lives. When a business owner dies, the proceeds are paid to those surviving owners who hold one or more policies on the deceased owner, and these surviving owners buy the shares from the deceased owner's personal representative.

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

Each owner would pay the premiums and be the beneficiary of the policy. The face amount of the insurance would be calculated based on the other's ownership interest. Upon the death of one owner, the insurance proceeds would be used to purchase the ownership interests from the deceased owner's estate or family.

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Advantages of a Cross Purchase PlanWhen the owner(s) purchase the business interest of their departed or deceased owner, their basis increases by what they pay to the exiting owner or estate of the deceased owner. This then improves the tax consequences of their exit if it occurs during their lifetime.

One common question we receive when discussing key person benefits is What is a buy/sell agreement? A buy/sell agreement, also known as a buyout agreement, is a contract funded by a life insurance policy that can help minimize the turmoil caused by the sudden departure, disability or death of a business owner or

Why is life insurance important? Buying life insurance protects your spouse and children from the potentially devastating financial losses that could result if something happened to you. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses.

The smartest method for funding a buy-sell agreement is through life insurance. This ensures that funds are immediately available when a death occurs; plus, death benefit proceeds are generally income-tax free.