Michigan Consulting Agreement with Independent Contractor who was a Retired Chief Technical Officer with Unique Technical Knowledge of Technology and Intellectual Property of Corporation

Description

How to fill out Consulting Agreement With Independent Contractor Who Was A Retired Chief Technical Officer With Unique Technical Knowledge Of Technology And Intellectual Property Of Corporation?

Have you been in a place where you need to have documents for possibly company or person purposes just about every day time? There are a lot of legal file templates available on the net, but finding versions you can trust is not effortless. US Legal Forms delivers 1000s of type templates, like the Michigan Consulting Agreement with Independent Contractor who was a Retired Chief Technical Officer with Unique Technical Knowledge of Technology and Intellectual Property of Corporation, which can be published to satisfy state and federal demands.

If you are already acquainted with US Legal Forms website and also have a merchant account, just log in. Following that, it is possible to obtain the Michigan Consulting Agreement with Independent Contractor who was a Retired Chief Technical Officer with Unique Technical Knowledge of Technology and Intellectual Property of Corporation web template.

If you do not come with an accounts and want to begin using US Legal Forms, adopt these measures:

- Find the type you require and ensure it is for the correct metropolis/state.

- Use the Preview option to examine the form.

- Look at the explanation to ensure that you have chosen the appropriate type.

- When the type is not what you are trying to find, take advantage of the Lookup area to obtain the type that meets your requirements and demands.

- Whenever you get the correct type, just click Get now.

- Select the rates plan you desire, fill out the desired details to make your account, and purchase the order using your PayPal or credit card.

- Pick a hassle-free file formatting and obtain your duplicate.

Get every one of the file templates you possess purchased in the My Forms menus. You can get a further duplicate of Michigan Consulting Agreement with Independent Contractor who was a Retired Chief Technical Officer with Unique Technical Knowledge of Technology and Intellectual Property of Corporation whenever, if needed. Just select the necessary type to obtain or printing the file web template.

Use US Legal Forms, by far the most considerable variety of legal forms, to conserve time and avoid faults. The service delivers skillfully manufactured legal file templates which you can use for an array of purposes. Create a merchant account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

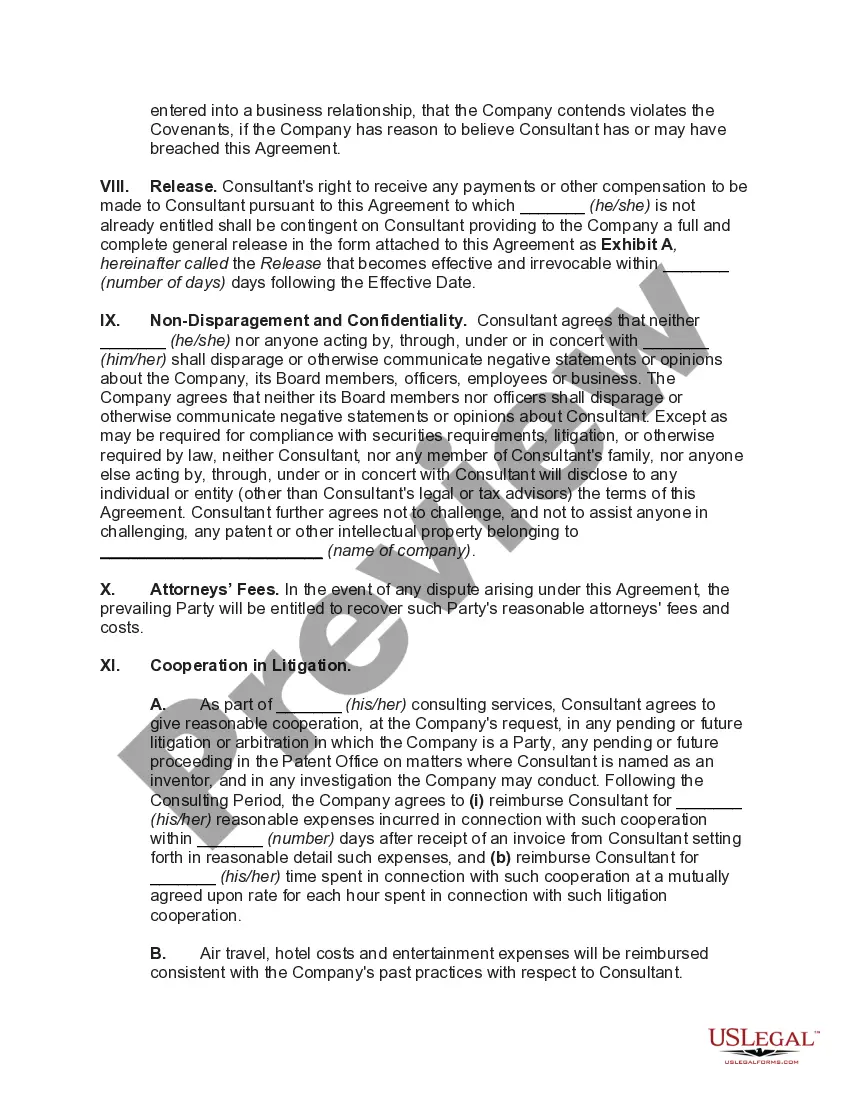

Contractor Intellectual Property Contractor shall retain all right, title and interest in and to any work, ideas, inventions, discoveries, tools, methodology, computer programs, processes and improvements and any other intellectual property, tangible or intangible, that has been created by Contractor prior to entering ...

In this article, we set out six things that you need to include in your consulting agreement. Commercial Details. You can use a master consulting agreement that you update for each client. ... Payment Terms. ... Intellectual Property. ... Dispute Resolution. ... Liability. ... Termination.

It's much more common for a consultant to charge for their work on a large, per-project basis, while independent contractors are more likely to charge an hourly fee.

A consulting agreement is a legally binding document that affirms a client's request for assistance from a consultant. It's a contract detailing the terms of service between a consultant ? operating as an independent contractor ? and a client.

Here are six best practices to write a consulting contract that defines your project scope and protects both you and your business. Define Duties, Deliverables, and Roles. ... Prepare for Potential Risk. ... Specify Project Milestones and Engagement Time. ... Identify Expenses and Outline Payment Terms. ... Specify Product Ownership.

Consultant agrees that all intellectual property, including but not limited to all deliverables, writings, documents, data, video recordings, audio recordings, electronic recordings, and other materials that Consultant makes (or participates in making), conceives, discovers or develops at any time as a result of or in ...

A professional services contract agreement is defined as a contract structure between a professional services firm or consultant and the client that dictates the expectations of each party. It dictates who bears risk, when money changes hands, and how the final project-based service is to be delivered.

A consultant agreement's benefits include a clear outline of the work to be done and financial compensation. It also facilitates the other party's compliance with quality assurance requirements.