The Michigan Agreement Replacing Joint Interest with Annuity is a legal document that is used when two or more individuals or entities decide to replace their joint interest in a property or investment with an annuity. This agreement outlines the terms and conditions of the agreement, including the details of the annuity, the responsibilities of each party, and the procedures for transitioning from joint interest to annuity. This agreement is typically used in Michigan and is a popular choice for individuals or entities who want to secure a regular income stream from their joint investment. By replacing joint interest with an annuity, parties can ensure a steady cash flow that is predetermined and guaranteed over a specified period of time. There are several types of Michigan Agreements Replacing Joint Interest with Annuity, including the Immediate Annuity Agreement, Deferred Annuity Agreement, and Fixed Annuity Agreement. 1. Immediate Annuity Agreement: This type of agreement provides an immediate and regular income stream that starts right after the agreement is executed. It is suitable for individuals who are looking for instant income from their joint investment and want to commence receiving annuity payments without any delay. 2. Deferred Annuity Agreement: In contrast to the immediate annuity agreement, this type of agreement allows for the deferral of annuity payments to a later date. This is beneficial for parties who do not need immediate income and want to accumulate their joint investment over a specified period of time before receiving annuity payments. 3. Fixed Annuity Agreement: This agreement guarantees a fixed income stream over the agreed upon term. The annuity payments do not fluctuate with market conditions, providing a predictable income source for the parties involved. This type of agreement is suitable for individuals or entities seeking a stable and consistent income from their joint investment. In conclusion, the Michigan Agreement Replacing Joint Interest with Annuity is a legal document that enables parties to transition from joint interest to an annuity. By outlining the terms and conditions, this agreement ensures a steady income stream over a specified period of time. The different types of agreements include Immediate Annuity, Deferred Annuity, and Fixed Annuity, catering to the specific needs and preferences of the parties involved.

Michigan Agreement Replacing Joint Interest with Annuity

Description

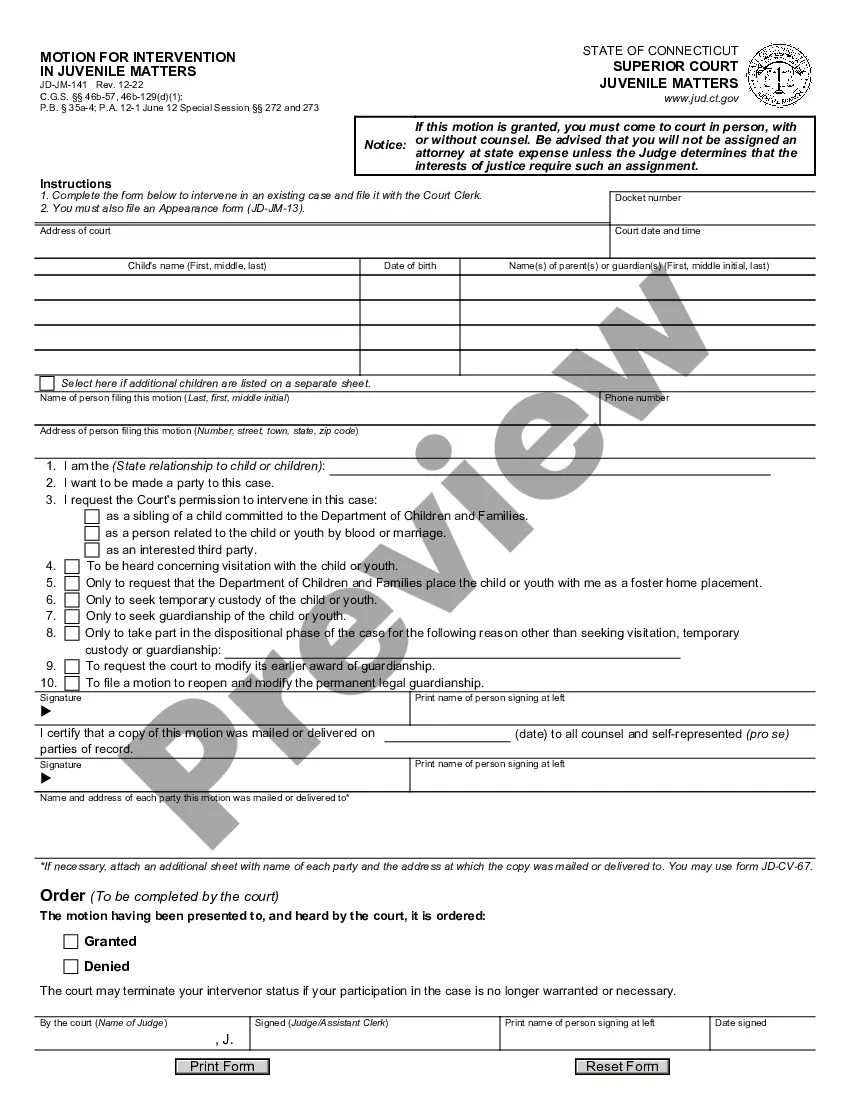

How to fill out Agreement Replacing Joint Interest With Annuity?

Are you presently in a placement in which you will need papers for possibly business or specific reasons virtually every day time? There are tons of lawful record web templates available on the Internet, but discovering kinds you can rely on is not straightforward. US Legal Forms delivers a large number of develop web templates, much like the Michigan Agreement Replacing Joint Interest with Annuity, that happen to be composed to fulfill state and federal demands.

In case you are previously acquainted with US Legal Forms web site and possess a free account, basically log in. Afterward, you are able to download the Michigan Agreement Replacing Joint Interest with Annuity template.

Unless you have an account and want to start using US Legal Forms, abide by these steps:

- Find the develop you want and ensure it is to the right city/state.

- Utilize the Review option to check the form.

- Look at the description to actually have chosen the correct develop.

- When the develop is not what you are trying to find, utilize the Look for discipline to obtain the develop that fits your needs and demands.

- Once you find the right develop, click on Buy now.

- Select the pricing prepare you would like, fill in the specified information to generate your bank account, and pay money for the order using your PayPal or Visa or Mastercard.

- Choose a convenient document structure and download your backup.

Discover all of the record web templates you might have bought in the My Forms food list. You may get a extra backup of Michigan Agreement Replacing Joint Interest with Annuity at any time, if possible. Just click on the required develop to download or produce the record template.

Use US Legal Forms, one of the most substantial collection of lawful varieties, to conserve time as well as steer clear of blunders. The support delivers skillfully produced lawful record web templates which can be used for a selection of reasons. Make a free account on US Legal Forms and initiate generating your daily life easier.

Form popularity

FAQ

A 1035 exchange is a provision in the tax code which allows you, as a policyholder, to transfer funds from a life insurance, endowment or annuity to a new policy, without having to pay taxes.

Definition: Replacement is any transaction where, in connection with the purchase of New Insurance or a New Annuity, you lapse, surrender, convert to Paid-up Insurance, Place on Extended Term, or borrow all or part of the policy loan values on an existing insurance policy or an annuity.

Steps of the 1035 ProcessDecide if it makes sense to 1035 your existing policy.Choose a policy to 1035 into.Contact the insurer that holds your existing policy so you understand their paperwork requirements.Fill out and submit the application for the new annuity, including a 1035 transfer request form.More items...

1035 exchanges can only go certain ways. For example, you can exchange life insurance for life insurance or life insurance for a non-qualified annuity. But you can't exchange a non-qualified annuity for a life insurance policy.

A 1035 exchange is a provision in the tax code which allows you, as a policyholder, to transfer funds from a life insurance, endowment or annuity to a new policy, without having to pay taxes.

A life insurance policy can be exchanged for an annuity under the rules of a 1035 exchange, but you cannot exchange an annuity contract for a life insurance policy.

So what is not allowable in a 1035 exchange? Single Premium Immediate Annuities (SPIAs), Deferred Income Annuities (DIAs), and Qualified Longevity Annuity Contracts (QLACs) are not allowed because these are irrevocable income contracts.

Exchange it. Through what's known as a 1035 exchange, you can convert your life insurance into an income annuity without paying taxes on your gains. You'll give up the death benefit, but you'll no longer have to pay premiums, and you'll lock in income for the rest of your life (or a specific number of years).

A 1035 exchange is a provision in the tax code which allows you, as a policyholder, to transfer funds from a life insurance, endowment or annuity to a new policy, without having to pay taxes.

Steps of the 1035 ProcessDecide if it makes sense to 1035 your existing policy.Choose a policy to 1035 into.Contact the insurer that holds your existing policy so you understand their paperwork requirements.Fill out and submit the application for the new annuity, including a 1035 transfer request form.More items...