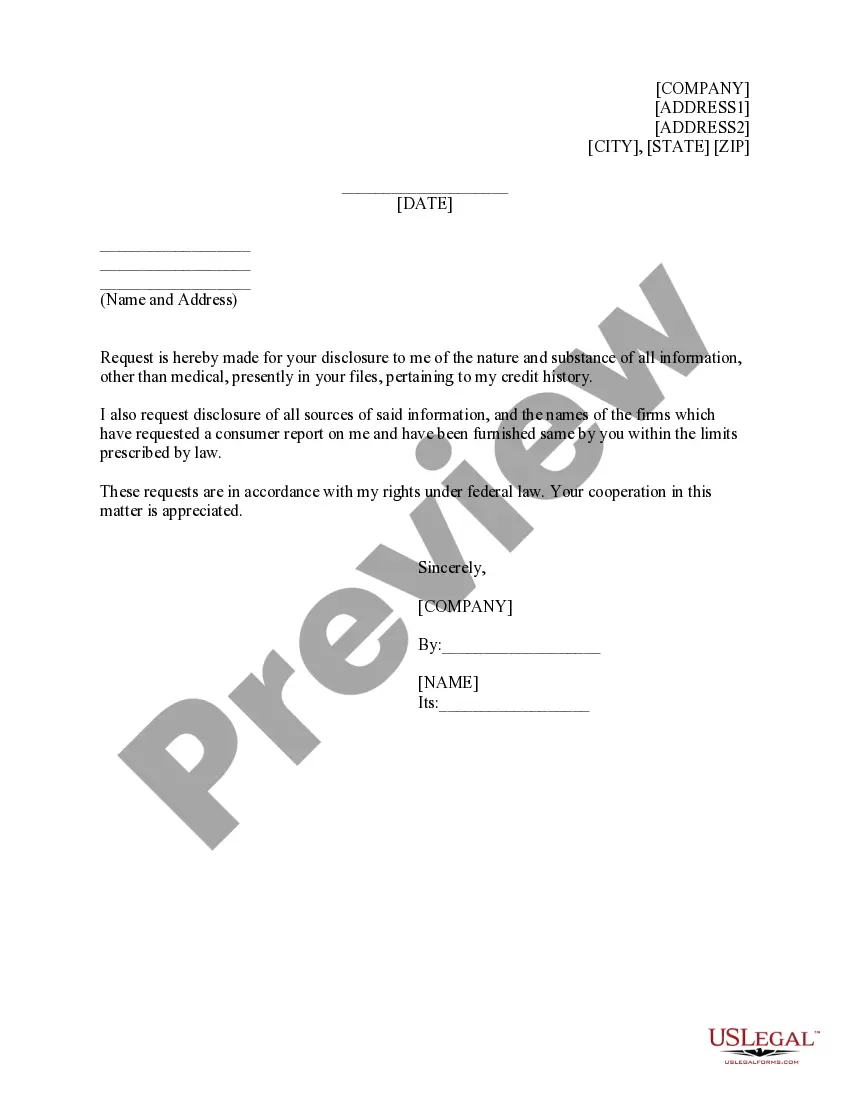

Michigan Credit Information Request

Description

How to fill out Credit Information Request?

If you need to compile, retrieve, or create legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase Now button. Select your preferred pricing plan and provide your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Michigan Credit Information Request.

Every legal document template you purchase is yours permanently. You can access each form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Stay competitive by downloading and printing the Michigan Credit Information Request with US Legal Forms. There are thousands of professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to obtain the Michigan Credit Information Request with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Michigan Credit Information Request.

- You can also view forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Call (888) 397-3742 if you want to order a credit report or if you have any questions related to fraud and identity theft. The number (888) 397-3742-6 (1-888-EXPERIAN) will also work. You can place an immediate fraud/security alert on your credit with this number.

.

Personal information: Your name, including any aliases or misspellings reported by creditors, birth date, Social Security number, current and past home addresses, phone numbers, and current and past employers.

A: No, you can't check your spouse's (or ex's) personal credit reports. In order to request a consumer report on someone else, you must have what's called a permissible purpose under federal law, and marriage or divorce is not one of them.

These are the only ways to order your free credit reports:visit AnnualCreditReport.com.call 1-877-322-8228.complete the Annual Credit Report Request Form and mail it to:

Request Your Free Credit Report: Online: Visit AnnualCreditReport.com. By Phone: Call 1-877-322-8228. For TTY service, call 711 and ask the relay operator for 1-800-821-7232.

The law regulates credit reporting and ensures that only business entities with a specific, legitimate purpose, and not members of the general public, can check your credit without written permission. The circumstances surrounding the release of your financial information vary widely.

You must provide written consent before a prospective or current employer can get a copy of your credit report.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail.

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies (Equifax, Experian and TransUnion). You can request a copy from AnnualCreditReport.com. You can request and review your free report through one of the following ways: Online: Visit AnnualCreditReport.com.